How Obama wants to fight inequality with a twist of the tax dial

Most Americans are worried about inequality, but especially the Americans in president Barack Obama’s political party—and so Obama has developed a plan to take on the problem.

Most Americans are worried about inequality, but especially the Americans in president Barack Obama’s political party—and so Obama has developed a plan to take on the problem.

His 2015 budget, released today, is largely an academic exercise. Spending levels for next year have already been set by a bipartisan agreement, and a gridlocked Congress isn’t likely to take up Obama’s plans to spend more on infrastructure and education. He’s got a better chance of securing $1 billion in loans to Ukraine than an additional $1 billion for new railroads and bridges in the US.

But he does have to provide his party’s lawmakers with a vision they can back in this year’s elections. They will determine whether he spends his final two years in office tussling with a united Republican Congress—if the opposition, which controls the House of Representatives, also wins the Senate—or cementing his legacy.

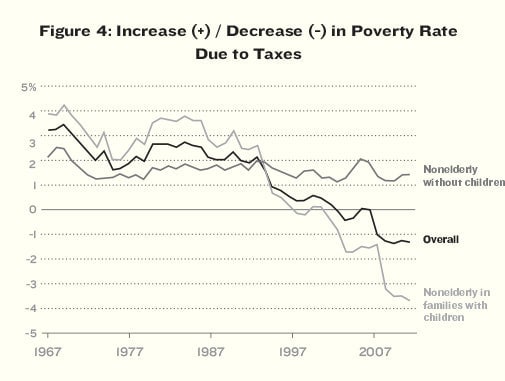

To help low-income people, Obama wants to deploy the Earned Income Tax Credit (EITC). Currently, it refunds taxes for low-income workers with children. The average refund in 2013 was $2,905. Since it was instituted, the EITC has done a lot to reduce poverty in the United States (see chart below), and because it encourages work (you have to be employed to access the credit) and cuts taxes, the right likes it. You can see the effect in this chart from Jason Furman, the former Obama economic adviser whose fingerprints are all over this proposal:

But you can also see that a significant chunk of the population wasn’t affected by the change—working-age Americans who don’t have children. That’s why Obama wants to expand the EITC (pdf) to include any workers who make less than $18,070 ($23,570 for married couples). That would help 13.5 million Americans and lift 500,000 of them out of poverty completely.

Of course, this costs money—$60 billion over ten years—and if Obama has his way, it will come mostly from two places: One, ending the “carried interest” tax break, which allows the managers of private equity, hedge and venture-capital funds to have their wages taxed as capital gains; and two, ending a tax break that lets professionals avoid even the limited social security and Medicare taxes on their salaries. These two loopholes are fairly easily classified as “unfair”—even a recent conservative tax reform plan took aim at carried interest—so perhaps the exchange can be made to raise taxes on the rich and lower them for the poor.