Congress still hasn’t picked a chair for its bailout oversight commission

When the US Congress enacted a $1.5 trillion pandemic rescue act in late March, it wanted to ensure help got to the right people, so it formed the Congressional Oversight Commission to monitor how the Federal Reserve and Treasury used the funds.

When the US Congress enacted a $1.5 trillion pandemic rescue act in late March, it wanted to ensure help got to the right people, so it formed the Congressional Oversight Commission to monitor how the Federal Reserve and Treasury used the funds.

The law requires the commission to report back to Congress 30 days after the Federal Reserve and Treasury begin using their authority. With the Fed’s first major actions under the law, known as the CARES Act, taking place on April 9, that first report is due on May 8.

There’s just one problem: While Congressional leaders have chosen four of the five commissioners, they have yet to appoint the chair of the commission, and there is little chance the body will make its deadline.

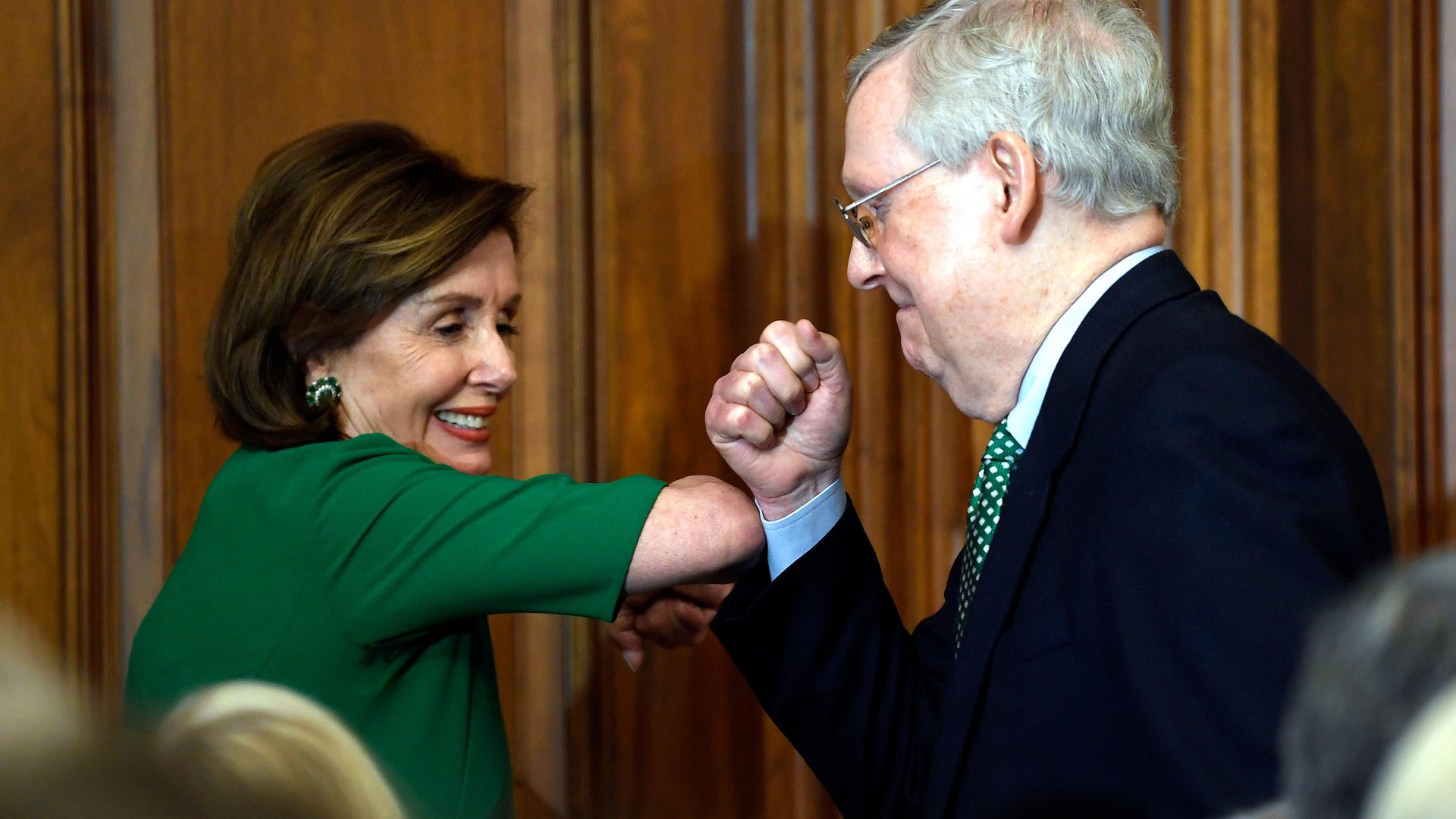

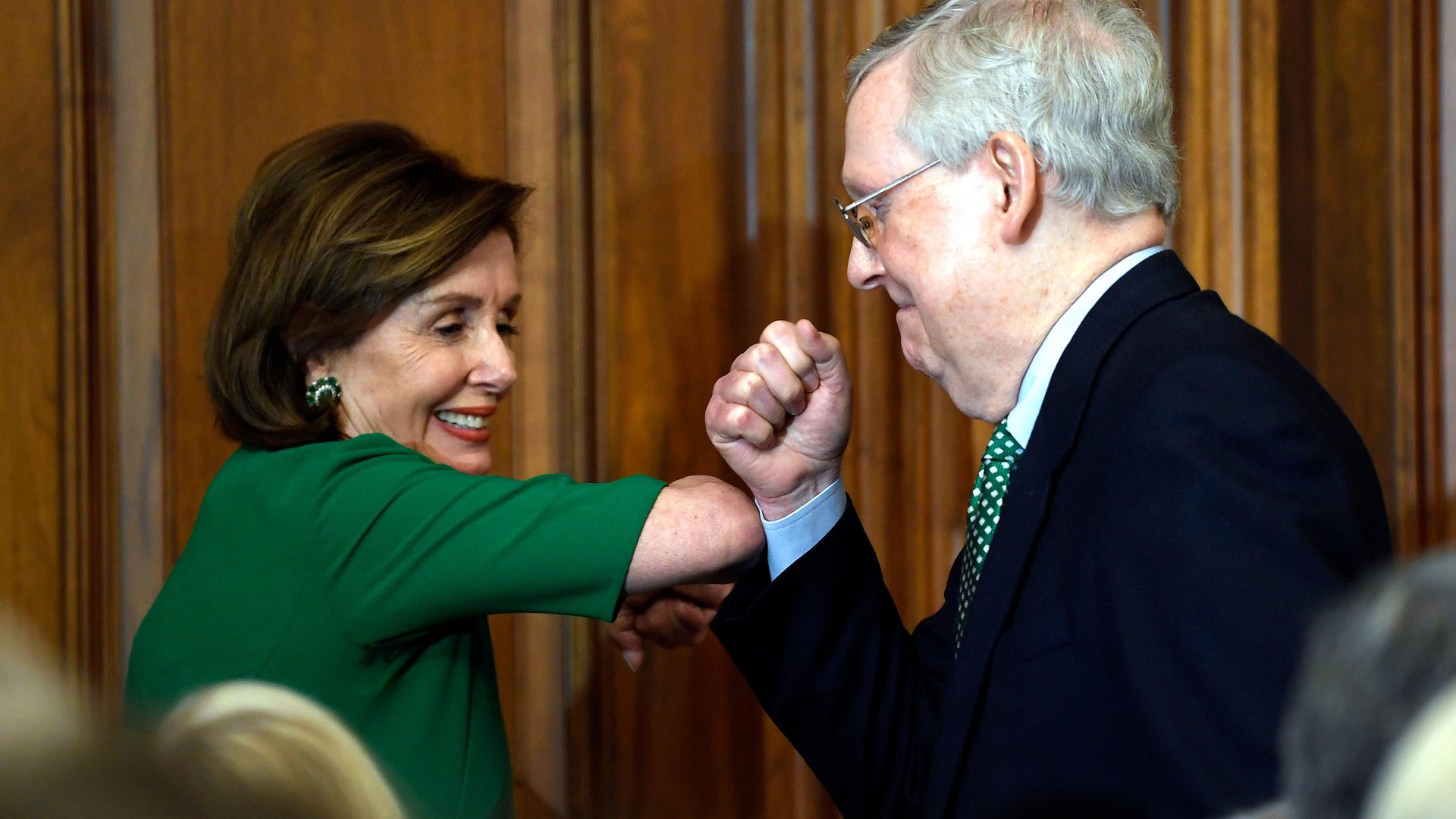

Unlike the other nominees, picked individually by the four majority and minority leaders in the two branches of Congress, the chair is a joint selection between speaker of the House Nancy Pelosi and Senate majority leader Mitch McConnell, two bitter political rivals.

McConnell’s office told Quartz it had no updates on the selection of a commission chair. Pelosi’s office did not respond to multiple requests for comment.

“I’m frankly astonished that they haven’t named a chair yet,” said Liz Hempowicz, the director of public policy at the Project on Government Oversight. “I understand that McConnell and Pelosi don’t agree on a lot, but they wrote the law. Both have talked about the importance of making sure the money from Congress gets where it is supposed to go.”

The four other commissioners include attorney Bharat Ramamurti, a former adviser to senator Elizabeth Warren; Pennsylvania Republican senator Pat Toomey; Arkansas Republican representative French Hill; and Florida Democratic representative Donna Shalala.

Last week, Ramamurti told Quartz that the commissioners have begun preliminary talks, but they hope a chair will help focus their efforts.

“A lot of what the oversight commission’s goal should be is to demystify and explain to the public, this is what is happening to half a trillion of your dollars,” he said. He has already called on the Fed to share more detail about its lending programs.

The other commissioners didn’t respond to requests for comment, but it’s clear there are divergent priorities among the group.

Toomey has criticized Ramamurti’s call for more restrictions on loans to large corporations, like requirements to keep workers on payroll or restrictions on stock buy-backs. After Shalala was revealed to have made stock trades without disclosing them as required by law, she told Politico that “I’m not particularly interested in nitpicking as I am in seeing what’s their strategy, who are they helping and what are the details.” And Hill’s Congressional website shared a story attacking Sheila Bair, a former FDIC chair reportedly under consideration to lead the commission.

Still, the law says that the commission’s quorum is four members, which means a chair is not technically necessary for them to do their job.

“The four members of the commission don’t align on what they should focus on [and] a chair could help mitigate that,” Hempowicz said, but “if they are not able to meet the reporting requirement for the law, they should give an explanation for that, and not having a chair is not a good explanation.”

Pelosi and McConnell’s joint inaction may indicate a lack of interest in scrutinizing a bill that dishes out more money than the 2008 bank bailout and 2009 economic stimulus combined.

“Speaker Pelosi and other people, Jim Clyburn, the distinguished whip, will talk about the importance of rooting out waste, fraud and abuse,” California Democratic representative Katie Porter, who lobbied unsuccessfully for a roll on the commission, said in an online forum this week. “I’m not really interested in rooting out waste, fraud and abuse. I’m interested in preventing that stuff in the first place.”

“The message they are sending is that oversight is not very important right now and I couldn’t disagree more,” Hempowicz said.