Wealthy Chinese are smuggling their riches out of the country with a state-backed bank card

It’s estimated that as much as $600 billion is smuggled out of China a year, through art, gambling, fake trade—and now bank cards. According to a report by Reuters, UnionPay cards aren’t just making everyday purchases easier—they’re a convenient way to circumvent China’s strict capital controls.

It’s estimated that as much as $600 billion is smuggled out of China a year, through art, gambling, fake trade—and now bank cards. According to a report by Reuters, UnionPay cards aren’t just making everyday purchases easier—they’re a convenient way to circumvent China’s strict capital controls.

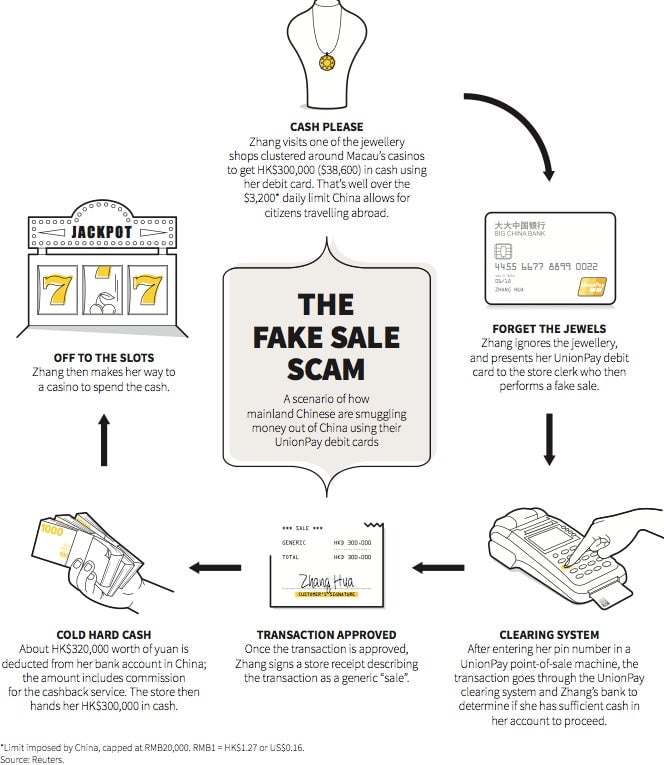

Here’s how it works: a wealthy Chinese citizen travels to neighboring Macau, the preeminent gambling hub of Asia, and pays the clerk of a jewelry or another store yuan via their UnionPay card. (UnionPay cards function like debit cards and are part of China’s state-backed payment card system.) They receive cash back, in Hong Kong dollars, as well as a receipt that masks the transaction as a retail purchase. Another way is to buy expensive jewelry from the store and sell it right back for cash. One jewelry outlet in a Macau casino told Reuters that customers could use their cards to buy up to 10 million yuan ($1.5 million) of gold bullion and sell it back for cash.

Both methods allow Chinese nationals to get around limits on how much money they can take out of the country—a maximum of 20,000 yuan ($3,200) a day. Some say as much as $202 billion is being channeled illegally through Macau every year.

The curious part of this picture is why mainland authorities, who have known about the problem since at least 2008, haven’t cracked down. That may be because capital flight, both legal and illegal, has been long been a part of the Chinese economy. Rich Chinese are plowing money into housing abroad, emigration investment schemes, and offshore tax havens. It’s possible that the UnionPay cash back practice may be the kind of capital flight China likes best because it can be tracked through the names listed on the bank cards used.

The other brake on Chinese regulators may be that the expanded use of UnionPay in Macau and around the world is part of the government’s mission to transform the yuan into a global currency, as Reuters points out. And UnionPay, at least, is catching on: credit industry experts say the cash-back practice has spread to other places where Chinese tourists visit, including Taiwan, Japan, and South Korea.