Why the US government isn’t making health a priority in its coronavirus response

To blunt a major recession sparked by the coronavirus pandemic, the US Federal Reserve has poured liquidity into global markets and US lawmakers have authorized trillions in economic relief spending. Public debate is now focused on when Americans can leave their homes and get back to work.

To blunt a major recession sparked by the coronavirus pandemic, the US Federal Reserve has poured liquidity into global markets and US lawmakers have authorized trillions in economic relief spending. Public debate is now focused on when Americans can leave their homes and get back to work.

A plan to address the root cause of the crisis, the coronavirus itself, however, appears to be missing from the US government’s emergency response. That’s in part because, as the old saying goes, the generals are always fighting the last war: Just as leaders in 2008 looked to lessons learned during the earlier Asian financial crisis to solve that economic meltdown, they are now looking to the 2008 debacle to inform their response to the current one. Unfortunately, this economic crisis originated outside the economy.

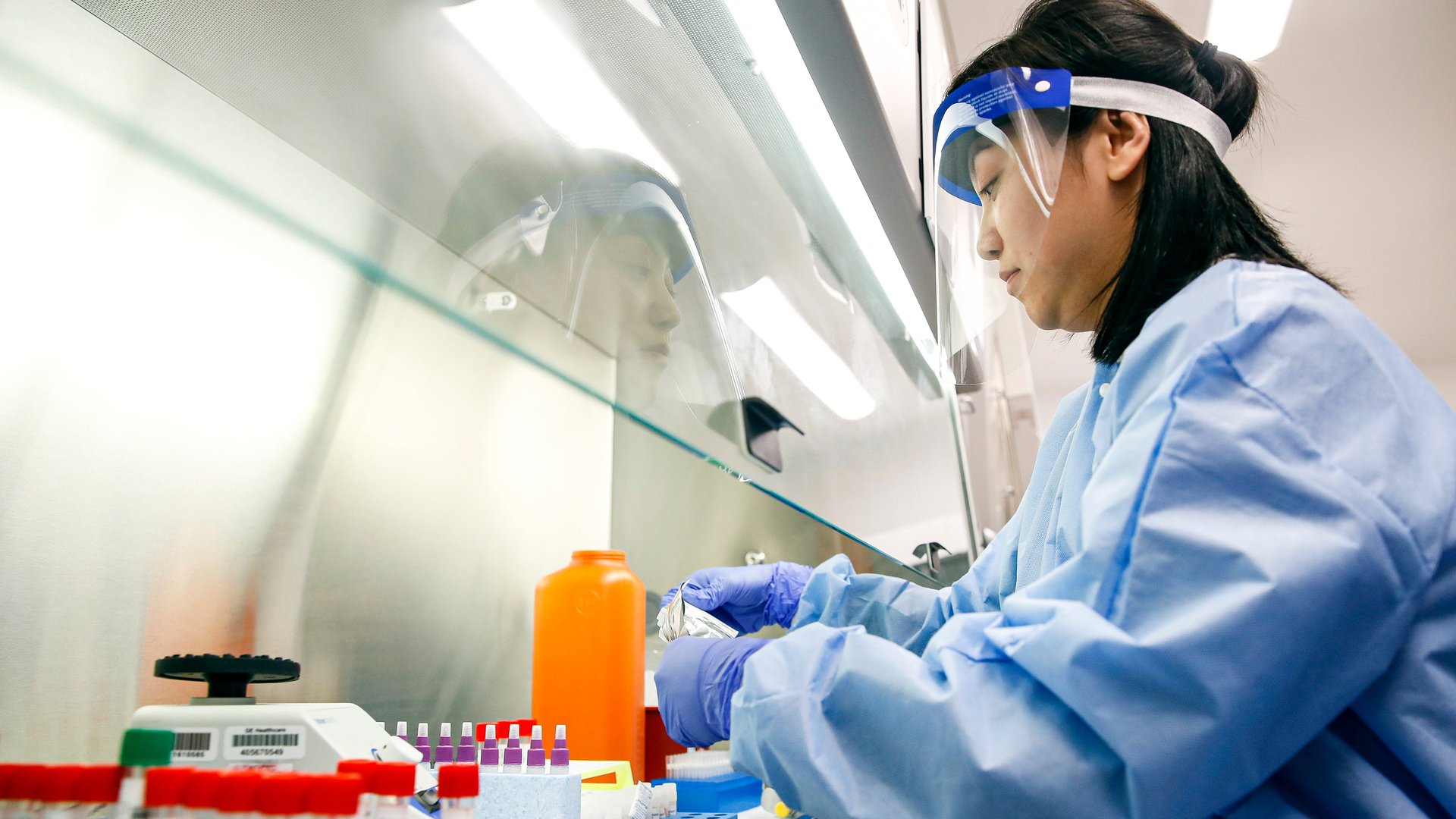

In order rescue the country from the economic crisis caused by Covid-19, Americans need to know it’s safe to leave the house. Yet daily virus testing has not meaningfully increased in weeks. A new report from an inter-disciplinary group of doctors, economists and engineers convened by Harvard University says the US needs 5 to 20 million tests daily to safely re-open the economy. On April 19 healthcare workers performed just 167,000, according to the Covid Tracking Project.

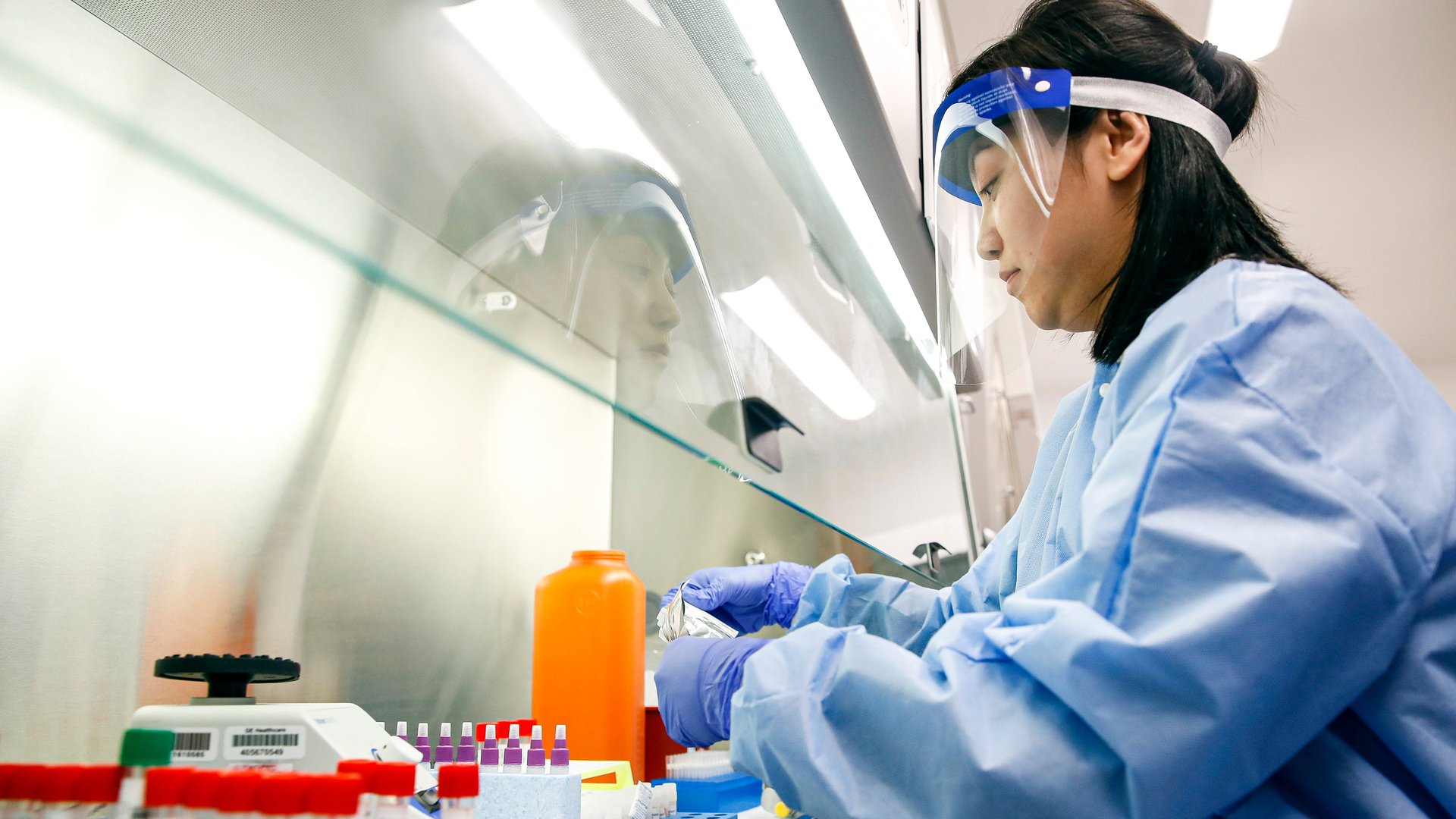

US lawmakers have not funded a national test and trace effort, and the federal government has not found the extra 100,000 people required to operate it. The government is not building a comprehensive database of who has the virus and where they’ve been. And there is still no coordinated effort to get personal protective equipment to the healthcare workers who need them most.

All this is not to criticize the economic policymakers responding to this crisis; much of that isn’t their job. But until the government recognizes that this crisis is unique, and treats public health with the same urgency as small business loans, this crisis won’t be solved.

From Asia to AIG

In 2008, after the US housing market—and soon after the entire global economy—collapsed, policymakers opened the emergency playbook used during the Asian financial crisis a decade before.

That crisis, in 1998, was sparked when spectacular growth in parts of Asia began to slow, causing a sudden departure of international capital. Like a run on a bank, money poured out of these countries, causing domestic currencies to drop in value, exacerbating debts held in foreign currencies and leading to stock-market sell-offs. The contagion spread around the Pacific and then the globe.

The International Monetary Fund (IMF), with help from the US, stepped in with aid to keep the countries afloat and restore confidence. Initially, it imposed classic “IMF programs” on borrowers, requiring them to cut spending and institute difficult reforms in the heart of a crisis. This made things worse rather than better, and by the end the lesson was learned and the fund began to provide cash to strapped countries on more generous terms.

Many of the key figures in the response to the 2008 financial crisis, in particular Obama’s Treasury secretary at the time, Tim Geithner, were influenced by the experience of the Asian financial crisis. While banking and currency crises operate differently, in both cases financial authorities seek to backstop troubled institutions as generously as possible to prevent a crisis of liquidity (“we can’t pay our bills because our assets can’t be sold”) from turning into one of insolvency (“we can’t pay our bills, period”).

So when the housing market failed, government officials focused on getting money into the financial system to keep it from going under, creating the Troubled Asset Relief Program (TARP). That wasn’t just the memory of Asia, either: then-Federal Reserve chair Ben Bernanke was a scholar of the Great Depression and saw a chance for the central bank to avoid the inaction that helped destroy the US economy in 1929.

But in reflexively avoiding the problems of previous financial debacles, US officials missed the chance to address the unique circumstances of that moment by providing support to homeowners at the bottom of the financial pyramid. Efforts to modify unsustainable mortgagers were scattershot and slow. Personal bankruptcies and falling consumer spending would ultimately exacerbate years of recession.

From TARP to CARES

This time around, policymakers in charge are drawing on the lessons learned in the aftermath of 2008: Don’t spend so much time focused on banks and big business that you forget the people bearing the brunt of the pain.

So the Coronavirus Aid, Relief, and Economic Security Act (CARES) based much of its business aid on whether employees still receive paychecks, increased unemployment insurance for workers without jobs, and provided the Federal Reserve with a largely unconstrained $454 billion to aid everything from big business to state and local governments.

This time, however, there’s a new wrinkle: This crisis did not spring from the economy itself—it was not a result of speculators or lax regulators, low interest rates or greedy executives. It was caused by a health crisis. Policymakers are clearly having a hard time wrapping their minds around this. Less than a fifth of the $2 trillion allocated by the CARES Act is directed at fighting the virus, and the bulk of that money went to backstop hospitals and other healthcare providers that are losing money by deferring non-Covid-19 care. Keeping those hospitals operating is important, but it won’t be enough to allow the economy to re-open.

When it came to testing, only a small amount was earmarked for the task: $1.5 billion in aid to states for everything from buying face masks and ventilators to scaling up test and trace, and $1.5 billion to bolster the US Centers for Disease Control and Prevention (CDC) testing program. Compare that to the $30 to $50 billion experts say will be required in the next year to launch a full-scale national testing program. If the cost seems daunting, the authors note that it “is dwarfed by the economic cost of continued collective quarantine of $100 to 350 billion a month.”

What now?

The White House is anxious to re-open the economy, with US president Donald Trump clearly concerned about the ongoing disruption affecting his reelection prospects. Lawmakers are now preparing new legislation that aims to make more funding available to beleaguered small businesses and their employees.

Predictable fault lines have emerged, with Republicans hoping that private industry will take up the testing problem—the precedents don’t look good—and Democrats calling for a $30 billion national testing program. With the White House now insisting that states must be responsible for testing programs, the debate has shifted now to how much aid they need to do so. But most experts agree that national coordination is needed—already, states are setting up ad hoc regional coalitions in an attempt to replace the traditional role of federal authorities.

It’s clear that the US wasted most of February and March, not acting even as the pandemic spread within American borders. Now, the US is buying time, at a steep price, trying to keep people and businesses afloat. The slowing growth rate of viral spread in many American hotspots is a blessing, but the US is not making better use of this time to lay the ground work for a safe return to regular economic activity.

Unfortunately, it’s all too easy to predict what the big blue ribbon commission will say when it writes its report on this crisis.