The European banking system still is a mess: RBS edition

Here comes the axe.

Here comes the axe.

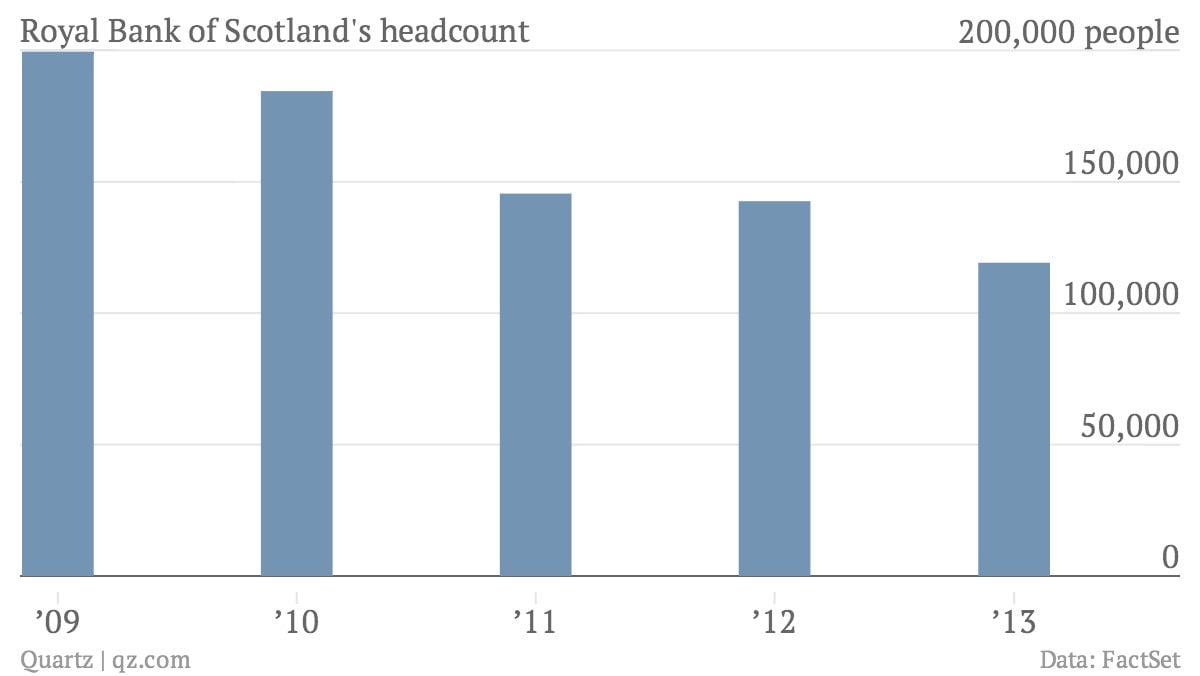

The Royal Bank of Scotland is set to layoff as much as a quarter, or 30,000 employees, of its roughly 120,000 work force, the Financial Times reports (paywall).

The severe cuts are expected to be executed over the next several years as the government-owned financial institution, along with other European banks, make a steady retreat from risky businesses such as trading. According to the FT report RBS, headed by CEO Ross McEwan, is slated to focus a smaller franchise on retail, small businesses and large corporate clients.

Reports of RBS’s moves to slash its headcount follow the bank’s announcement last year that it would aim to accelerate an overhaul of its business by in an effort to return billions to the British government, which owns 81% of the sprawling bank after it accepted a government-backed bail out loan a little over five years ago.

The off-loading of business units already has begun with RBS announcing plans earlier this week to sell a specialty structured products unit to BNP Paribas. RBS also has stepped up a plan to launch a partial initial public offering of Rhode Island-based Citizens Bank, which RBS acquired in 1988.

RBS plans to scale back its business follow a number of European and US banking franchises that have been cutting employees five years after an economic crisis that brought much of the global banking system to its knees. Barclays, UBS and others have been retreating from riskier businesses and reducing staff spurred by regulators over the past several years.