Goldman Sachs is looking to scoop up bond traders in Australia

Goldman Sachs is chasing fixed-income business Down Under by snapping up the best bond traders in Australia. Bloomberg reports that the firm is in talks with about 10 potential hires as it seeks to expand from trading to capital markets.

Goldman Sachs is chasing fixed-income business Down Under by snapping up the best bond traders in Australia. Bloomberg reports that the firm is in talks with about 10 potential hires as it seeks to expand from trading to capital markets.

It’s an interesting and seemingly counterintuitive move for one of the world’s most prominent investment banks. For one thing, Australia’s economy—which has gone more than two decades without a recession—seems to be softening. Indeed, economists are predicting that Australian GDP, to be released later this week, will show growth of just 2.5% in the fourth quarter. That’s much slower than the 4% growth pace of 2012. (In theory, slower growth and slower investment growth means less corporate-bond-market borrowing, to which fixed-income trading is traditionally linked.)

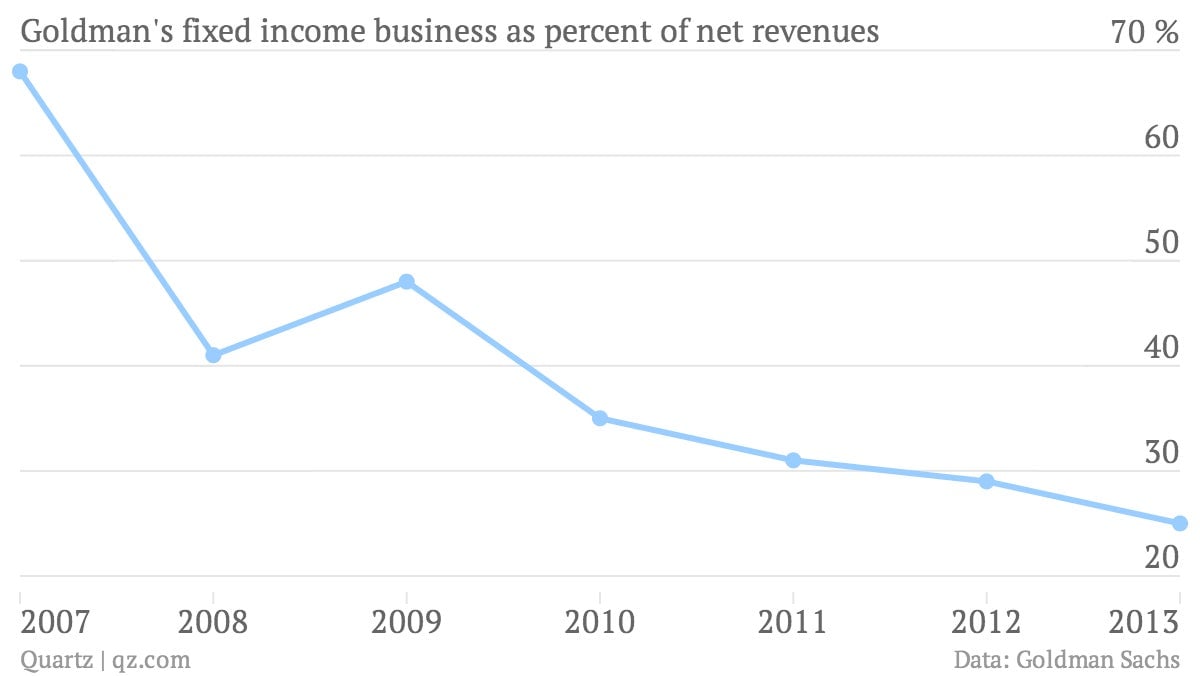

And in the past few years, Goldman has been doing anything but growing in its fixed-income currencies and commodities area, which is the heart of its fixed-income platform—once a main driver for its revenues during the height of the pre-crisis boom. To say that Goldman has undergone a retraction in fixed income is perhaps an understatement, given that nearly 70% of Goldman’s revenues were driven by areas that included fixed-income sales and trading back in 2007, and now those segments only generate a quarter of the firm’s revenues.

The recent retreat has been underpinned by new regulations, including the Volcker Rule, which limits banks’ ability to use their own money to make bets on the market.

So why Australia? And why now? Simon Rothery, chief executive officer for Australia and New Zealand at Goldman, told Bloomberg Businessweek that fixed-income trading is one of the firm’s biggest growth areas. And with other banks pulling back from the market—Royal Bank of Scotland and Lloyd’s Banking Group among them—it might be time for a deep-pocketed entity such as Goldman to pick up some talent. Back in October, Goldman president Gary Cohn said that the firm (paywall) would more broadly aim to “redouble or triple” its efforts in fixed income.

“We’re looking for seasoned traders,” Cohn told Bloomberg. ”We’re replenishing our trading supply.”