The great 1960s bowling bubble was so awesome

There’s a reasonable amount of conjecture in the markets right now about whether things are getting a bit overheated. Wiser minds than us have been vexed by the topic of asset price bubbles, so we’ll leave that to one aside.

There’s a reasonable amount of conjecture in the markets right now about whether things are getting a bit overheated. Wiser minds than us have been vexed by the topic of asset price bubbles, so we’ll leave that to one aside.

But the current discussion about market conditions still led us to stumble upon what is surely one of the most interesting periods of market euphoria in America’s history: the 1961 boom (and subsequent bust) in ten-pin bowling stocks. (Hat-tip to Reuters, which highlighted the bowling bubble in its analysis this week).

And, this bubble doesn’t just tell us about market behavior, it also casts light on important changes in American society since then.

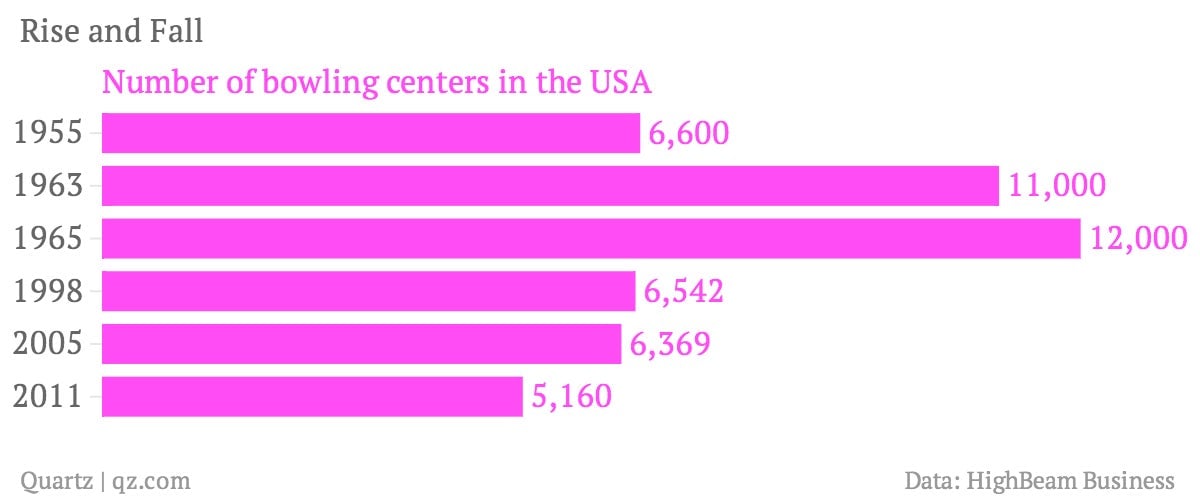

Bowling has been around in America since before the revolution: Versions of the pastime were brought across by Dutch settlers in the seventeenth century. But bowling really blossomed, particularly among blue-collar types, in the 1950’s and 1960’s after the introduction of the automatic pin setter. According to HighBeam Business research, the number of bowling alleys in America nearly doubled from 6,600 in 1955 to 11,000 by 1963. Over the same period, the number of people bowling in leagues increased from less than three million to seven million.

Around this time, “action bowling,” which the New York Times described as “a high-stakes form of gambling in which bowlers faced off for thousands of dollars” was particularly popular in New York City. ““You’d go at 1 in the morning, and there were 50 lanes and the place was packed,” one exponent of the sport, hall of famer Ernie Schlegel told the Times. “The action was huge back then, like poker is today.”

All of this ebullience was reflected in the stock prices of bowling companies such as Brunswick Corporation, which according to the Wall Street Journal (paywall) increased 1,590% between 1957 and its 1961 peak.

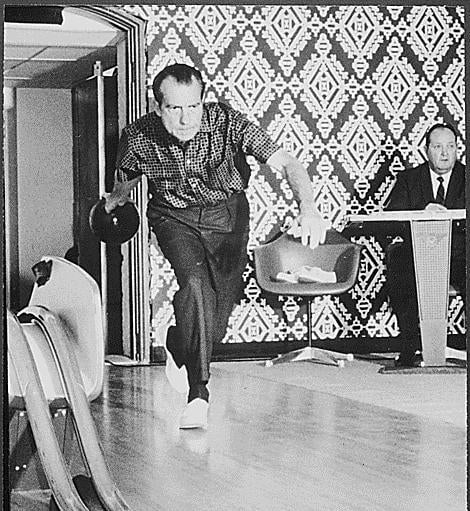

That bowling stock bubble deflated, but it took awhile longer for bowling to suffer in the real world. It was still popular in 1970, when then-president Richard Nixon, an avid bowler, had an alley installed beneath the White House. (The west wing of the White House got its first bowling alleys in 1947, but they were moved in 1955 to make way for a mimeograph room. The bowling facility put in by Nixon remains in place to this day.)

Basically, the boom in bowling spurred massive investment in bowling centers which led to overcapacity in the industry. And around this time, blue-collar Americans began fleeing the cities for the suburbs, rendering many urban bowling centers obsolete. This also made land occupied by bowling centers in outer suburban areas more valuable for alternative users, like pharmacies and department stores, Sandy Hansell, a Michigan-based bowling center broker tells Quartz.

In the 1980s, the popularity of league bowling also began to wane, simply due to lifestyle changes. The number of league bowlers has reportedly declined by half since then.

By 2011 there were 5,860 bowling centers in the US, according to HighBeam, less than half the 1960s peak.

So what does all of this tell us? Basically, it’s difficult to predict the future, no matter what industry you’re in.