How investors should stay afloat amidst the market waves of 2020

Global stock markets rallied in 2019, defying political and macroeconomic unrest. Will investors be as fortunate in 2020? Risks remain, so investing in stable markets and maintaining a broad portfolio will be important ingredients for equity allotment.

Global stock markets rallied in 2019, defying political and macroeconomic unrest. Will investors be as fortunate in 2020? Risks remain, so investing in stable markets and maintaining a broad portfolio will be important ingredients for equity allotment.

The year in review

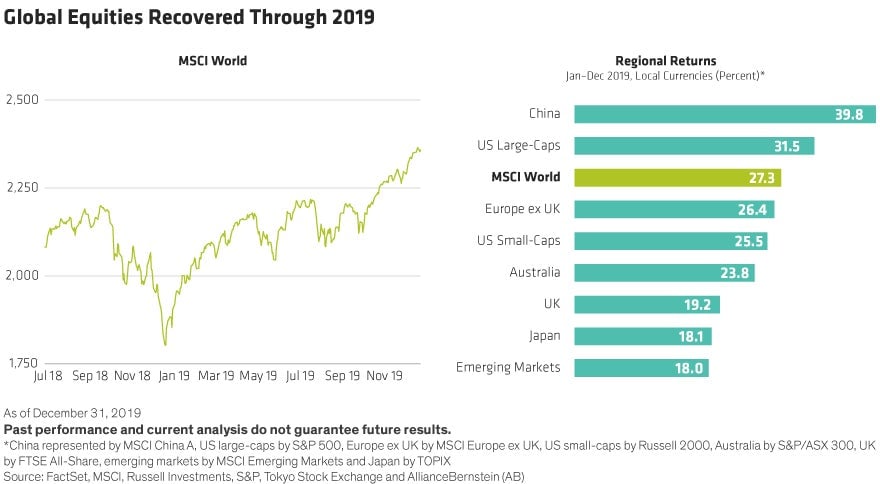

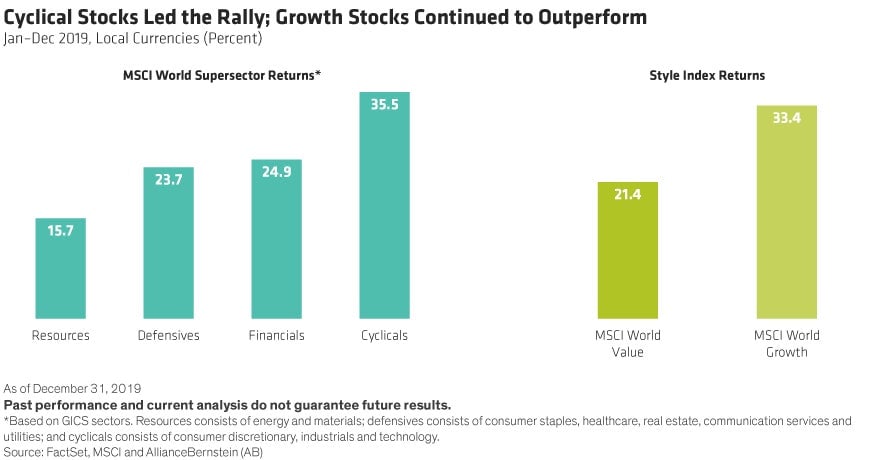

The MSCI World Index exceeded its September 2018 peak in the second half of 2019. In developed markets, US-based large-cap stocks created global gains. While emerging markets were relatively weak, Chinese stocks surged through the constant rumbling of trade war tensions. Meanwhile, growth stocks led markets throughout most of the year, with brief signs of value recovery in the third quarter.

The last of the bull market, maybe

While it’s unclear if we are in the last stage of a purchase-driving market, investors are asking whether the conditions that got us here will last despite the prolonged stock-climbing phase.

What powered stocks in 2019? A decline in worst-case scenarios.

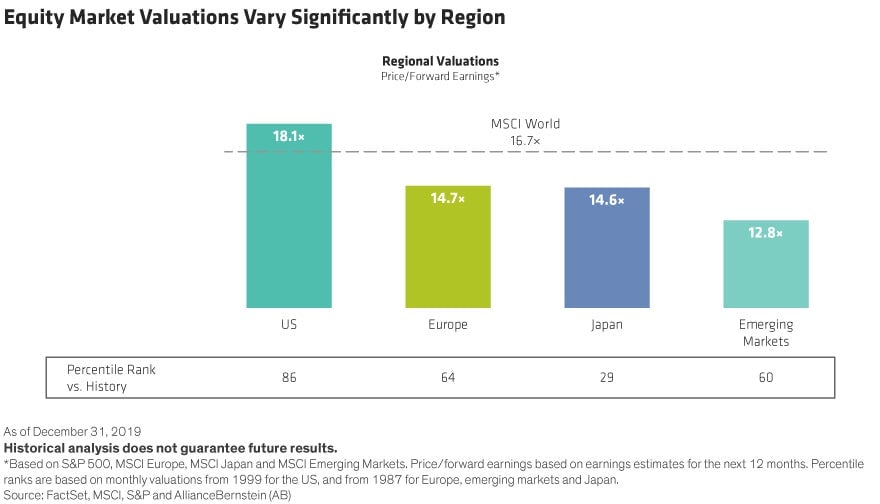

Global macroeconomic growth hasn’t collapsed; it has continued to expand at a modest pace. By the end of 2019, global equity market valuations were historically high, though regional markets varied. European and Japanese stocks looked more attractive than their US peers.

There’s no escaping uncertainty

Over the past two years, markets have been more tenuous. Global stocks were up or down more than 1% on 71 days in 2018 and 2019, compared to only five days in 2017.

Market unrest has been fueled by political concerns: Will the US-China trade war resolve or deteriorate? Does Brexit threaten European economic stability? How will the US presidential election play out?

Anxieties about these issues cloaked reassurances that investors received in December about relief on two fronts. The first phase of a US-China trade truce offered hope of further de-escalation between the two economic powers, and the victory of Boris Johnson’s Conservative Party in British elections suggested that the UK might have a clear path to Brexit.

Still, investor worries persist.

This is the time for optimism

Stronger growth, looser monetary policy, and fiscal easing could set the stage for another good year. Since it’s impossible to predict changes in erratic markets, we think investors should stay in stocks—but with style diversification.

Last year’s patterns reinforce the case for scrutinizing style and regional exposures. For most of 2019, growth stocks surpassed value stocks. But value stocks outperformed in September, reminding investors how quickly style sentiment can turn, and refocusing attention on an asset class that has been out of favor for the last decade.

The valuation gap between equity styles is still extreme. By year-end, growth stocks traded at a P/FE ratio of 22.8, versus 13.1 for value, according to MSCI. Minimum-volatility stocks, which got more expensive in 2019, lagged toward the end of the year.

From a regional perspective, US equities outperformed other developed markets for more than a decade. While US stocks are still an important slice of the global equity pie, investors who have been under non-US markets should reconsider their positioning.

Find stability in healthcare and tech

In any equity decision, current conditions make it important to assess how vulnerable holdings are to risks.

In the US, for example, political risk is widely seen as a source of volatility for the healthcare sector. These stocks will likely fluctuate as the November 2020 presidential elections loom.

Rather than avoiding healthcare, investors should tread carefully. Politics are unlikely to derail areas like gene sequencing, robotic surgery, and healthcare companies offering products with real benefits. Even select health insurers are well-positioned.

Stable tech companies can also be found. Investors should look for microindustries and companies immune to regulatory issues. For example, companies that can enable high-quality shrinking semiconductors should enjoy a solid demand. IT services that provide new cloud-based services should benefit, too.

Take the heat in 2020

These trends have a few things in common. They aren’t tied to a macroeconomic or political outcome. That doesn’t mean these industries are immune to change, but over the long term, their fundamentals should prevail.

At the same time, it’s essential to make sure overall allocation is diversified. Core equity portfolios can neutralize style biases, while low-volatility portfolios can prepare for downswings.

Investors who stayed on the sidelines in 2019 because of unrest in 2018 paid a heavy price for complacency. By finding companies that can take the heat in stride, and building distributions that can capture return potential, investors can gain the confidence to dive into the market through the waves of 2020.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorized and regulated by the Financial Conduct Authority in the United Kingdom.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein

This article was produced on behalf of AllianceBernstein by Quartz Creative and not the Quartz editorial staff. Sources are provided for informational and reference purposes only. They are not an endorsement of AllianceBernstein or its products.