Four big questions for Twitter ahead of its first quarterly earnings report

Twitter is scheduled to reveal its first quarterly earnings report as a public company after the close of trading today. The expectation is that Twitter lost $0.02 per share in the fourth quarter of last year on revenue of $218 million. Even more attention will be paid to the number of monthly active users, which stood at 232 million (53 million in the United States) at the end of the third quarter.

Twitter is scheduled to reveal its first quarterly earnings report as a public company after the close of trading today. The expectation is that Twitter lost $0.02 per share in the fourth quarter of last year on revenue of $218 million. Even more attention will be paid to the number of monthly active users, which stood at 232 million (53 million in the United States) at the end of the third quarter.

Naturally, the company says it will field some questions for the conference call through Twitter, using the hashtag #TWTRearnings. Here are a few issues we hope get some attention.

What’s the deal with those plunging ad rates?

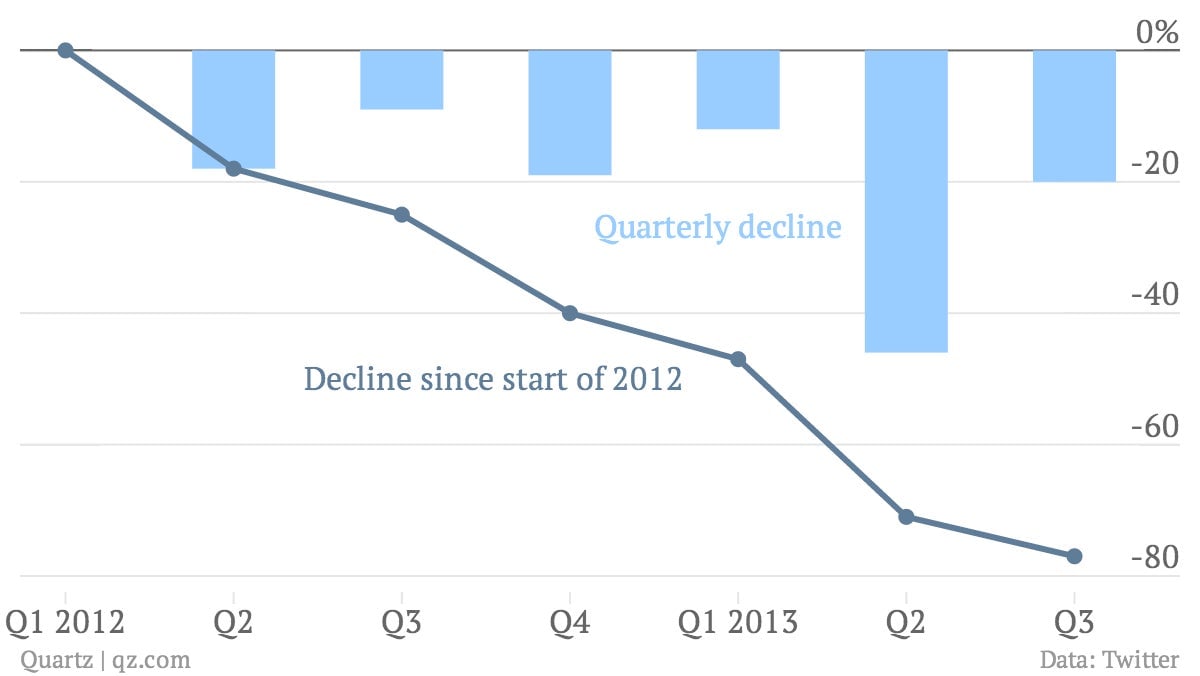

Twitter only makes money from promoted tweets, its primary advertising product, when people click or tap on them. But the amount Twitter charges advertisers each time that happens has been falling for some time. It was perhaps the most alarming, if little discussed, disclosure in Twitter’s IPO prospectus: The “average cost per ad engagement” has declined each quarter since at least the middle of 2012.

That’s a 77% drop since the first quarter of 2012, or 57% over the first three quarters of last year. (Those figures are derived by Quartz from Twitter’s disclosure of quarter-over-quarter percentage declines.)

Twitter says not to worry, that the plunging rate is to be expected as its advertising inventory increases with more users and more usage. Greater supply will naturally push down prices. And if total advertising revenue is heading in the right direction, then who cares?

Still, that is quite a drop and an indication that Twitter, which sells a lot of its advertising through automated auctions, is still searching for a price that the market will bear.

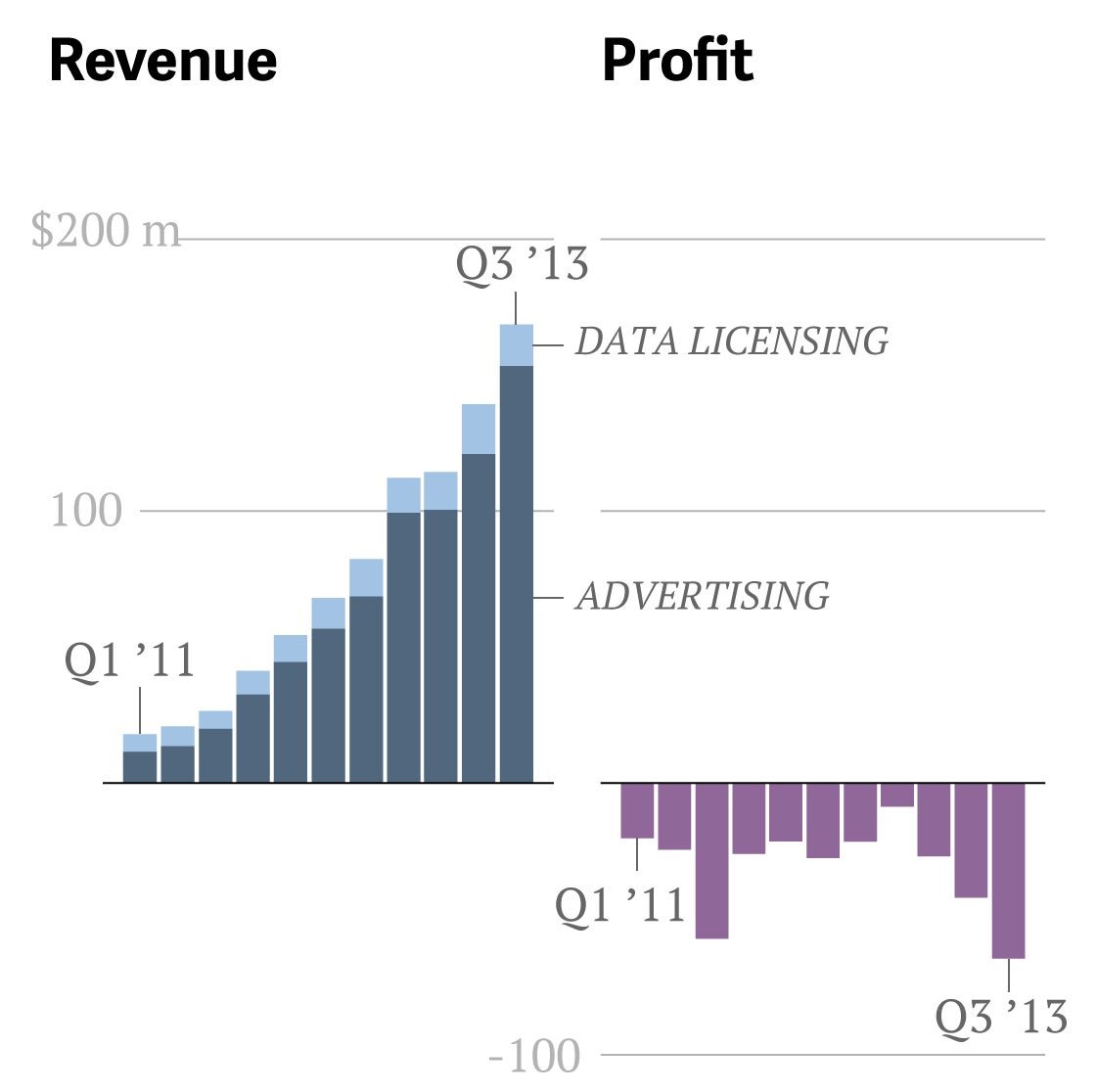

Can data licensing be a surprise growth area?

Twitter, like Facebook, is essentially a mobile advertising company. It generates 91% of its revenue from ads (and 70% of that from mobile). But don’t neglect the rest of Twitter’s business, which is licensing the stream of all tweets to other companies that use it for marketing and analytics.

Data licensing was good for $15.1 million in the third quarter of 2013; many analysts expect that to have dropped a bit in the fourth quarter. But in just the past few days, Twitter has announced partnerships to use its data for breaking news and spotting musical talent. It’s not clear how much, if any, new revenue those deals amount to, but they could be a sign of potential growth in future quarters.

Which revenue-generating lever is best to pull?

To generate more revenue, Twitter can:

- attract more people to the service (monthly active users);

- get those people to use it more (timeline views per MAU);

- show them more ads (ad engagements); or

- charge more for the ads it shows (cost per ad engagement).

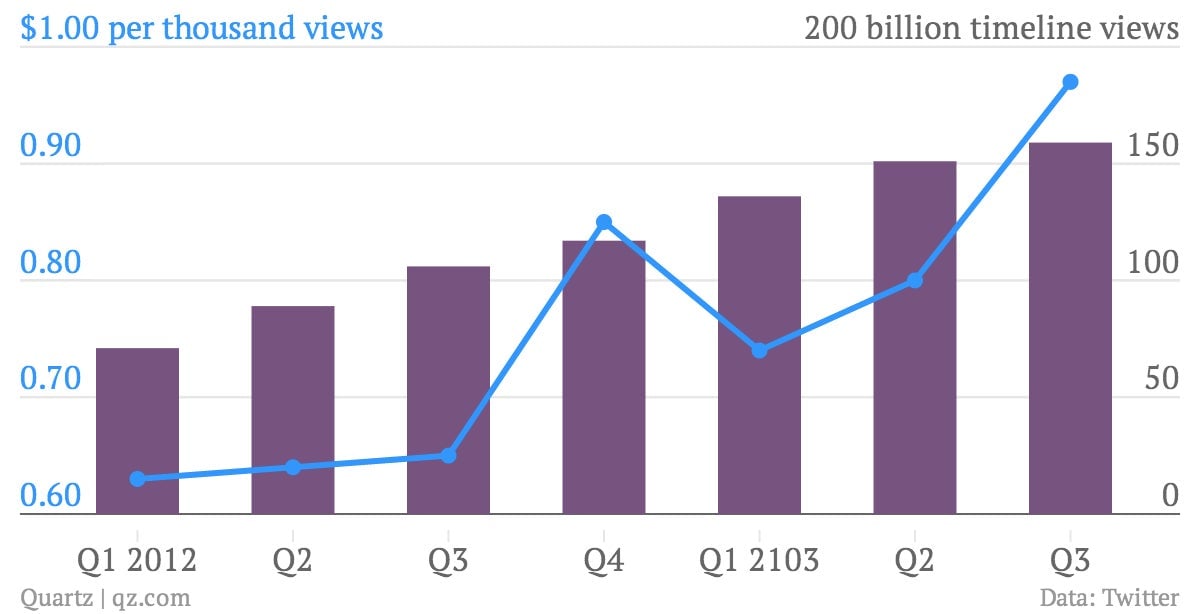

The last option seems to be out, as discussed above in the section on advertising rates. So the question is whether Twitter should focus on user growth or wringing more money out of the users it already has.

The answer will vary from market to market. In the US, where user growth has already slowed, Twitter’s challenge is to better monetize its existing users, who generate $2.58 per thousand timeline views. In the rest of the world, simply increasing the number of users is key.

I wrote about this last week, noting that every time you refresh your tweets, which Twitter considers a timeline view, the company banks a tenth of a penny. This chart captures much of the dynamic:

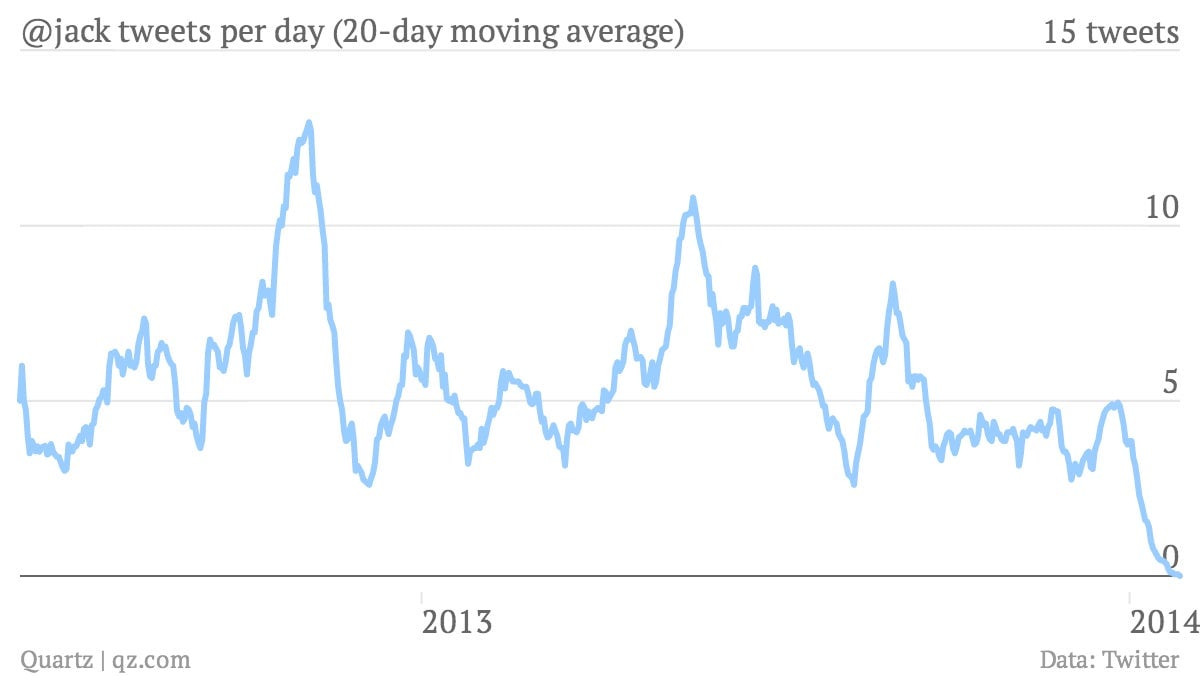

Why did the executive chairman stop tweeting?

Not to harp on this, but it’s simply bizarre that Jack Dorsey, co-founder and executive chairman of Twitter, hasn’t tweeted in more than four weeks. His silence is striking because it’s so unusual.

Dorsey, whose day job is CEO of mobile payments startup Square, isn’t likely to appear on Twitter’s conference call today, but can someone please ask about this? He’s chairman of the board, after all.