Four types of people you’ll meet at the bitcoin market

The collapse of the Mt. Gox bitcoin exchange has been a speed bump for bitcoin, but the chaos has shed light on the opaque crypto-currency markets. Earlier this month, hackers published what is purported to be the exchange’s trading data from 2011 through November 2013 in an effort to publicly expose any malfeasance. (Some users have been able to confirm that their transactions are in the database because bitcoin addresses are public.)

The collapse of the Mt. Gox bitcoin exchange has been a speed bump for bitcoin, but the chaos has shed light on the opaque crypto-currency markets. Earlier this month, hackers published what is purported to be the exchange’s trading data from 2011 through November 2013 in an effort to publicly expose any malfeasance. (Some users have been able to confirm that their transactions are in the database because bitcoin addresses are public.)

The visual designers at Stamen took that database and visualized a trading history by type of user to help understand the kinds of people (and non-people) you meet at the bitcoin market. “These exploratory charts revealed so many intricate patterns and behaviors that we thought they would be compelling to publish with minimal analysis,” Kai Chang, on of the designers writes. ”Our hope was that viewers would imbue the MtGox traders with their own stories and narratives.”

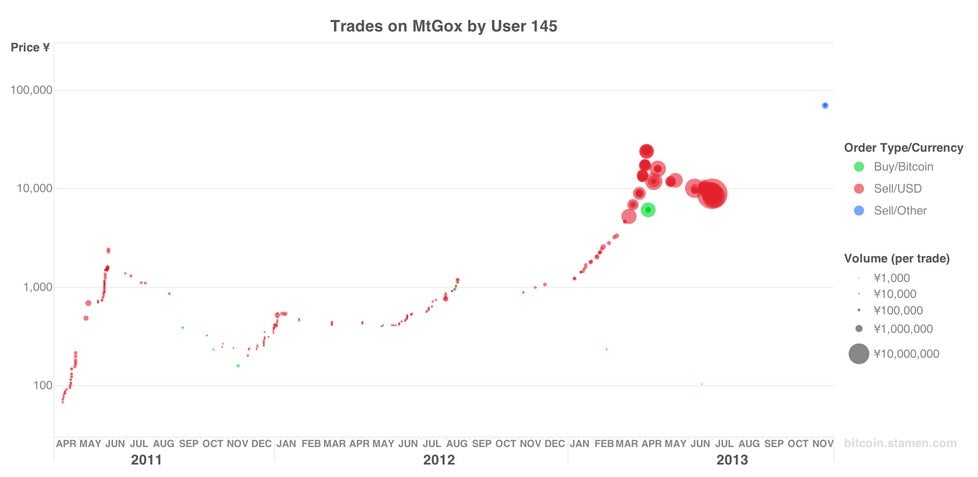

Bitcoin barons

Traders whose patterns look like this—an early start in the market followed by big sales at higher prices—bought low and sold high, living the bitcoin dream.

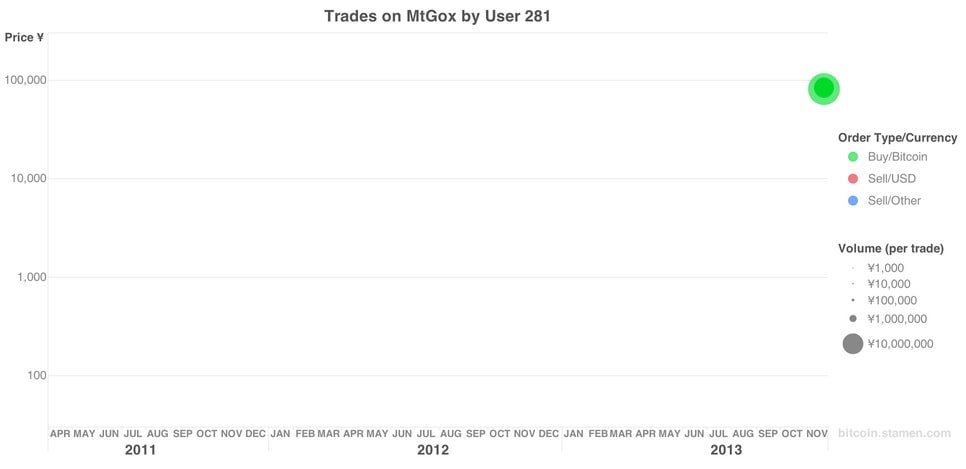

Greater fools

For every dream there is a nightmare, and traders whose charts look like this lived it: They bought big when bitcoin’s price was at its highest, just before the exchange (and prices) collapsed. There’s a lesson in that for every amateur investor.

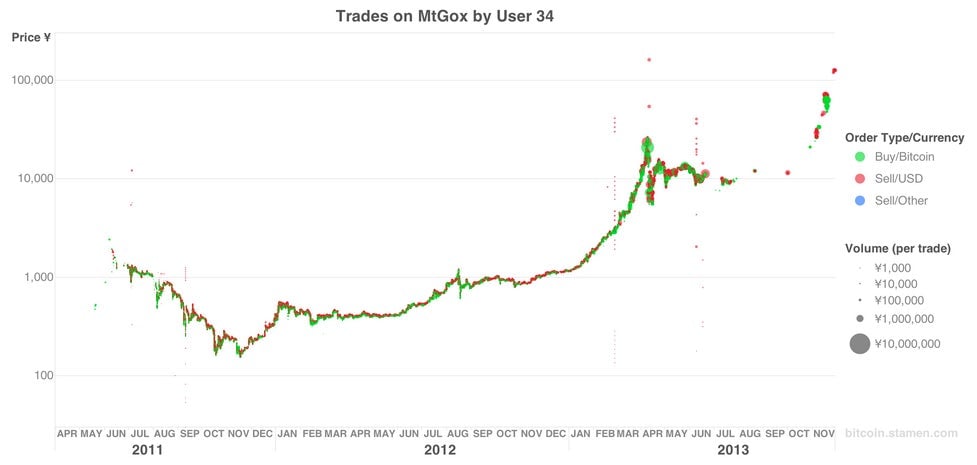

Dueling bots

It wouldn’t be a financial market on the internet if there weren’t robots involved. A chart like this, with thousands of small trades, and lots of instantaneous sales across a wide price range, suggests algorithms in the marketplace looking for an advantage.

Crazy bots

Sometimes, the trading patterns are too bizarre to interpret. This user is buying large volumes of bitcoins at random prices, some incredibly low and some really high. This may be a result of an algorithm gone berserk or faulty trading.

You can see many more examples of different trading behaviors in Stamen’s collection. And there’s likely to be more information forthcoming about what happened at Mt. Gox soon, if the recent discovery of 200,000 misplaced bitcoins—worth perhaps $114,524,000 today—is any indication.