How Urban Outfitters plans to win back the hipsters it lost

The planned opening of Urban Outfitters’ first store in the New York neighborhood of Williamsburg in coming weeks may be the final nail in the coffin of that Brooklyn enclave, once world-famous as a place to watch hipsters cavort in their native habitat.

The planned opening of Urban Outfitters’ first store in the New York neighborhood of Williamsburg in coming weeks may be the final nail in the coffin of that Brooklyn enclave, once world-famous as a place to watch hipsters cavort in their native habitat.

But even as the store that successfully marketed hipster clothing to the masses prepares to unleash its rompers and fedoras upon the already-hip (in a glitzy, multi-floor store that will serve booze), the Urban Outfitters corporation acknowledged that it has made some serious fashion mistakes of late—with financial consequences.

The company posted record profits this week, but that was mainly due to solid growth at Anthropologie (its lifestyle brand focused on a slightly older female demographic) and the bohemian-themed Free People line. The core Urban Outfitters chain, which accounts for about 44% of the company’s overall business, remains a problem: sales from stores open for at least a year fell by 9%, after falling 7% in the preceding quarter, and are expected to shrink further this year.

The company is refreshingly honest about how it found itself in this predicament. While other retailers in the young adult market make excuses for poor results, Urban Outfitters cops to its stylistic missteps: ”I believe the theories which correlate demographic shifts, poor employment numbers, online tipping points, or other similar factors to the difficult sales in the young adult market are off-point,” CEO and founder Richard Hayne said on an earnings call with analysts. “Sales correlate directly with fashion hits and misses, and I believe the Urban brand has had fewer hits than normal. It’s that simple.”

This was a case of bad fashion-forecasting, he explained. “When the fashion did change, a number of people, including us, didn’t call the fashion as well as we could have.”

Urban Outfitters has built an impressive business over the past three decades by taking the counter-culture to the mainstream. Its first location, described as a “hippie general store,” was opened in 1972 near the University of Pennsylvania’s campus in west Philadelphia. Business boomed in the 1980’s, as the retailer, known now and then for selling obscure trinkets and novelties in addition to clothes, cleverly tapped into nostalgia amid a revival in 1960’s culture. In the fading days of grunge and at the height of the punk revival, a glowing 1996 profile in the New York Times described Urban Outfitters as “the apparel company that caters to the young and multiple-pierced.” The 2000s were even kinder to the company, as its embrace of the hipster era and its deft handling of new products like skinny jeans fueled steady double-digit sales growth. In 2008, the Philadelphia Inquirer called it “recession proof.”

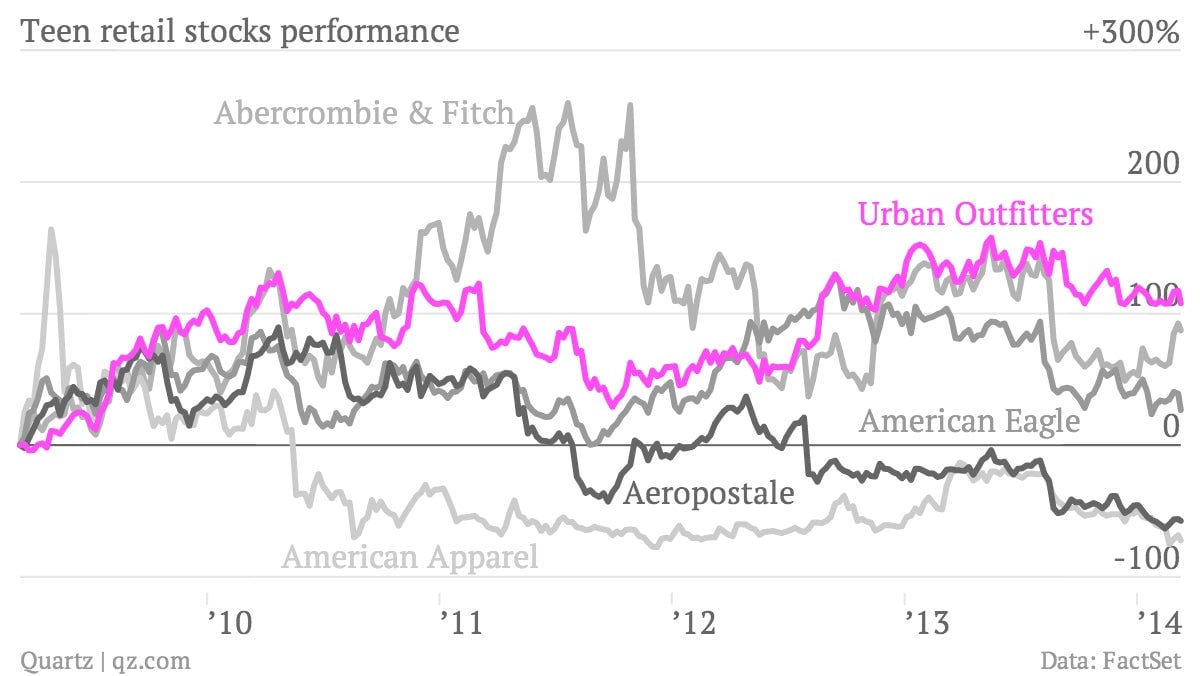

Of course, it must be noted that as a company, Urban Outfitters by no means in terrible shape. Its last quarter may have failed to excite Wall Street, but as the above chart shows, its stock price has easily outperformed the rest of the teen specialty retail sector (in the case of the beleaguered American Apparel, dramatically so) over the past five years.

Still, the languid performance of Urban Outfitters’ core branded stores is beginning to make analysts nervous. “The Urban Brand continues to struggle,” wrote Macquarie Equities analyst Liz Dunn this week. “Management was adamant that this was not a structural problem, but one of self-inflicted fashion issues.” Turning that ship around will take some time, given the cycle of clothing design and production, she said, noting, “We look to be six months away from improvement.”

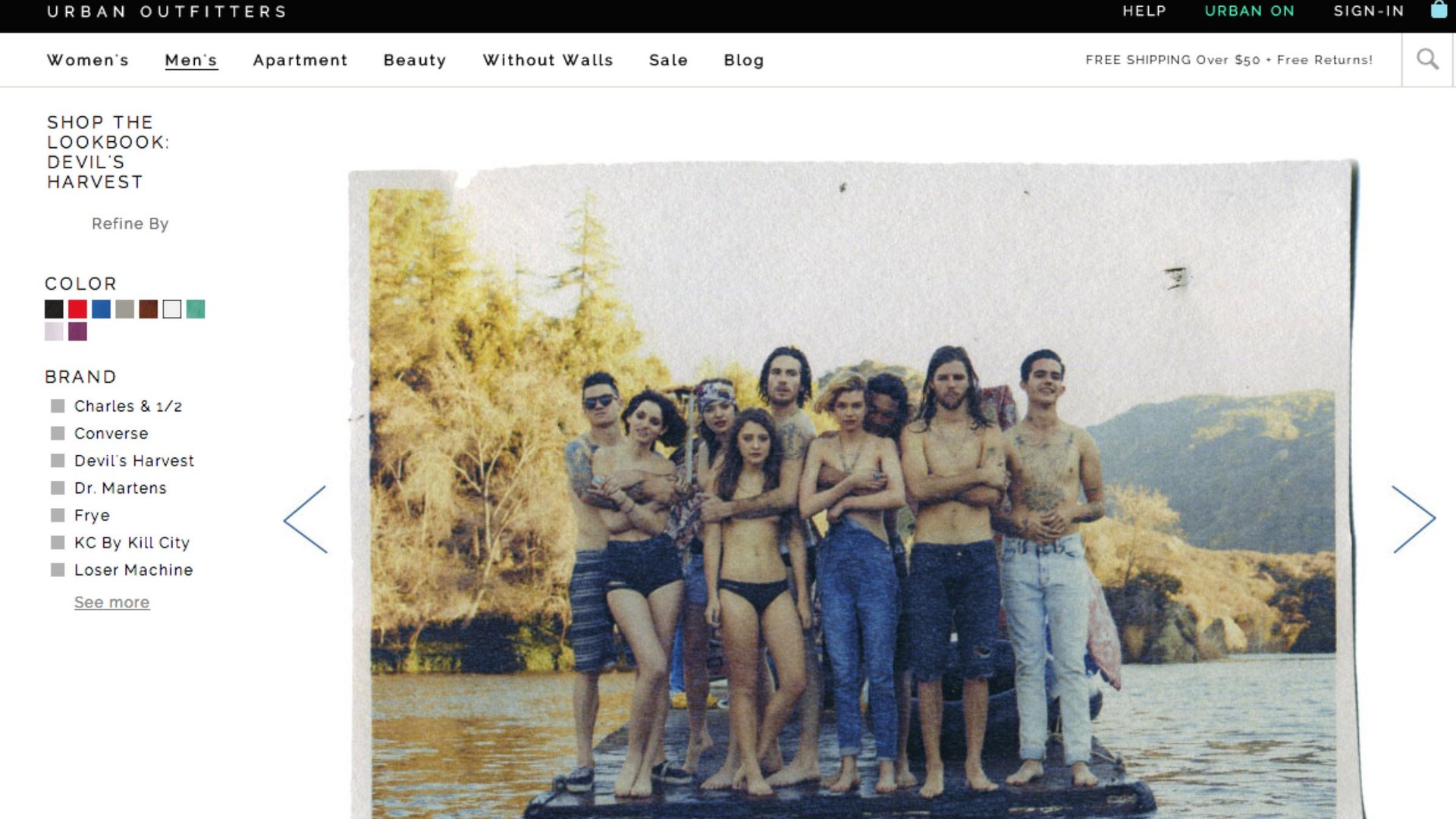

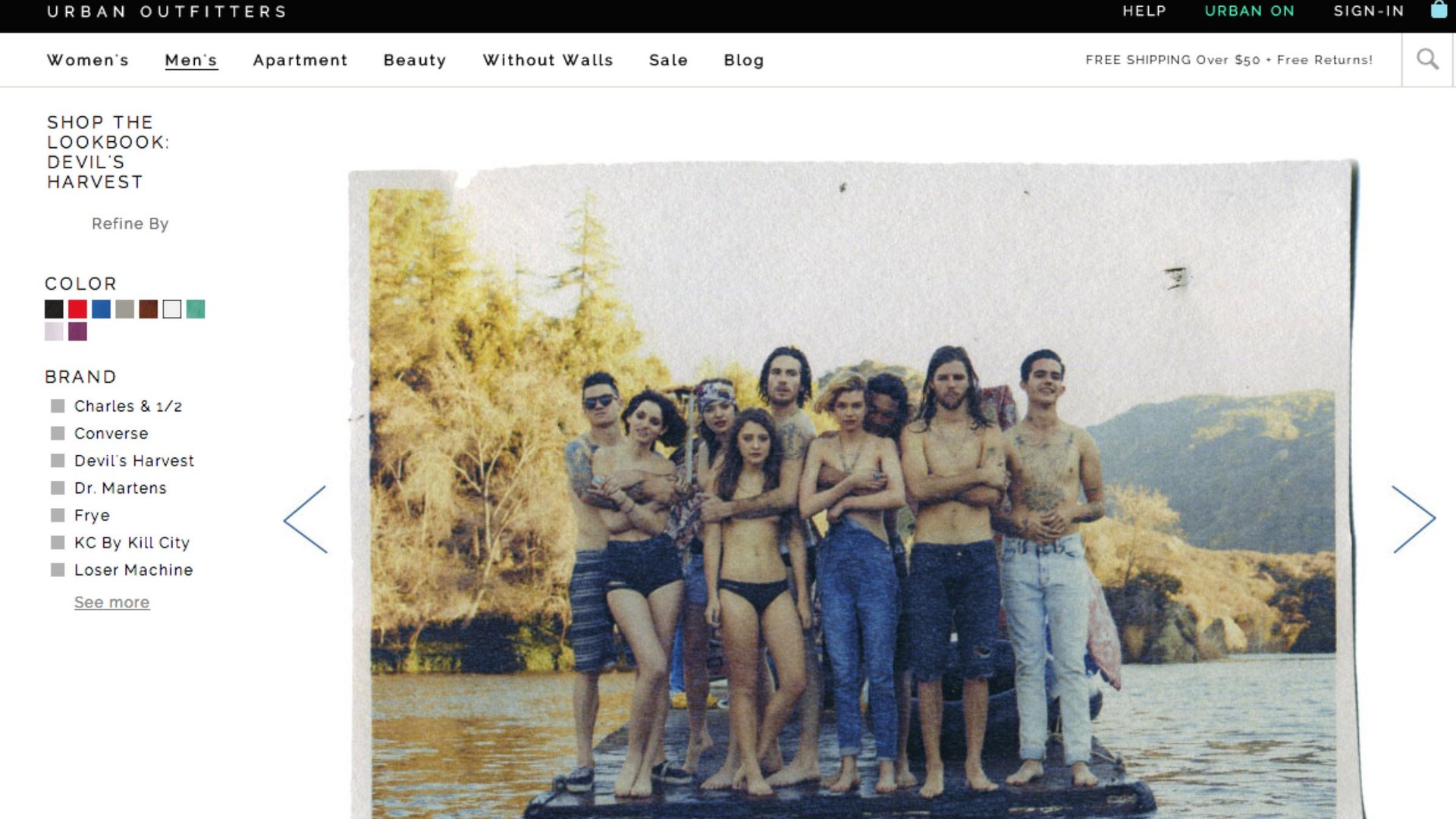

Urban Outfitters has long described itself as “fashion forward.” But earlier this year Goldman Sachs’ retail analysts cautioned that the company might have pushed too far with some of the latest designs on its shelves, including this infamous denim-and-tutu creation:

Hayne, who did not respond to a request for comment for this article, told the analyst briefing that the company understands the problems, and has a plan to make itself relevant again. “Quite frankly, the Urban brand organization became too silo-ed, with too little communication across functional areas,” he said. “The great creativity that has been the hallmark of our success became stifled.” The company will restructure its procedures, elevate creative functions to a more central role in the business, and refocus on the 18- to 28-year-old age bracket that has driven its past success, he said.

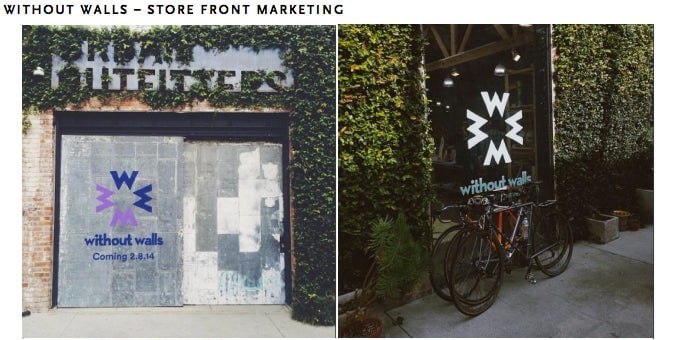

Hayne also touted a new in-store concept, “Without Walls”—a “shop in shop” aimed at hip, outdoorsy types. Hayne said Without Walls aims to “engage the young adult customer with active lifestyle products housed in a compelling environment.” Piper Jaffray analyst Neely Tamminga, who expects a turnaround at Urban this year, describes the concept as designed to appeal to Millennials—”a generation that likes to attend music festivals, prefers to camp, and in general likes to be active both indoors and outside.”

The concept has been rolled out at five Urban Outfitters stores, with a further three to six locations slated for release in the year ahead.

Unlike other retailers,Urban Outfitters gets the internet. It has invested heavily in technology and mobile platforms. Tamminga gushes about the company’s “tech savvy investment culture” a view that is shared by Morgan Stanley analysts who argue that the company can use its analytics capabilities to “powerfully engage shoppers,” “improve data-driven decisions” and reduce “fashion risk.”

So can Urban Outfitters successfully reinvent itself, again? It could be well positioned for the next “macro shift” in the industry, which according to Goldman Sachs is the return of high-waisted women’s jeans to mainstream American fashion.

Such macro shifts are rare—the last was skinny jeans, which Urban Outfitters initially struggled with, before nailing. In contrast to micro fashion shifts (like brightly-colored jeans, which could be combined with existing clothing) macro shifts at first appear odd, but usually lead to a complete wardrobe overhaul. This means they are especially lucrative for retailers that exploit them.

Urban Outfitters, for one, will be hoping it does.