How the ETF explosion transformed global markets

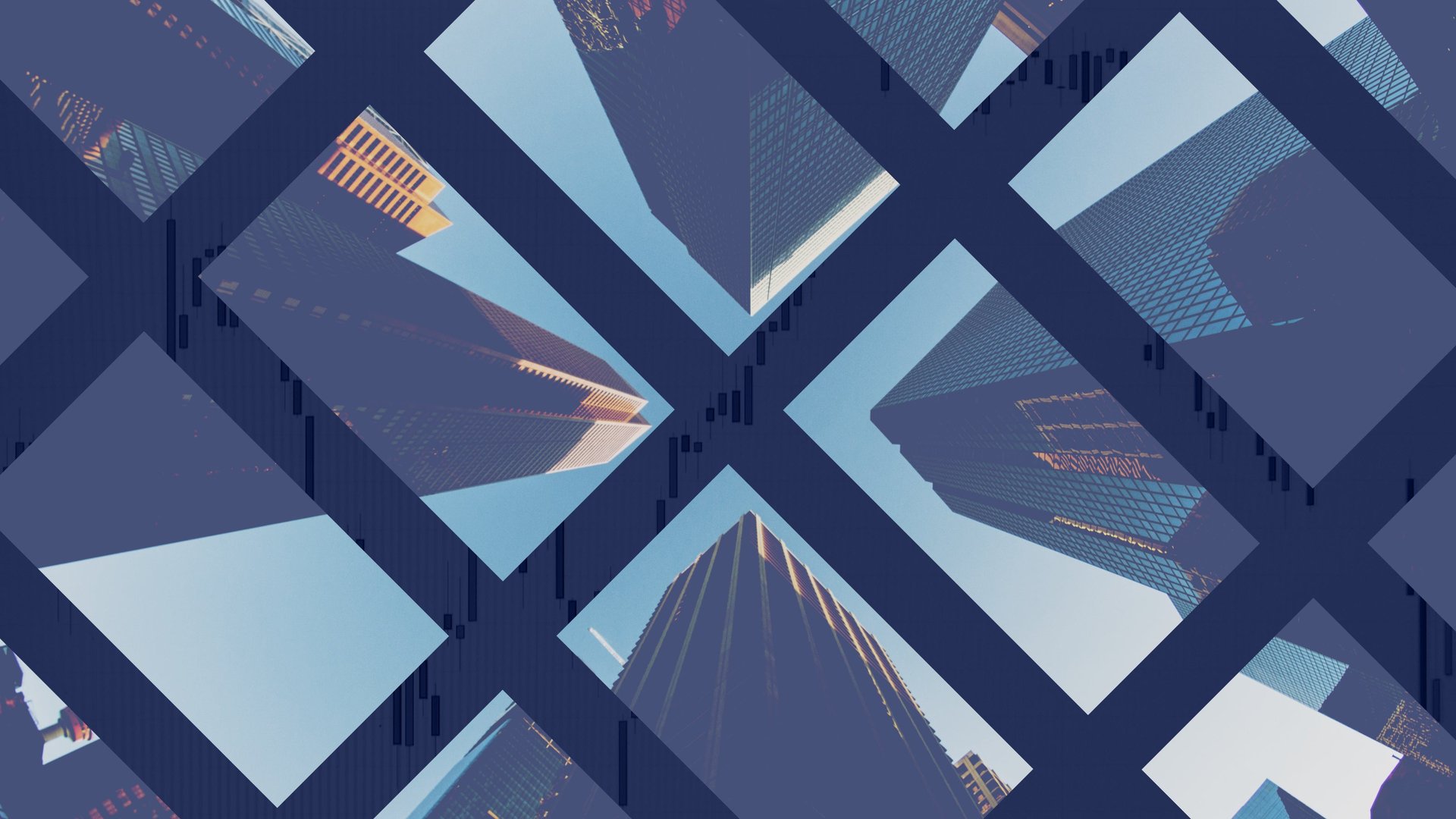

Exchange-traded funds (ETFs) have captured 10% of global markets’ $51.4 trillion in assets. The top five ETF issuers—including BlackRock and Vanguard—manage $3.8 trillion of these assets. More than 400 smaller investment management companies share the remaining $1.3 trillion.

Exchange-traded funds (ETFs) have captured 10% of global markets’ $51.4 trillion in assets. The top five ETF issuers—including BlackRock and Vanguard—manage $3.8 trillion of these assets. More than 400 smaller investment management companies share the remaining $1.3 trillion.

The ETF explosion has impacted individual investors, financial management companies, and global markets. Quartz’s latest presentation for members breaks down how.

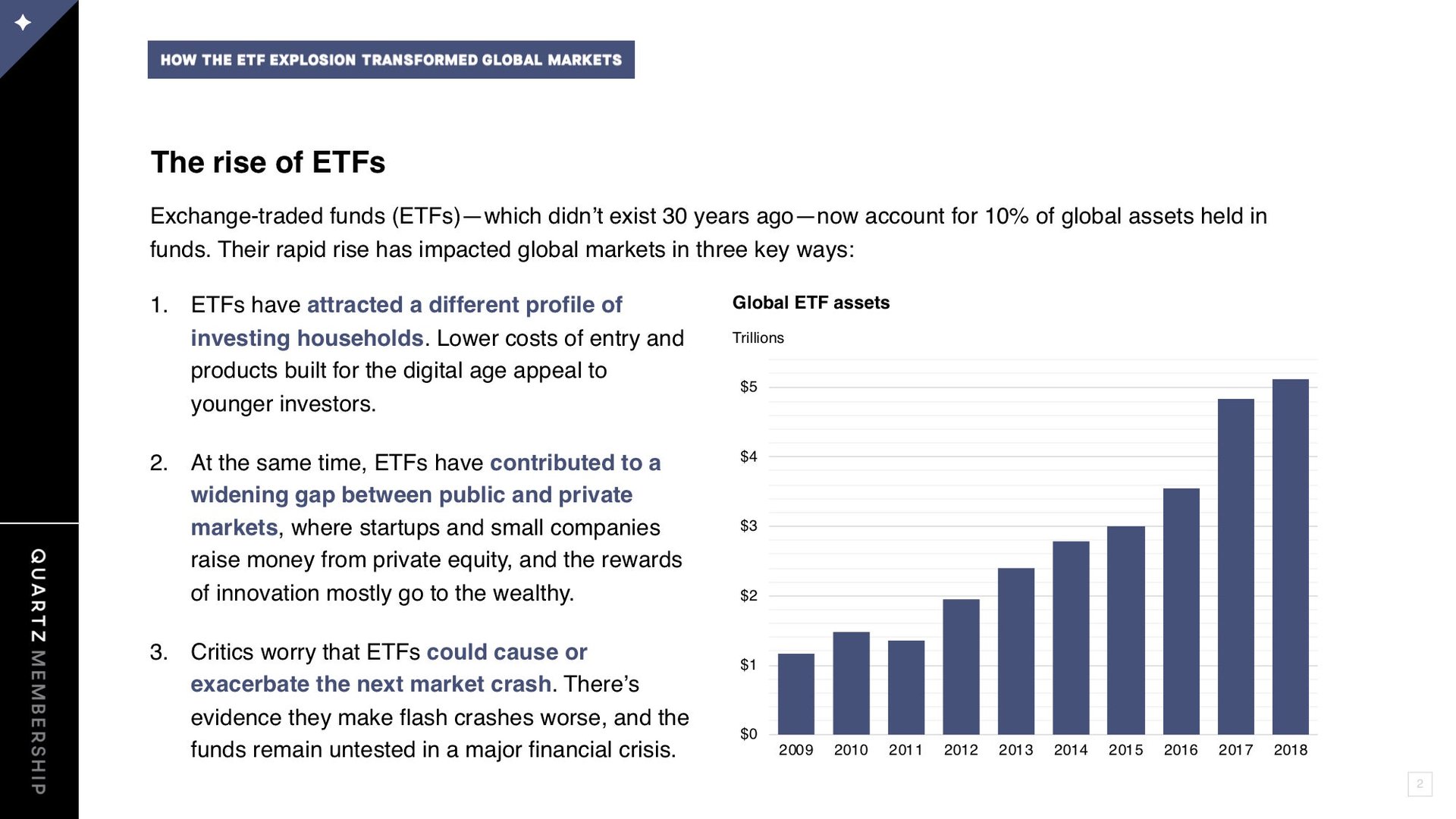

ETFs’ popularity hinges on a few key features of their design. They are flexible and diversified like mutual funds but trade in the same way as stocks. The digital platforms on which ETF purchases and advising largely occur attract young investors who are comfortable navigating financial choices online. Low investment minimums and commission fees make ETFs a relatively affordable option for individual investors.

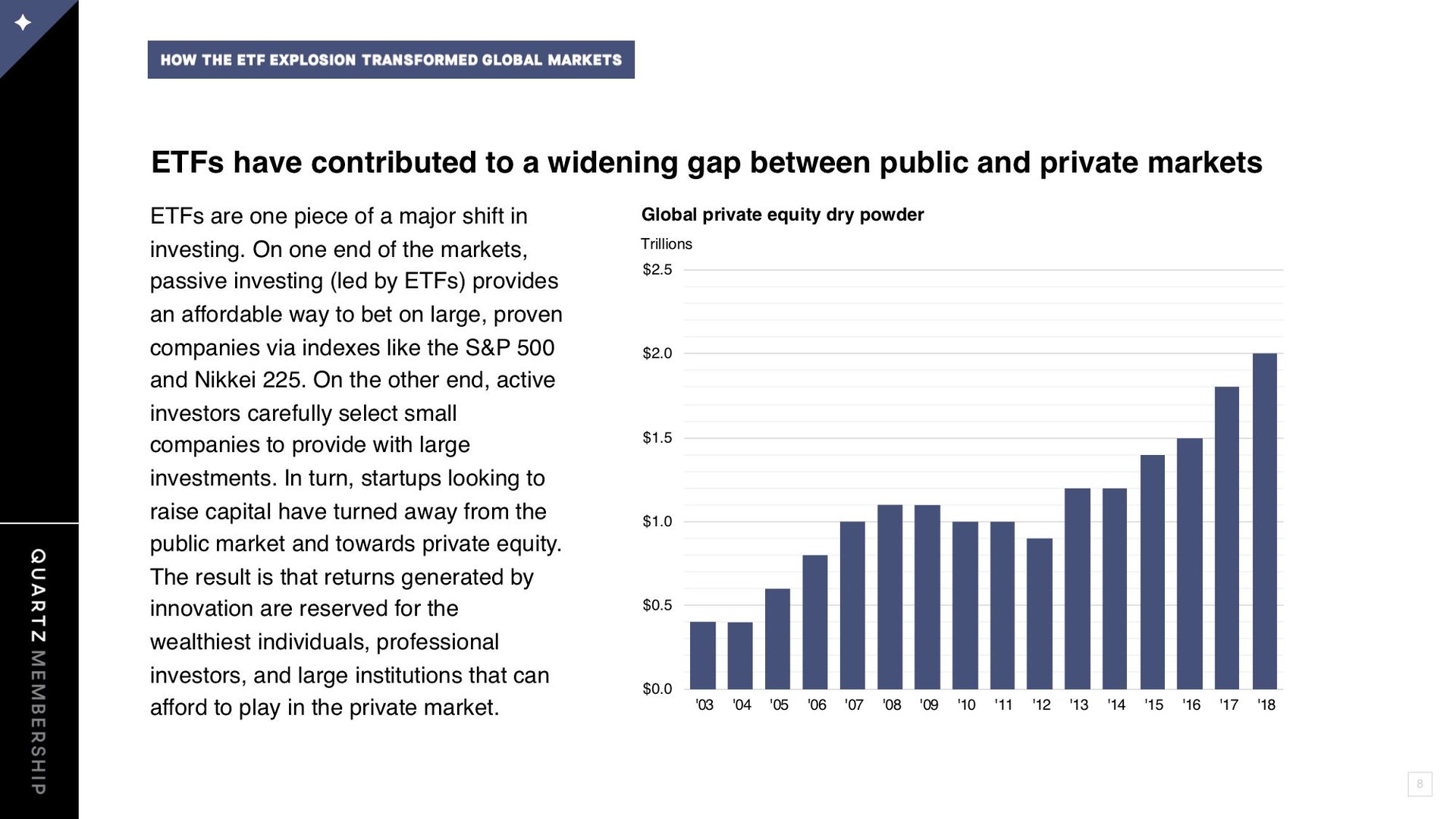

Despite their low cost of entry, ETFs have not democratized financial markets. In reality, the ETF explosion is one contributing factor in a trend towards market bifurcation: Large returns are increasingly limited to the private market as innovative but small startups shy away from a public market dominated by giants.

To see all of the slides, you can view the PDF version or download the PowerPoint file, which includes our sources and notes. This is one of an ongoing series of member-exclusive presentations, which you can read, reformat, and use as you wish.

Please share any feedback about what would make these presentations more useful—or topics you’d like to see us cover—by emailing us at [email protected]. These presentations are an exclusive benefit for Quartz members. We’d love it if you’d encourage any friends or colleagues who express interest to become a member so they can access them too.