Japan is doomed unless it learns to love inflation

It’s hard to believe, but Japan’s total economy is smaller now than it was 20 years ago.

It’s hard to believe, but Japan’s total economy is smaller now than it was 20 years ago.

The country’s story has become an all-too-familiar one: boom, bust, and stagnation. As Nomura economist Richard Koo points out, Japan lost three GDPs worth of wealth when its “Heisei bubble” burst in the early 1990s. The U.S., as point of comparison, “only” lost one during the Great Crash of 1929. But despite this bigger shock, 1990s Japan managed to avoid a 1930s-style collapse by pumping money into infrastructure and selling things to the rest of the world.

It was just enough to keep their economy on life support. But growth still died. You can see that in the chart below from Brad DeLong. The red line shows Japan’s GDP per capita as a percentage of the U.S.’s: after catching up for decades, it lost ground in the 1990s, and never made it up. In other words, Japan is rich, but it should be richer still.

The problem was Japan’s falling prices. Now, deflation sounds like a good deal for consumers—who doesn’t like cheaper things?—but it’s a disaster for the economy. In the worst case, prices and wages fall so much that people can’t pay back loans that don’t fall. It’s what economist Irving Fisher called “debt deflation”: a downward spiral into mass bankruptcy and mass unemployment.

But even in the not-as-bad case, in which prices only fall a little and wages don’t, it can still maim the economy. People put off purchases and companies put off investments when things cost more today than tomorrow. And over-leveraged households and businesses have a hard time cutting their debts to more manageable levels when inflation isn’t helping them out. That’s true even if inflation is a low positive, instead of a low negative, number—what the IMF fittingly calls “lowflation.”

Irresponsible responsibility

So why did Japan let itself get stuck in this deflationary trap? Let prices fall more than real GDP grew, so that its total economy shrank? Well, it was afraid to do what it needed to do to get out. The Bank of Japan (BOJ) couldn’t just cut interest rates like it normally would, because rates were already at zero. So it had to try new things, unconventional things—and it didn’t want to. Instead, it said that there was nothing it could do. Or that a little deflation was actually agood thing.

Now, it wouldn’t have been easy for Japan to shake its post-bust blues. But it didn’t even try. As Paul Krugman pointed out in 1998, the problem was that the BOJ couldn’t cut interest rates to increase inflation today, so it needed to “credibly promise to be irresponsible” to increase expected inflation tomorrow. In other words, it needed to convince markets that it was going to keep rates lower than it “should” once the recovery got going. But that was too much for a staid central bank like the BOJ. It was more worried about inflation than a lost decade. So it very responsibly did nothing. It was, as another Princeton professor named Ben Bernanke put it in 1999, “a case of self-induced paralysis.”

Rooseveltian resolve …

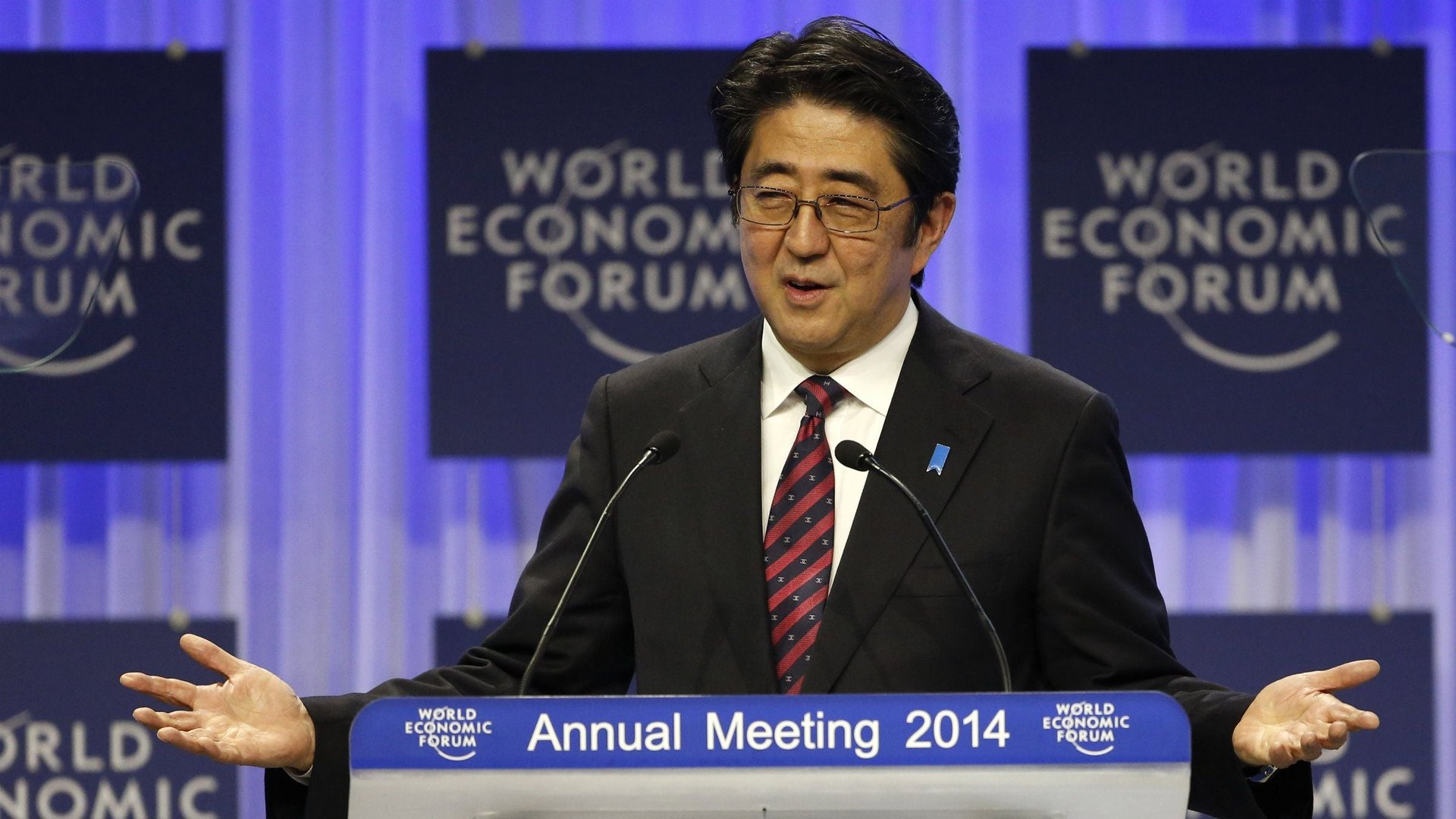

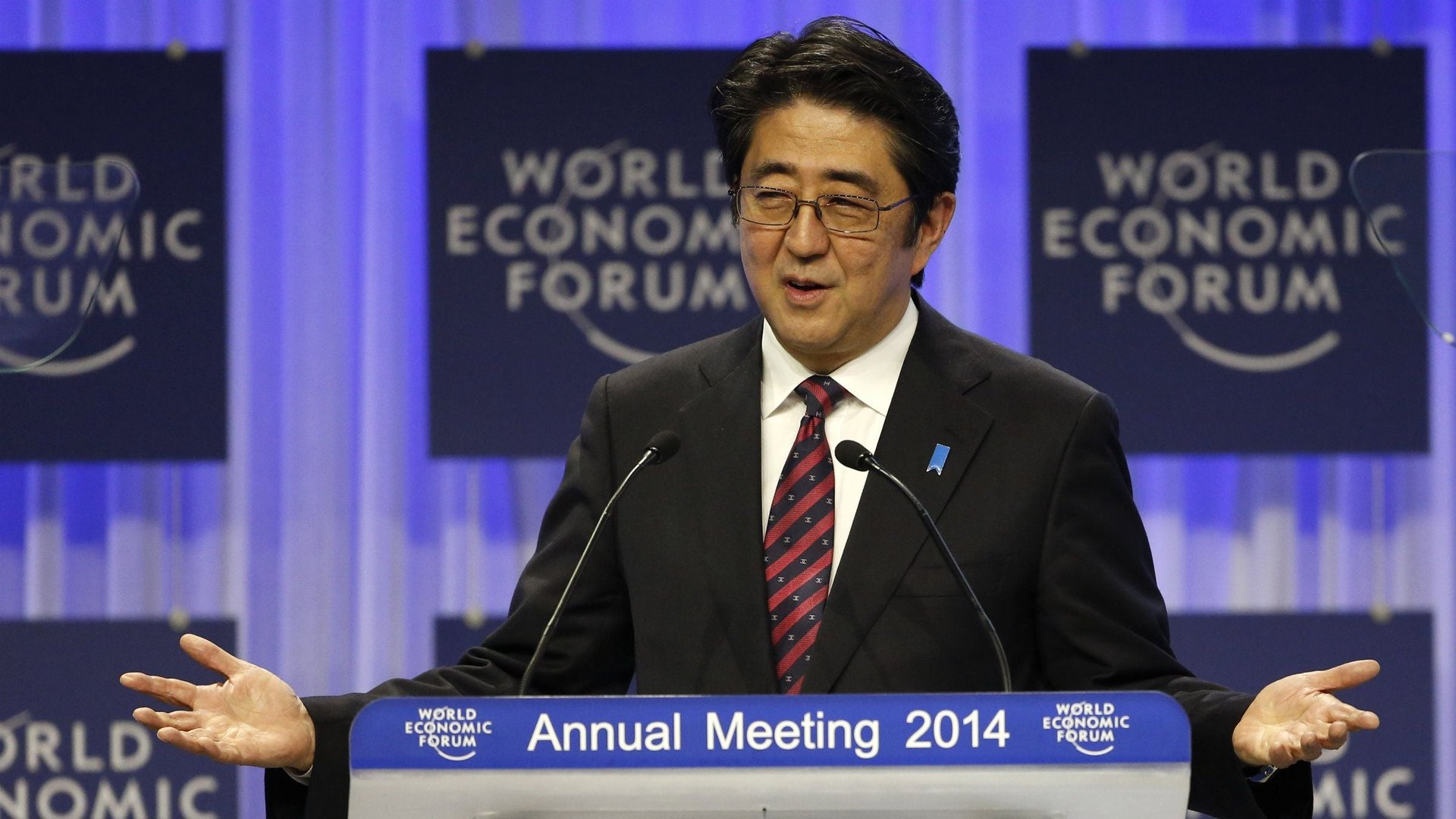

It only took 15 years, but the BOJ is finally waking up. Japan’s prime minister, Shinzo Abe, has made whipping deflation a priority—and he’s stacked the central bank with people who agree. In the past year, the BOJ has said it will do “whatever it takes” to stop prices from falling, and it’s backed that up. It’s announced a two percent inflation target, and said that it will keep buying long-term bonds until inflation gets and stays there.

It’s working. The stock market has soared. Core inflation is at a 15-year high. And workers are starting to demand, and get, raises. But this might not be enough. A new Brookings paper estimates that this added about one percentage point to 2013 growth—a good start, but just that. Japan is still far from where it should be, and far from growing fast enough to get there. The question is if this is as good as it gets. And the answer depends on how you think bond-buying works.

“The problem with quantitative easing (QE),”Bernanke has said, “is it works in practice, but it doesn’t work in theory.” Now, there are two basic stories about why it does actually work. The first is mechanistic: When the Fed buys Treasury or mortgage bonds, the banks that owned them will, hopefully, buy other things. That might be stocks or corporate bonds or something else entirely. Whatever the case, it should push those asset prices up. And that should help companies borrow for less and make the people who own these things feel richer—and more likely to spend. If this is how QE works, then the BOJ can do a little bit better, but not much more, by buying different types of assets than it already is.

But QE might be a Jedi mind trick. It might only work, because markets think it does. Here’s what that means. Say interest rates are zero, but the economy “needs” them to be -4 percent. Well, the central bank can’t cut rates into negative territory, because if it tried, people would just move into cash that didn’t cost money. But the central bank can try to increase inflation expectations to 4 percent instead; that’s effectively the same thing. The problem, though, is people won’t believe a central bank that’s been religiously targeting 2 percent inflation is going to allow double that. And that’s where QE comes in. Bond buying can, as Michael Woodford argues, convince markets that the central bank won’t raise rates anytime soon—which makes them expect more inflation. The magic is if they expect enough inflation, then the economy will recover and inflation will go up. It’s a self-fulfilling prophecy.

… or Rooseveltian radicalism?

The good news, if that’s true, is that the BOJ could theoretically get the recovery going much faster. The bad news, as Krugman points out, is that’s much harder than it sounds. To see why, let’s try one more thought experiment. Say an economy has deflation, wants two percent inflation, and needs four percent inflation. (Call it “Japan”). What happens then? Well, people are used to falling prices, so it will take awhile to get them to believe in the new two percent target. But hitting and staying at that target depends on it being enough inflation to jumpstart a recovery. If it’s not, then the self-fulfilling prophecy will fail. In other words, believing in two percent inflation won’t create two percent inflation if the economy needs four percent inflation. Instead, inflation will undershoot its target a little, and then a lot as people stop listening to the central bank.

Unconventional monetary policy doesn’t work as well with a conventional inflation target.

Now, the gold standard of unconventional policy is, well, when FDR took us off the gold standard in 1933. As you can see in the chart below from Brookings, industrial production exploded when he did. But it didn’t, not even close, when Abenomics started. Why?

Well, Bernanke likes to say policymakers need “Rooseveltian resolve,” but he’d be better off talking about Rooseveltian radicalism. As Mike Konczal points out, FDR didn’t just take us off the gold standard. He also promised to get prices back up to their 1929 levels—about a 42 percent increase from where they were in 1933. Now, that obviously wasn’t going to happen in a year, but over four years, that’s still 10 percent inflation. Or a five times bigger shock than the BOJ’s two percent inflation target.

That might sound too crazy for Japan today, but it shouldn’t. Japanese prices are about 50 percent below where they would have been if they’d just had 2 percent inflation the past 20 years. They need a big shock, and, even now, they’re not getting it. They’re still stuck in what Krugman calls the “timidity trap.”

The only thing we have to fear is fear of three percent inflation.

This originally appeared on The Atlantic. Also on our sister site: