This may be the worst time to launch a new hedge fund

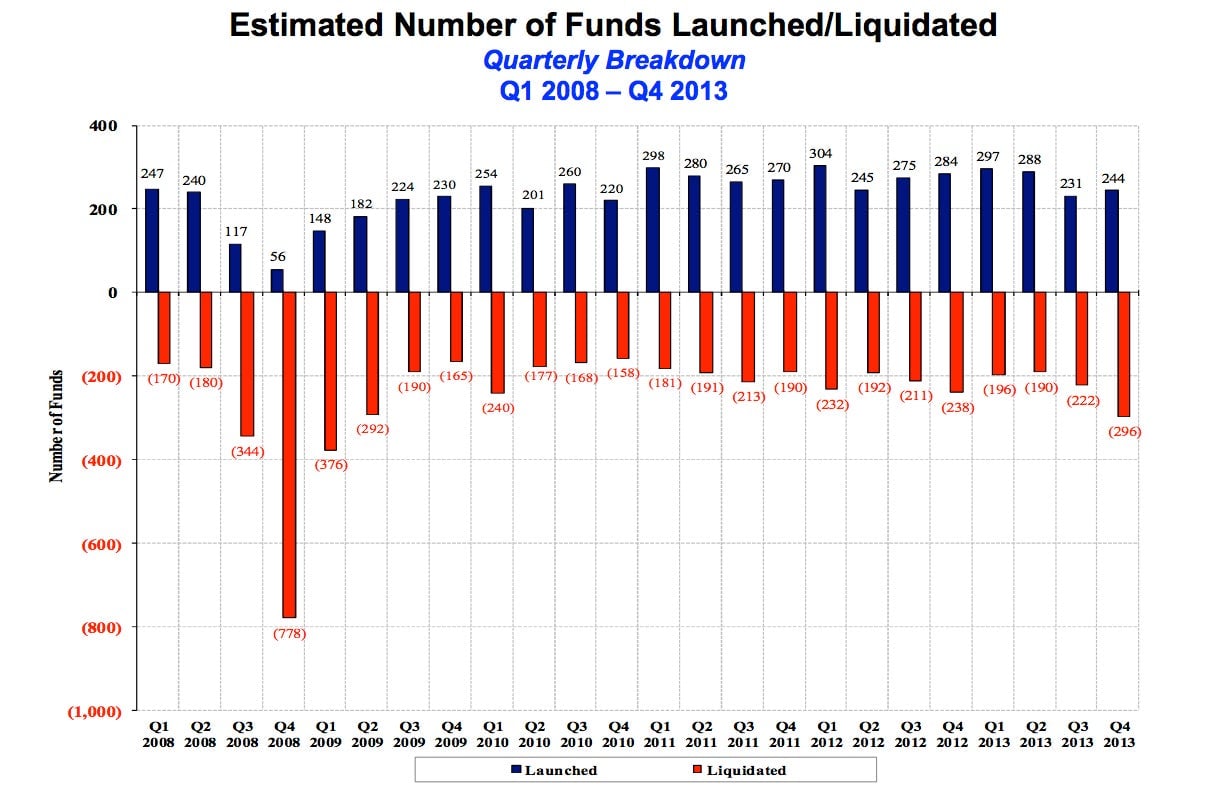

There were fewer aspiring masters of the universe in the hedge-fund industry last year. Launches of new hedge funds (1,060) hit their lowest level in three years in 2013, and more existing hedge funds (904) went out of business than any year since 2009, according to Hedge Fund Research.

There were fewer aspiring masters of the universe in the hedge-fund industry last year. Launches of new hedge funds (1,060) hit their lowest level in three years in 2013, and more existing hedge funds (904) went out of business than any year since 2009, according to Hedge Fund Research.

What gives? One might think that billion-dollar hedge funds and new entrants alike would be champing at the bit to set up shop. After all, the US’s Jumpstart Our Business Startups Act lifted a broad ban on hedge-fund advertising in 2012, enabling hedgies to hawk their wares to a greater swathe of the deep-pocketed masses. Although it seems that some funds have begun to advertise, the rate at which new ones are hanging out their shingles is falling.

Why? Well, one big reason is likely the relatively paltry returns that hedge-fund managers have generated over the last few years. These managers, who typically charge investors a 2% management fee and take a 20% cut of the profits, have trailed the S&P 500 index (a broad gauge of the US stock market) for the past five years. Bloomberg reports that hedge funds returned on average 7.4% last year compared to the S&P 500’s 30% gain—the benchmark index’s best performance in 16 years.

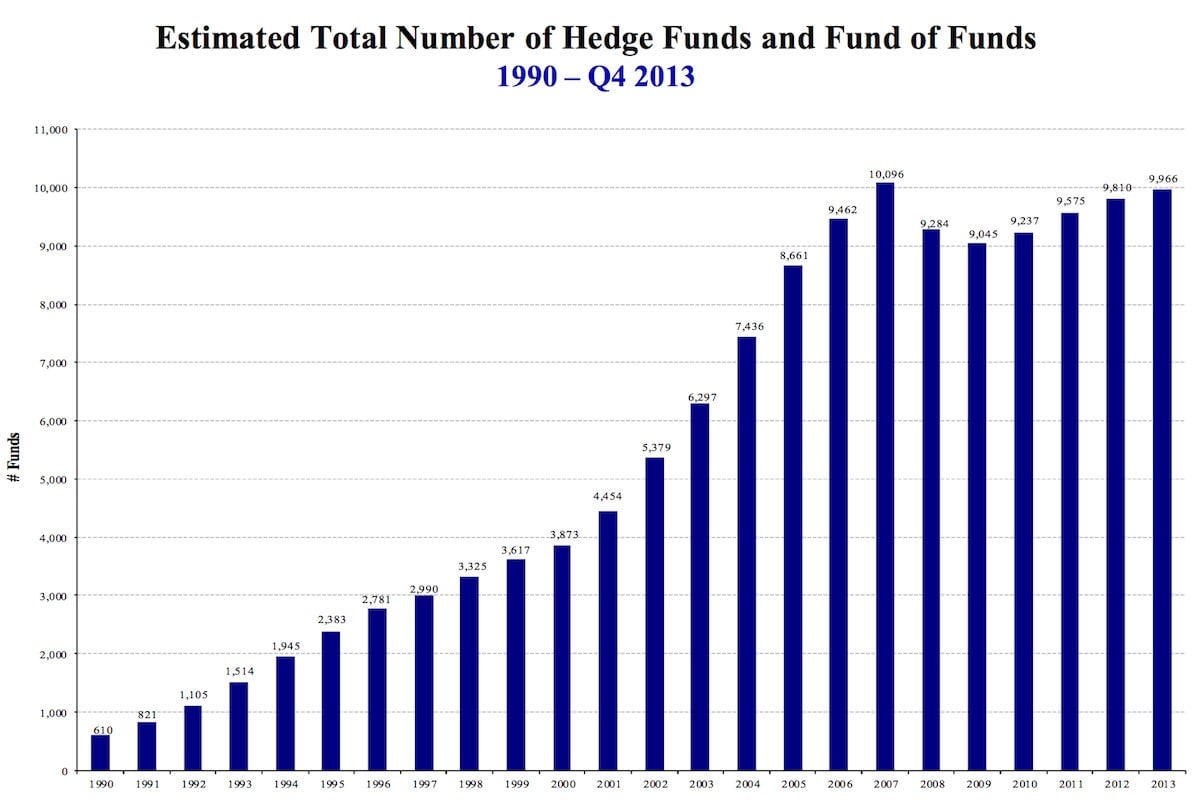

To be sure, those masters of the universe are still making billions. The total number of funds in existence is still increasing, almost returning to the 2007 peak:

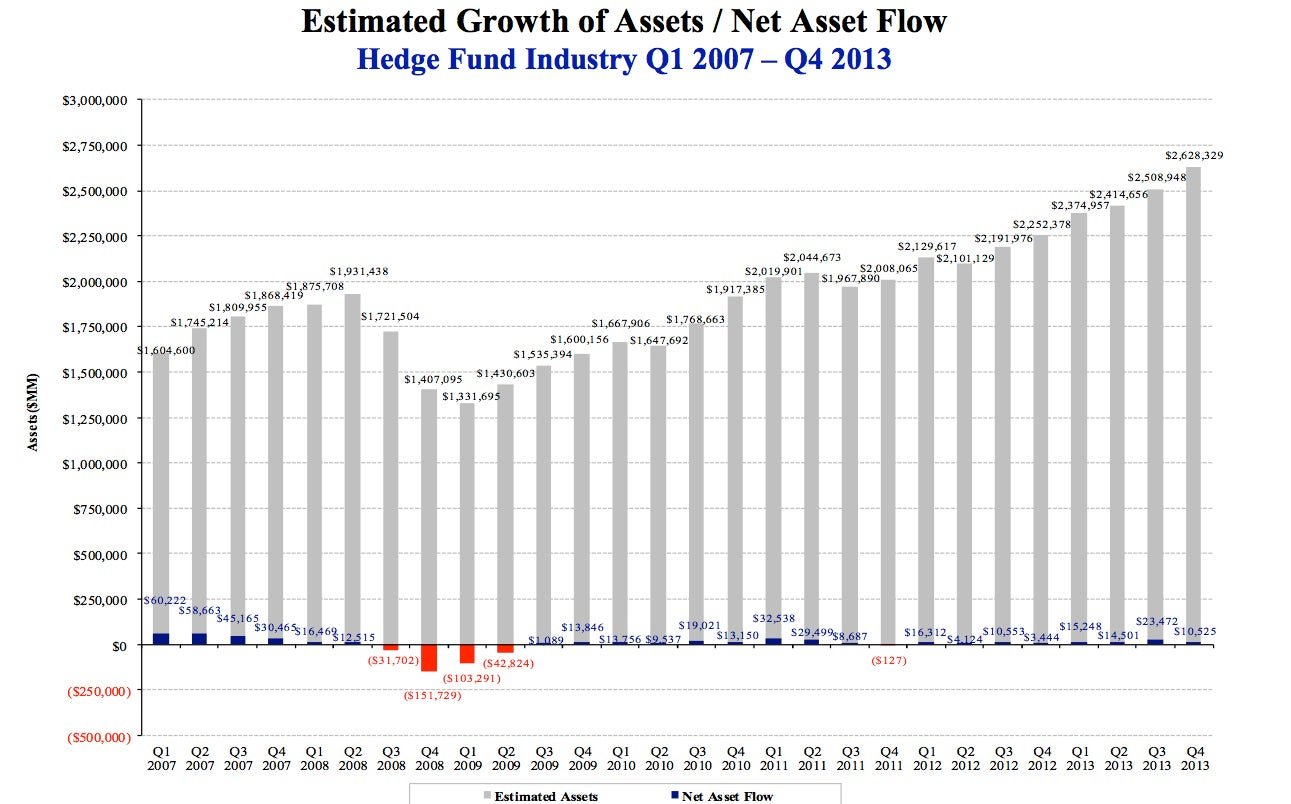

And reported assets under management for hedge funds have exceeded that peak, hitting a record $2.62 trillion.

That suggests that established funds that have done well can raise new money from clients, but it’s tougher to get started in the business. Which confirms the feeling that the long-held mystique of hedge funds’ potency—and their ability to justify their hefty fees—isn’t what it once was.