Uncle Sam is paying US companies to borrow their tax-sheltered cash

Why pay taxes when you can just loan that money to the government and get interest back?

Why pay taxes when you can just loan that money to the government and get interest back?

It’s well-known that most American multinational companies take advantage of loopholes in US tax law to avoid taxes on overseas income, and many use accounting techniques to shift domestic profits overseas, which costs US taxpayers some $27 billion each year, according to the Treasury Department.

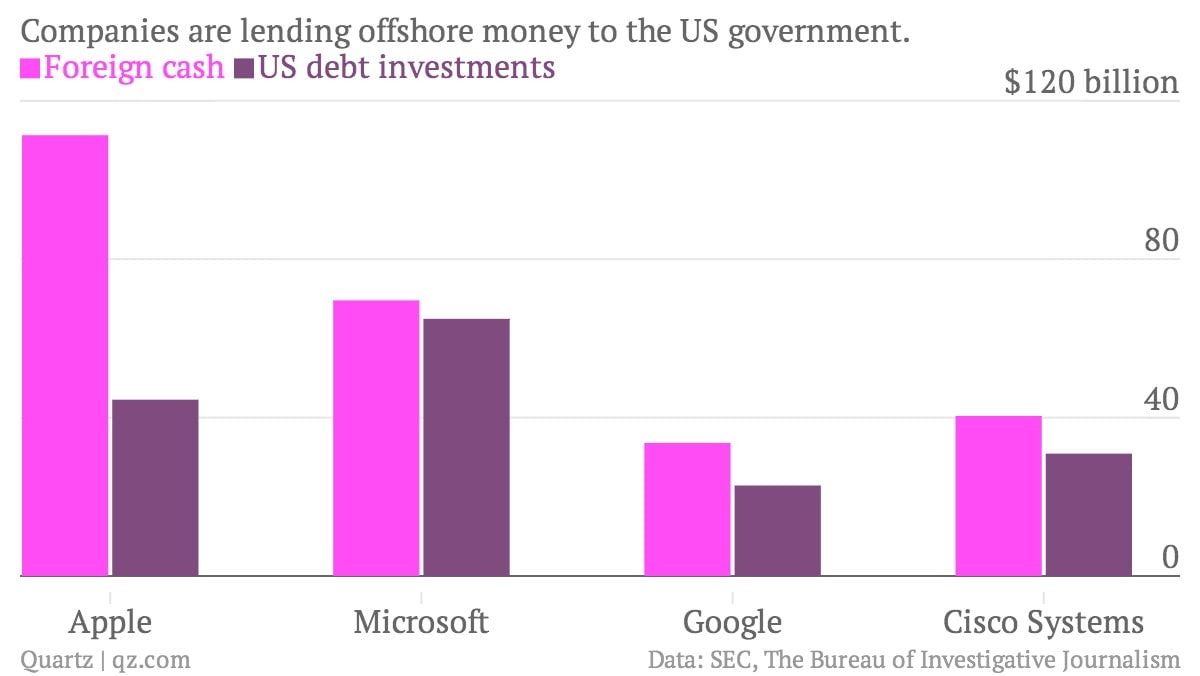

But what are they doing with the money? A surprising amount (paywall) of it is held in US banks, but a new analysis of corporate filings has found another place it often winds up: US treasury bonds. Big corporations, like investors of all stripes, rely upon highly-liquid, super-safe US debt. The Bureau for Investigative Journalism looked at filings from the four most cash-heavy American multinationals—Microsoft, Apple, Google and Cisco Systems—and found a significant chunk of their offshore cash has been loaned to the US government.

If the four companies’ overseas cash was repatriated today, the taxes owed on that income would reduce the deficit by $89 billion—about 17%. Instead, the US is borrowing almost twice that from these companies—some $163.2 billion—and paying interest to their foreign subsidiaries for the privilege.

None of this illegal, though president Barack Obama and some like-minded US lawmakers would like it to be. One long-time critic of the offshore behavior of US corporations, senator Carl Levin, has said it’s particularly galling that corporations are not only enlarging the deficit, they’re getting paid for the privilege.