The ultra rich are starting to like the risks involved in asteroid mining

Even as commodity prices whipsaw on Earth, smart ultra-wealthy investors are starting to take an interest in precious assets overhead in the form of asteroids. So says global consultants Knight Frank in its most recent Wealth Report, detailing the state of property and wealth worldwide.

Even as commodity prices whipsaw on Earth, smart ultra-wealthy investors are starting to take an interest in precious assets overhead in the form of asteroids. So says global consultants Knight Frank in its most recent Wealth Report, detailing the state of property and wealth worldwide.

The company says some ultra high net worth individuals (UHNWIs) are keeping an eye on the progress of new asteroid mining ventures as startups seek to tap near-earth bodies for valuable metals and other elements.

At the moment, a handful of companies such as Planetary Resources, Deep Space Industries and Kepler Energy and Space Engineering have announced various strategies to reach asteroids in the inner solar system. They’ll extract metals such as iron, nickel, cobalt, and platinum and either process these in place or return them to Earth to cash in on their considerable value. The most advanced of these, Planetary Resources, says it will have prospecting platforms in place in the next decade.

Knight Frank says that while these companies’ plans may still be rough, some private investors are happy to take the long view and back interesting ventures in the early stages if they promise a nice return. “These investors tend to be relatively happy to take an element of risk and they are more able to be flexible with investments compared to corporate investors,” Liam Bailey, research director for Knight Frank told Quartz. And these investors, said Frank, tend to be in the United States, and affiliated with the technology sector.

In space, no one can read the fine print

In this case, the elements of risk UHNWIs favor are substantial. Setting aside the technical hurdles, the economic issues surrounding asteroid mining remain fraught with difficulty. While the valuable minerals may be in space, the markets in which they are valued are on Earth, and suddenly bringing large quantities of platinum to market, for instance, would drive down prices, undercutting the ability to use it to fund astoundingly expensive missions.

Also, there is no substantial law on who can claim what objects or resources in space, beyond the 1967 Outer Space Treaty that declared space open for most kinds of exploitation, so long as “states” clean up their mess, leaving no contamination or dangerous objects that could harm others. Private companies weren’t contemplated in the Treaty, leaving a lot open to interpretation.

Perhaps most attractive to UHNWIs, there is also no formal law clearly defining taxation of profits from asteroid mining, though some legal experts contend there is current US law that could be adapted to cover it, albeit only for American citizens. Given the interest in offshoring business and assets among the ultra rich technorati, it seems unlikely that congress would ultimately be able to pin down tax liability, labor rules or much else if these companies decide to exercise their technical genius to seastead, build a jungle city, or find a nice island to operate from.

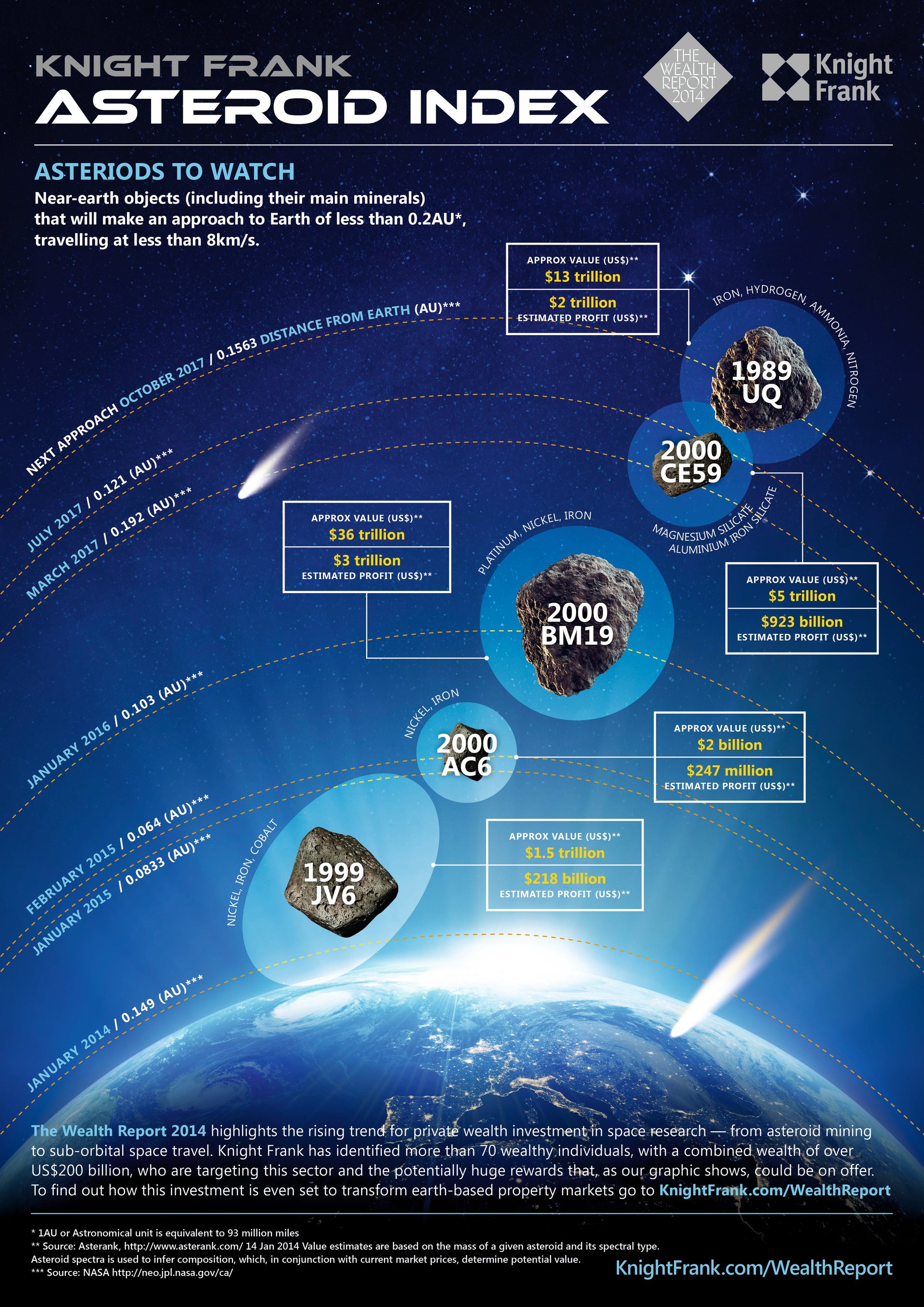

In the meantime, Knight Frank has provided an asteroid cheat sheet to keep UHNWIs’ eyes on the prize. The most recent, asteroid 1999 JV6, unfortunately just slipped past in January with an estimated worth of $1.43 trillion, or an estimated mining profit of about $190 billion based on what asteroid tracking database Asterank thinks can be retrieved. Not to worry though, 1999 JV6 will pass near Earth again in January 2015 and again every January for the next seven years.