Currency trading scandals are the next big black eye for banks

These days, it doesn’t take much digging to find potentially scandalous behavior coursing through the world’s biggest banks. But the latest round of probes into currency trading are shaping up to be a real doozy.

These days, it doesn’t take much digging to find potentially scandalous behavior coursing through the world’s biggest banks. But the latest round of probes into currency trading are shaping up to be a real doozy.

Already more than 20 traders, which make money for their firms by betting on currencies’ shifting values, have left or been placed on leave by their employers. These banks and traders have not been accused of wrongdoing, but their departures send a message that something is amiss in currency trading.

- Citigroup: The bank’s London-based global head of foreign exchange announced his departure today (paywall). Citi ousted its head of European spot trading last month, when the bank also confirmed that two unnamed currency traders were also placed on leave.

- Goldman Sachs: Two partners in the currency trading business have reportedly left the bank, according to reports today.

- Deutsche Bank: Three New York-based currency traders were sacked yesterday, according to Reuters.

- Lloyds Banking Group: A senior trader has been suspended, according to reports yesterday.

- HSBC: The bank confirmed to the Wall Street Journal (paywall) last month that it suspended two traders in London.

- JPMorgan: The bank’s chief London dealer was placed on leave in October.

- RBS: The bank suspended two traders in October.

- Barclays: Six foreign exchange traders were suspended in late October (paywall), in both London and Tokyo.

- UBS: Two senior spot traders, one in the US and the other in Switzerland, were reportedly suspended in October. Around the same time, an ex-UBS trader who joined Standard Chartered was put on leave shortly after switching banks.

The departures parallel a global probe into whether traders at various financial institutions colluded to manipulate exchange rates in order to boost bank profits and employee bonuses. Bloomberg reported in June that traders were being accused of front-running client currency orders and rigging benchmark currency rates. Regulators in the US, UK, Switzerland, Hong Kong, and Singapore are all jumping in.

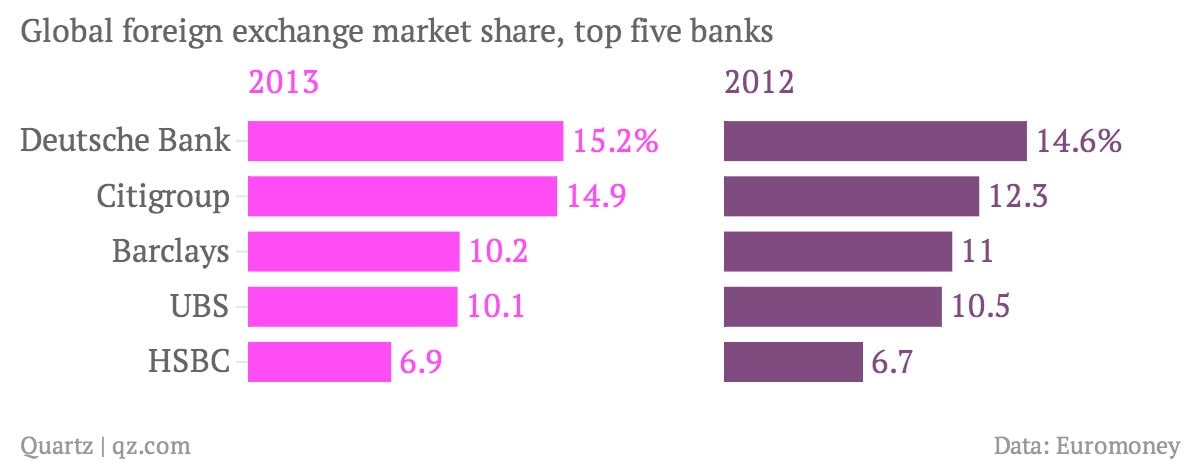

Five banks control nearly 60% of the global foreign exchange market—an indication of the big impact collusion within the group could have on currency markets.

Recently, New York’s financial services regulator Ben Lawsky launched a probe into a dozen banks. The regulator, which has jurisdiction over banks chartered to operate in New York, has demanded emails and instant messages from Goldman Sachs, Deutsche Bank, Lloyds Banking Group, Credit Suisse, Standard Chartered, and RBS. The probe does not include banks which maintain bank charters outside of Lawsky’s New York purview. Those include Morgan Stanley, JPMorgan, Bank of America Merrill Lynch and Citigroup, whose international bank charters place them under a different authority, a source familiar with Lawsky’s investigation told Quartz.

Lawsky has extracted hundreds of millions in fines from banks related to money laundering, so banks could be facing another sizeable round of fines a la Libor, the scandal involving traders who allegedly manipulated the key benchmark (paywall) interest rate known as the London Interbank offered rate. The head of the UK’s financial regulator, Martin Wheatley, yesterday referred to the currency manipulation allegations as “every bit as bad“ as the Libor scandal.