The bankers at Moelis & Co. make over $1 million a year and they’re about to get richer

Superstar banker Ken Moelis has been paying handsomely for talent at his privately held advisory firm.

Superstar banker Ken Moelis has been paying handsomely for talent at his privately held advisory firm.

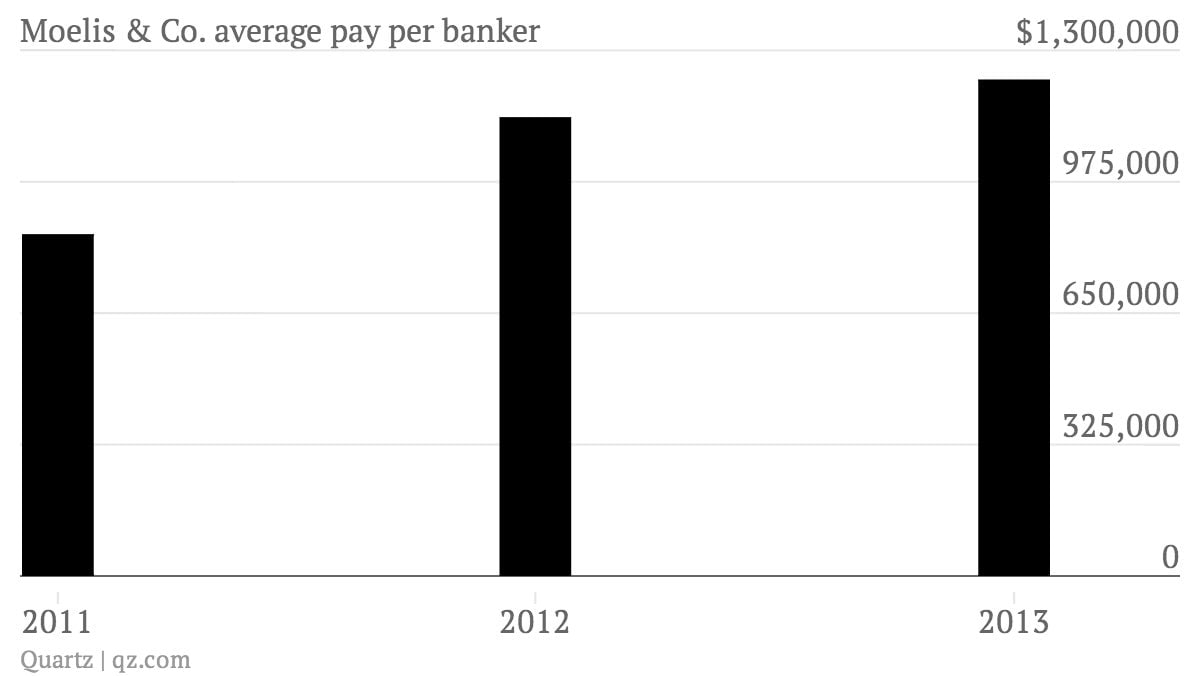

Bankers at Moelis & Co. were paid $1.2 million on average last year, according to filings by the fast-growing investment bank, which made its intention to go public official today.

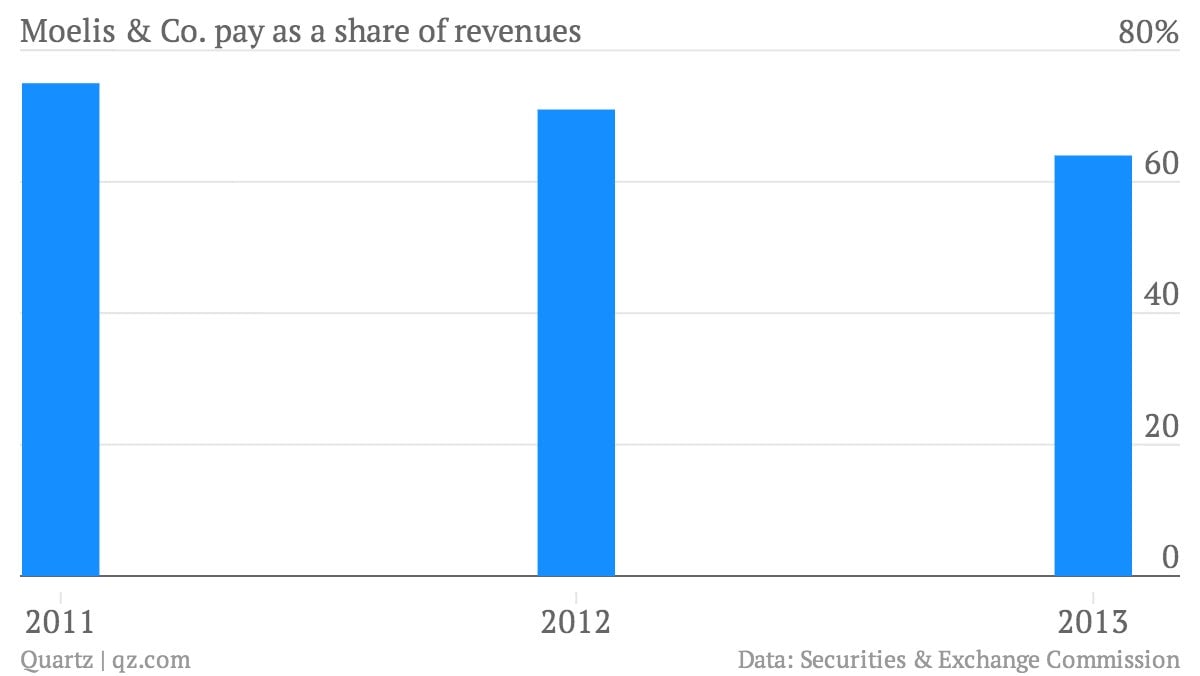

Although compensation—including salaries, bonuses, and benefits—tends to be one of the biggest expenses of any investment bank or advisory firm, (a firm’s compensation as a share of its revenue is typically in the 50% range), Moelis’s compensation might strike some as high relative to other firms. For example, Goldman paid out 37% of its revenue in salaries and other employee benefits, About 30% of the $10.8 billion of revenue in JP Morgan Chase’s investment banking unit was directed toward pay. More than 60% of Moelis & Co.’s revenue was earmarked for pay in 2013, and nearly three-quarters in the two prior years.

Luring talent away from competitors and then keeping them happy as the markets stabilized has been the name of the game for Moelis since the former UBS banker started the firm in mid 2007, just as the economy was imploding. Since then the company has grown so quickly that it’s not clear whether it should still be considered a “boutique” investment bank (a designation usually conferred upon speciality banks that have a small number of employees). Smaller investment bank advisory firms have performed relatively well compared to their bigger peers in the crisis because the business of advising clients on deals doesn’t generally require a firm to incur a lot of expenses, compared to trading.

Moelis hired Goldman Sachs and Morgan Stanley to help the firm underwrite the IPO. Goldman and Morgan Stanley leading the public listing of Moelis carries with it a bit of irony considering that Moelis has been trying to nip at the heels of the bigger banks. Goldman and Morgan Stanley ranked first and third in fees generated from merger and advisory business in 2013. That compares to Moelis, which was at 17th (still pretty good for a 317-banker shop), according to Dealogic. The firm is set to trade on the New York Stock Exchange under the ticker symbol “MC.”