Russia’s market meltdown is dragging a host of European companies down with it

What do Russian troops in Crimea have to do with a Danish beer company, a Finnish tire maker, and an Austrian bank? In the interconnected world of finance, what happens on the shores of the Black Sea quickly reverberates on bourses across Europe. Amid the rout in Russian markets, companies across the continent that do business with Russia also saw their shares dumped by jittery investors.

What do Russian troops in Crimea have to do with a Danish beer company, a Finnish tire maker, and an Austrian bank? In the interconnected world of finance, what happens on the shores of the Black Sea quickly reverberates on bourses across Europe. Amid the rout in Russian markets, companies across the continent that do business with Russia also saw their shares dumped by jittery investors.

A weaker ruble, higher interest rates, and general economic turmoil spell trouble for firms that generate a significant share of their profits in Russia. Moscow’s uncertain intentions in Ukraine and the West’s options for retaliation seem to have convinced investors to cut their exposure to Russia-related assets and sit out the turbulence on the sidelines.

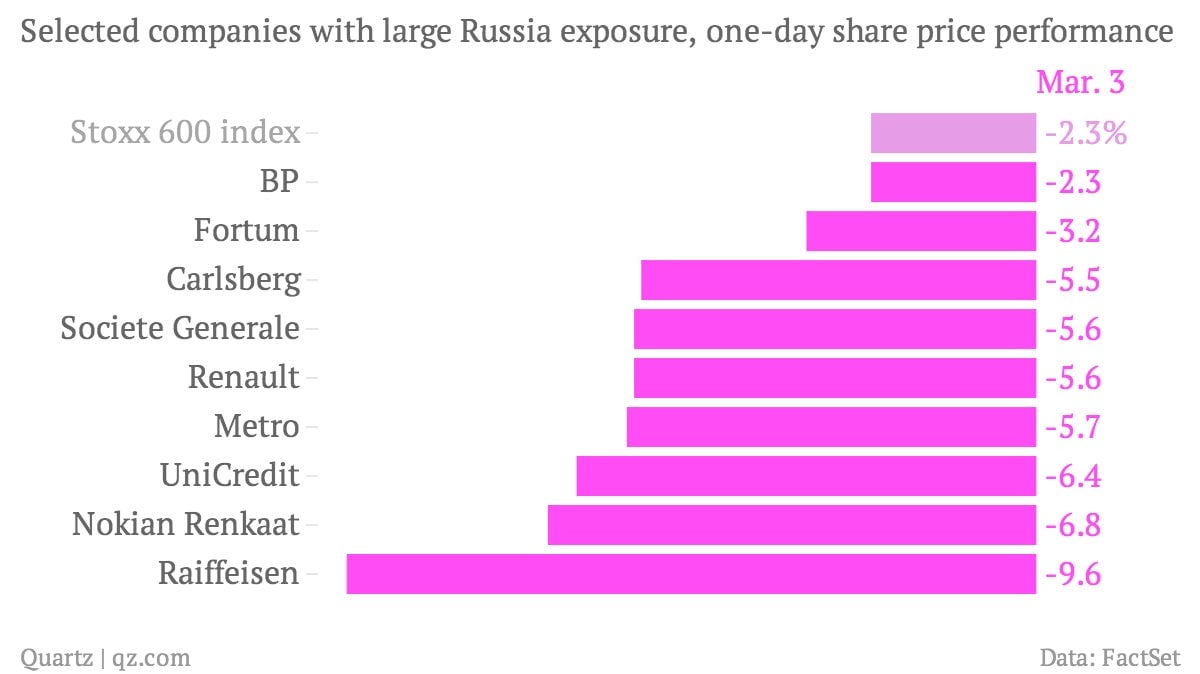

The deep links that companies have forged with the BRIC economy on Europe’s doorstep are apparent in the scale and scope of the carnage in the markets: Germany’s DAX had its worst day of trading in two and a half years. Thanks to Vladimir Putin’s land grab, these are a few of the companies based in Western Europe that are destined to suffer a discount in the markets for the foreseeable future:

- Carlsberg was already suffering from sluggish sales in Russia, where its Baltika is the most popular beer in the country. The Danish beer group is also the number-two brewer in Ukraine. Together, these and other businesses in Eastern Europe account for around a third of the group’s operating profit.

- German retailer Metro reportedly is thinking of shelving a planned listing of its Russian wholesale business thanks to the market turmoil, putting off a potential €1 billion ($1.4 billion) payday.

- European banks with Russian and Ukrainian exposure were particularly hard hit today. Austria’s Raiffeisen halted the sale of its Ukrainian subsidiary, while other lenders with extensive links to Eastern Europe, like Italy’s UniCredit and France’s Société Générale, also saw shares fall.

- Unsurprisingly, a number of energy companies operate in resource-rich Russia, but traders seem the most nervous about Finnish utility Fortum, which runs power plants across the country, and British supermajor BP, thanks to its large stake in Rosneft, which lost more than $4 billion of its market value in trading today.

- Russia is the third-largest market for French carmaker Renault, and it will gain even more exposure to the country this year after it is obliged to take a majority stake in local manufacturer AvtoVAZ as the result of a 2008 deal with the firm.

- Finnish tire maker Nokian Renkaat generates a third of its sales in Russia (pdf, p. 10), and another fifth elsewhere in eastern Europe; the group was one of the hardest-hit stocks among members of the European blue-chip Stoxx index today, down nearly 7%.