Goldman Sachs’ tech IPOs have popped the most lately, and JP Morgan’s the least

Memo to Silicon Valley’s IPO candidates: If you’re looking for a sizable first day “pop” on your offering, you might want to tap Goldman Sachs as your the lead underwriter.

Memo to Silicon Valley’s IPO candidates: If you’re looking for a sizable first day “pop” on your offering, you might want to tap Goldman Sachs as your the lead underwriter.

Of the tech IPOs that came to market in 2013 and the first quarter of 2014, the offerings Goldman Sachs’ bankers shepherded through the process have risen an average of almost 56% in their first day of trading. Goldman investment bankers have claimed the coveted “lead left” position on 17 tech IPOs over that period, including Aerohive Networks last Friday.

During that period, the average first-day “pop” on offerings Goldman led was tops amongst major underwriters. (We looked only at banks that at had least two tech IPOs that raised at least $30 million.)

Contrast that with the first-day performance of the eight tech IPOs led by JPMorgan Chase over the same period. JPMorgan served as lead underwriter on a batch of deals that haven’t been met with the most-glowing market reception. In November, Chegg—an online student textbook rental service—fell about 23% in its first day of trading. Violin Memory, which makes high-speed data storage systems, fell 22% its first day. Internet website publishing company Wix also slipped on day one. Just recently, King Digital Entertainment, the company behind the popular mobile game Candy Crush Saga arrived in the public markets with a resounding thud.

Both Goldman and JPMorgan Chase declined to comment, as did other underwriters we contacted for this story.

So is that an ironclad indication that one set of tech bankers is more skillful than another? Not exactly. To be sure, the size of the first-day pop isn’t the only measure of an underwriter’s success in handling a deal. For many firms, kicking off an IPO can be a high-wire act between balancing the expectations of the company trying to raise money by selling shares and the demands of the mutual funds, hedge funds and other institutional buyers, who scoop up the company’s equity on day one.

For the well-connected investors who land shares of an IPO, a first-day pop generates a healthy, low-risk return. But for the company trying to raise money, a giant pop indicates that there was significantly more demand for their shares than supply. In other words, the company could have charged higher prices for the stock and raked in more cash. (Of course there are other events that can result in a lackluster reception for an IPO such as a rough patch in the market. The prospects for a company can also change because of a breaking news event.)

So what’s the right balance between a pop—which benefits the buyers of shares and makes the offering look successful—and less of a pop, which indicates that the sellers of the shares got a good deal?

“The stock has to pop,” said David Menlow president of independent IPO research firm IPO Financial Network. ”We want a deal to price on the upper end of its range, open above where it priced and close above the opening price.”

Sounds simple enough. But as King Digital’s experience shows, simple doesn’t always mean easy.

To be fair, the job of the underwriters of an IPO isn’t finished after the first day of trading. Underwriters can continue to support the price of a stock stock for up to a month after the shares begin trading.

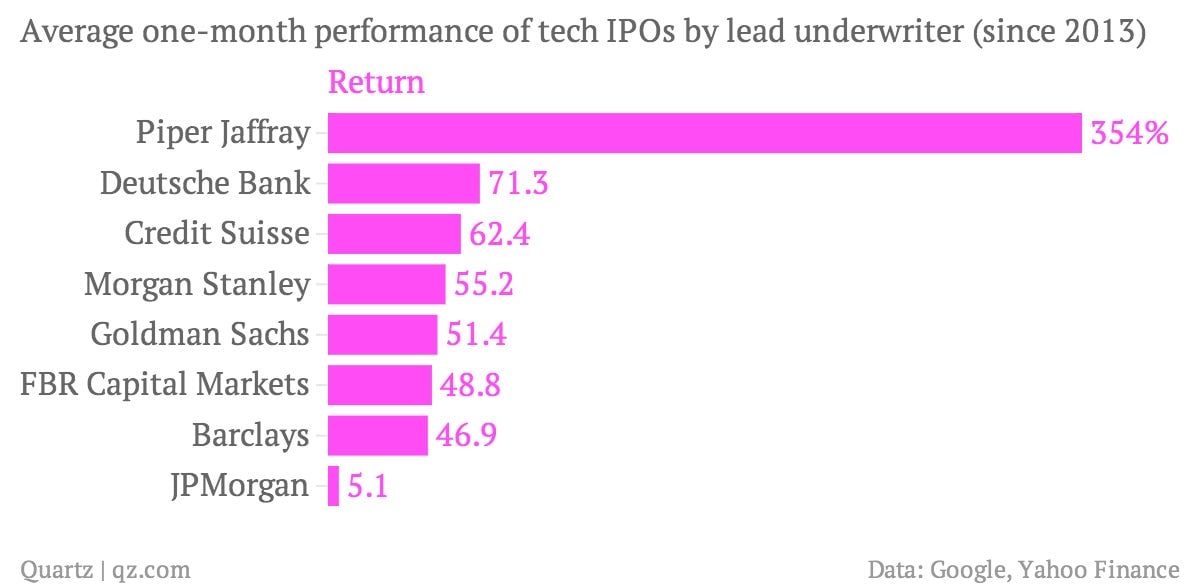

The following chart shows the performance of deals by underwriters, who have helped issue at least one tech offering since 2013. Boutique investment bank Piper Jaffray’s performance on one tech deal, German 3-D printing company VoxelJet AG, stands out for its eye-popping 354% return.

Over the month-long time frame, Deutsche Bank—which had five deals over that period—followed Piper Jaffray, with a 71.3% return on its tech offerings. Goldman ranks fifth among tech underwriters and JPMorgan rounds out the list, in last place among the banks we looked at.