Why corporate America has never had it this good in the modern era of taxes

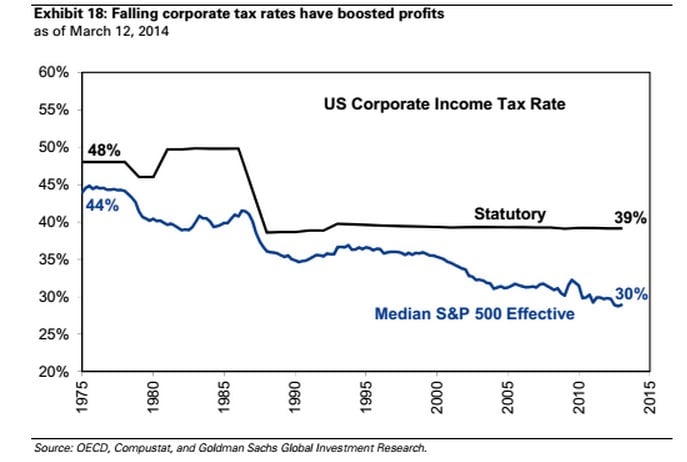

Taxes “have never been more favorable for the profitability of US firms,” Goldman Sachs says in a note this morning. As the above chart from the investment bank shows, since 1975 the median effective tax rate paid by S&P 500 firms has never been lower, while the gap between effective tax paid and the statutory rate has never been wider.

Taxes “have never been more favorable for the profitability of US firms,” Goldman Sachs says in a note this morning. As the above chart from the investment bank shows, since 1975 the median effective tax rate paid by S&P 500 firms has never been lower, while the gap between effective tax paid and the statutory rate has never been wider.

Of course, America still has the highest statutory corporate tax rate in the OECD, at about 39% if you combine national and state taxes—way ahead of the lowest, Ireland, at just 12.5%. Yet fewer than 10% of S&P 500 firms have actually paid this statutory rate over the past decade, according to Goldman’s analysis.

Why does all of this matter? For starters, there is a heated debate in the US about tax reform. While America’s fiscal woes have moved out of the headlines, they’ve hardly been solved and the Obama administration is already looking at ways to close loopholes on the billions in corporate profits housed offshore.

In the equity markets, there’s also a growing debate about whether corporate profit margins—currently at record highs—are sustainable. The expansion in profit margins since the end of the recession been driven mainly by lower costs (record low interest rates and benign labor costs, for example) rather than higher revenues.

As Carl Icahn has pointed out, interest rates are at record lows and will eventually have to rise. In this sense, earnings could be a mirage. And as Goldman points out, lower tax rates were the biggest contributing factor to higher equity returns during the 1980s (when President Reagan cut statutory rates from 50% to 39%) and potential changes to taxes could have “meaningful implications for corporate profitability. “

The obvious solution for the government is to close the gap between mandated and effective tax rates by eliminating loopholes. This might allow the government to cut the statutory rate and still raise revenues (and present the overall reform as a tax cut). Alas, recent American history suggests this is easier said than done.