Are student loan debts setting the stage for the next bubble?

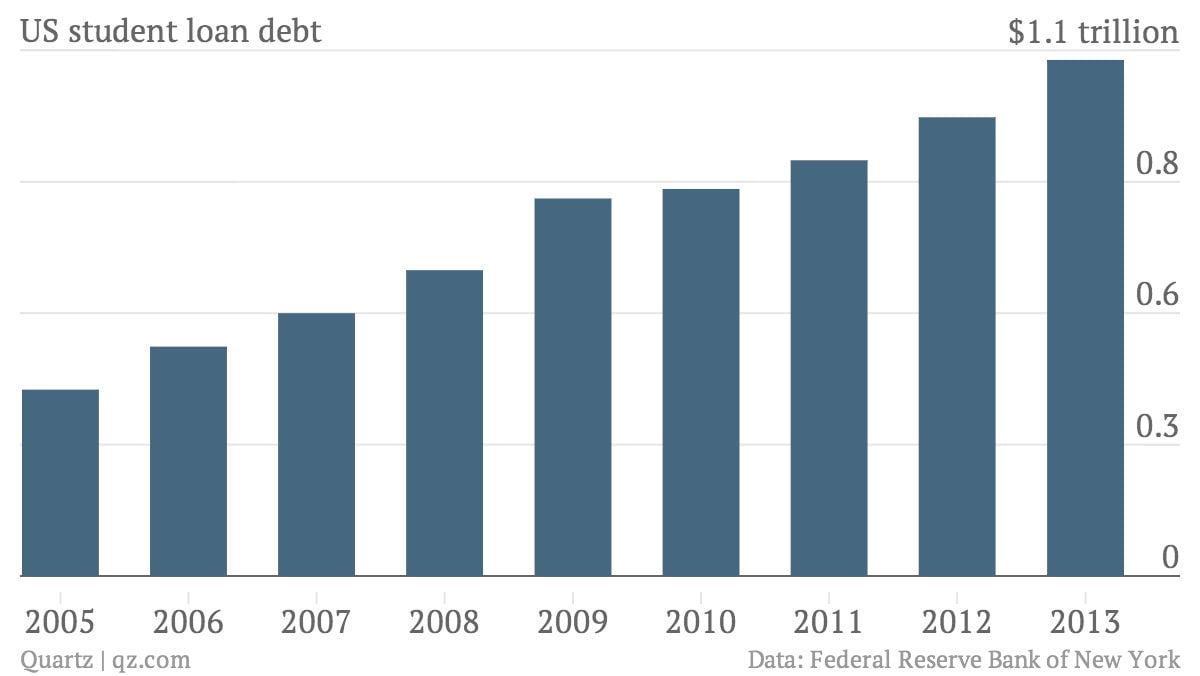

Maybe it’s just a sign that the markets are getting overheated: Americans are taking out student loans in part to cover everyday expenses. The Wall Street Journal reports on this phenomenon—in which borrowers are using student loans as stop-gap financing to cover everything from monthly bills to groceries to previous student loan payments. The development is particularly troubling as student loans hit a staggering $1.1 trillion, and as college tuition costs continue to rise.

Maybe it’s just a sign that the markets are getting overheated: Americans are taking out student loans in part to cover everyday expenses. The Wall Street Journal reports on this phenomenon—in which borrowers are using student loans as stop-gap financing to cover everything from monthly bills to groceries to previous student loan payments. The development is particularly troubling as student loans hit a staggering $1.1 trillion, and as college tuition costs continue to rise.

While some of the growth in student loans is attributable to people seeking more education, the Journal explains, these loans are attractive for other reasons too: For one thing, many of those seeking student loans can avoid credit checks.

This combination of rising costs and opportunistic borrowers leaning more on ever-growing student debt seems like a recipe for trouble. The only consolation is that the private banking system may emerge relatively unscathed. That’s because the US government, which has basically taken over the student-lending business over the last few years, would be on the hook for bad loans. That means taxpayers may take a loss if students can’t repay their debts. But maybe that’s better than another banking crisis.