Simple’s users were just valued at 28 times WhatsApp’s, and that doesn’t matter one bit

Facebook isn’t the only company making a big acquisition this week. The Spanish bank BBVA just bought US banking start-up Simple for $117 million.

Facebook isn’t the only company making a big acquisition this week. The Spanish bank BBVA just bought US banking start-up Simple for $117 million.

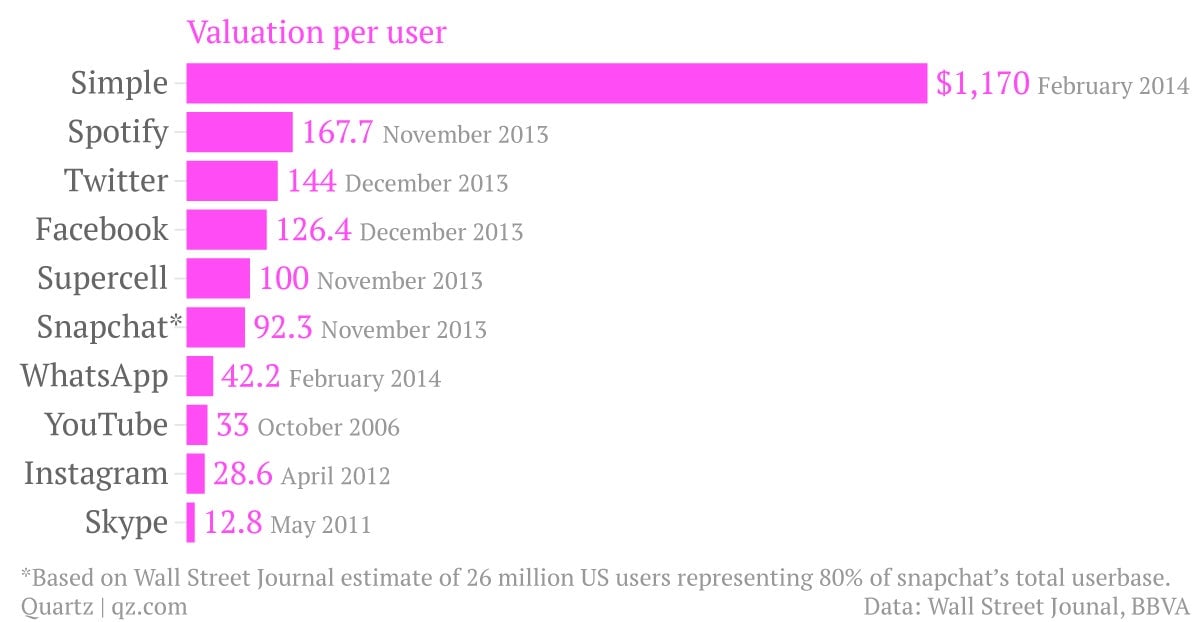

BBVA’s purchase is tiny compared to Facebook’s—162 times smaller, to be exact. But on a per-user basis, Simple’s valuation was 28 times that of WhatsApp—$1,170 versus WhatsApp’s $42. As the Wall Street Journal points out, WhatsApp’s per-user valuation set no records and in fact lags behind that of other high-profile companies.

The deal for Simple eclipses all of these.

The thing is, per-user valuation has very little utility outside of the deal negotiations. It is just one of many metrics buyers and sellers use to make each other comfortable with the price of an acquisition. This type of metric doesn’t tell you much about the business success of any of these companies, and reeks of dot-com bubble speculation on the future value of current customers.

Every company is different, and while it’s easy to compare two companies that hire lots of software developers, operate databases, and interact with customers primarily through websites and apps as equals, the reality is that such comparisons are irrational and idiotic.

For some companies, per-user numbers are used as a measure of their ability to monetize the user base—to predict how many ads they’ll see and click on or how many months they’ll likely subscribe. With Simple, and now BBVA, more users mean more customers to make deposits. More deposits means more capital to invest and make money. (Deposits through Simple currently end up in accounts provided by Bancorp Bank—though that will change with the acquisition)

It should come as no surprise that Simple has a high per-user valuation; banks value their customers enough to often pay hundreds of dollars for new accounts. In Simple’s case, they just happen to be selling their company too.