Amazon’s Prime price hike may signal it finally wants to make money

Amazon’s $20 price hike for Prime, its premium delivery and instant video service, is not as bad is it could have been. In January, the company warned that it could raise the cost of the service, which ensures deliveries of orders within two days, by as much as $40 a month, due to increased fuel and shipping costs and a dramatic increase in usage.

Amazon’s $20 price hike for Prime, its premium delivery and instant video service, is not as bad is it could have been. In January, the company warned that it could raise the cost of the service, which ensures deliveries of orders within two days, by as much as $40 a month, due to increased fuel and shipping costs and a dramatic increase in usage.

The move is highly symbolic because it’s difficult to remember the last time Amazon raised prices for anything.

Wall Street has been incredibly tolerant with Amazon’s relatively tiny margins and meagre absolute profits. CEO and founder Jeff Bezos has successfully sold investors on a business model built around reinvesting the company’s enormous cash flows into infrastructure—warehouses, data centers, drones—and low prices, rather than profits.

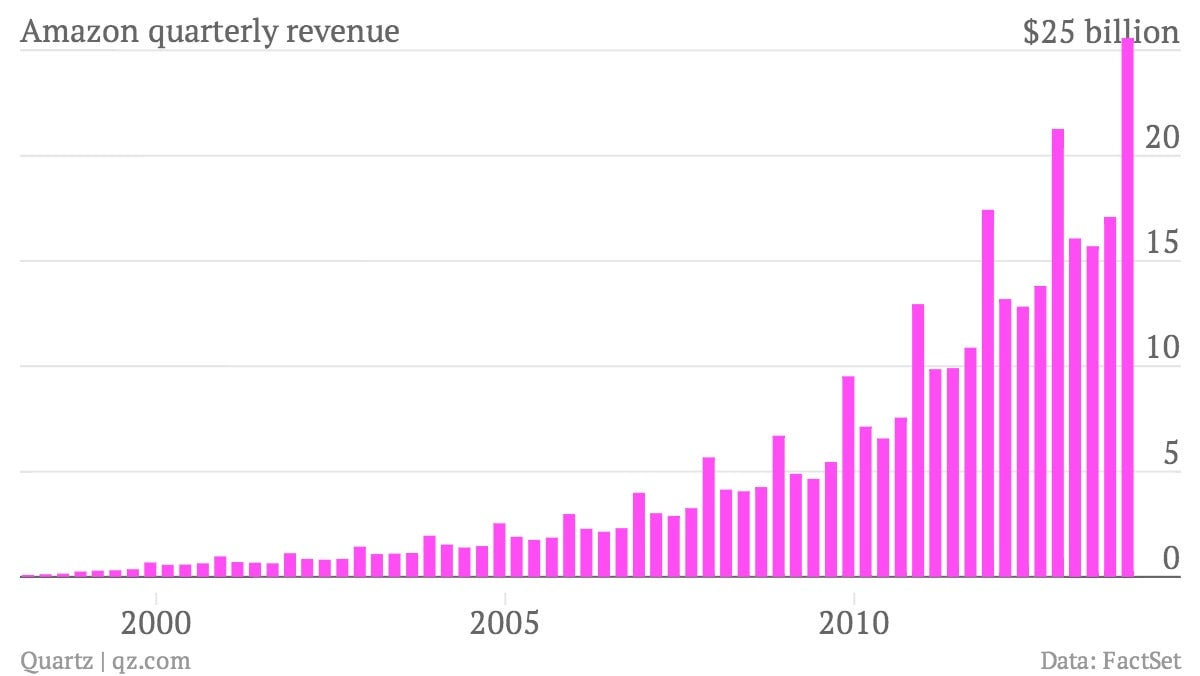

This is reflected in the fact that while the company’s revenue has been on a relentless upward march…

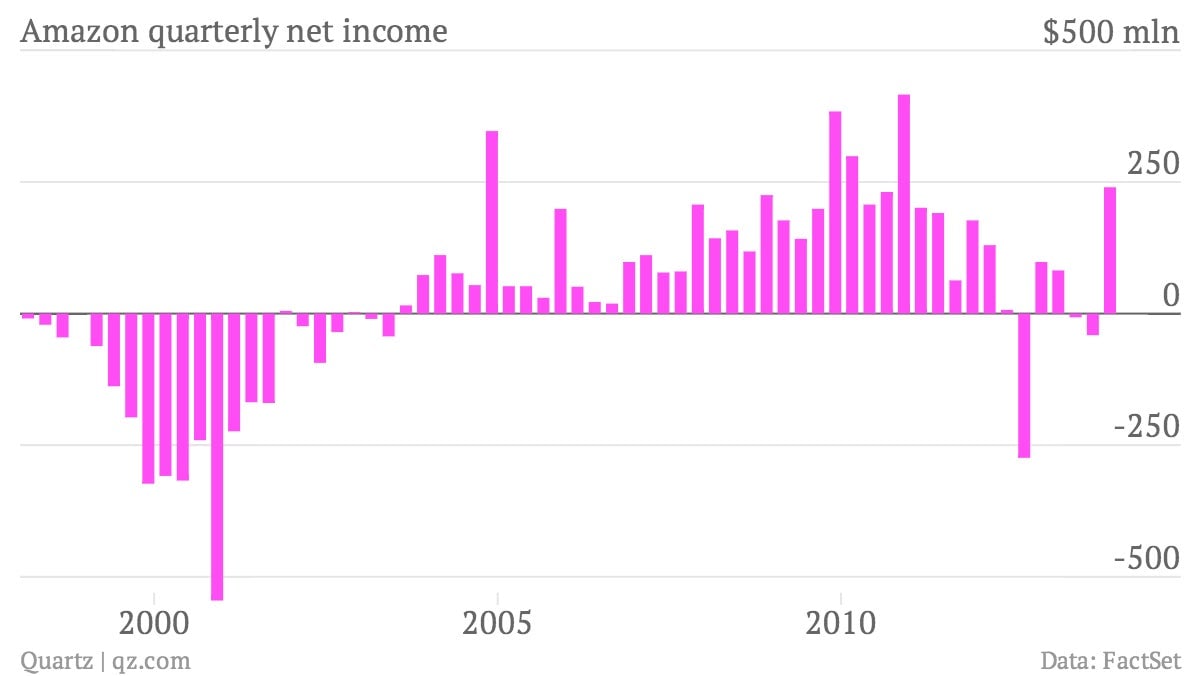

…its bottom line is very lumpy.

This model builds loyalty for Amazon. As Bezos explained to Bloomberg last year: ”We don’t do that [raise prices] because we believe—and, again, we have to take this as an article of faith—we believe that by keeping our prices very, very low, we earn trust with customers over time and that that actually does maximize free cash flow over the long term.”

What would it take for Amazon to focus on delivering profits, like most other businesses? Either Wall Street loses patience with the model, which is certainly not yet the case, or the company becomes so dominant (by capturing what’s known as its “total addressable market”) that it can afford to raise prices and or reduce its infrastructure spend. Perhaps we are seeing the beginnings of one of these today.

Cowen & Company estimates that there are 23 million Prime subscribers and the $20 hike will add $460 million in annual revenue, which in theory is pure profit for Amazon. Whether Amazon lets the incremental revenue flow through to its bottom line remains to be seen. But Wall Street is happy. Amazon stock is up 2.9% in the early going, having under-performed the broader market so far in 2014.