Community solar projects are helping residents save and forcing utilities to wake up

For years, electricity customers had two options to go solar in their neighborhood: Install their own solar panels or purchase solar off the grid from a local utility (if that was even possible).

For years, electricity customers had two options to go solar in their neighborhood: Install their own solar panels or purchase solar off the grid from a local utility (if that was even possible).

Now’s there’s a third option. Community solar promises to give anyone with a wall outlet access to clean energy for less than their current utility bill. As US states expand their carbon-free portfolio (and scramble to hit net-zero goals), expect to see community solar go mainstream.

How community solar works

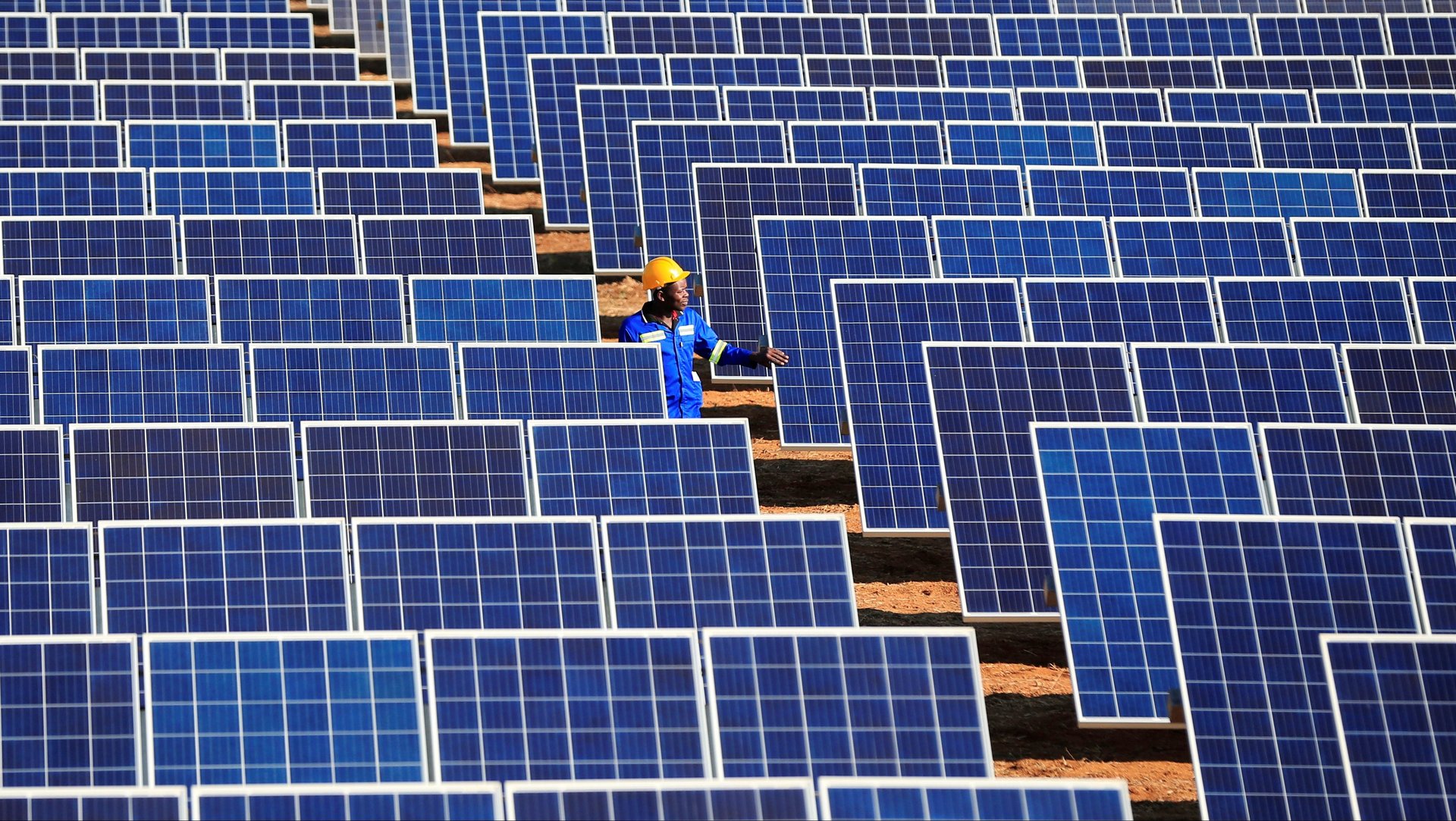

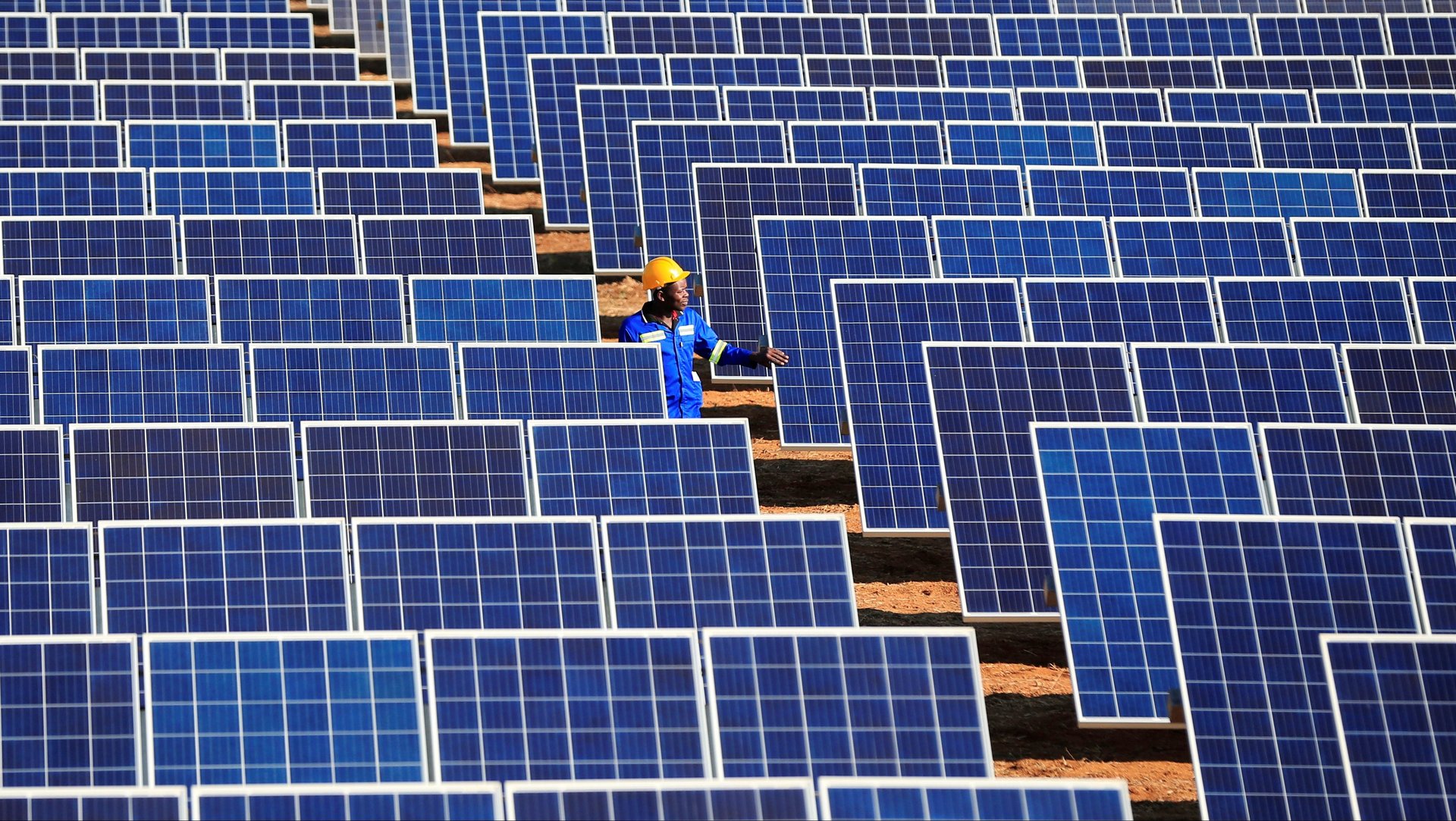

Community solar promises the savings of large-scale solar without the commitment (or a rooftop). No single definition exists, but most projects share a few traits: Customers subscribe to shares in a new solar farm in their service area (essentially helping finance it), developers build it, and the electricity itself flows onto the grid. Subscribers then get credits, cutting their utility bills by 10% or more.

That’s quite a change from how most solar options work for people today. For homeowners, rooftop solar panels deliver plenty of savings (generally paying for themselves within six to 10 years), but the average system costs about $13,000 after tax credits. Owners can pay upfront or finance it; some require no upfront costs but lock owners into multi-decade contracts. Yet only about 23% of American households have access to rooftop solar due to complications from rooftop suitability, ownership issues, tree shading, and restrictive homowners’ association rules (covering about half of US households).

At the other end of the spectrum are customers who buy solar directly from their utilities or retail energy suppliers. While wind and solar offer the cheapest source of electricity in most places, most of these savings end up in the pockets of retailers—green energy plans only pass on their green bonafides, with little to no savings. (Some even cost more.) Few actually finance the construction of new renewable projects because customers sign on only after a project is already underway.

The best of both worlds

Community solar, by contrast, promises flexible contracts that deliver energy savings by constructing new large-scale solar arrays. Community solar contracts typically deliver a 10% to 15% discount off prevailing utility rates, and let customers cancel with a few weeks’ or months’ notice. New solar gets added to the grid, and subscribers get credits to lower their utility bills.

“A large majority of the American population will have access to community solar in the next few years,” predicts Vikram Aggarwal, founder of EnergySage, a home solar marketplace. His company recently launched its own community solar marketplace with over 200 megawatts in projects across nine states, which allows users to comparison-shop for solar projects in their area.

This, argues Aggarwal, ensures developers pass on most of their energy savings to customers, initiating a virtuous cycle. More competition lowers rates, drives more demand, lowers costs to build new projects, and intensifies competition. Developers sign up customers months ahead of time, secure favorable project financing, and bring new solar power into the grid. Solar projects can go up in a year. It’s an unprecedented pace for an energy industry accustomed to projects stretching over years.

For solar advocates, community projects could also force complacent utilities to compete for customers and deliver on popular demand for renewable power. “These programs provide a source of competition in the marketplace,” says J.R. Tolbert, who leads state policy work at the national business group Advanced Energy Economy. “The best action states can take on community solar, rooftop solar, or utility-scale renewable energy is to ensure a vibrant third-party market, where the utility competes for the consumer’s business rather than controls it.”

Which US states allow community solar?

Last year, community solar projects in the US exceeded 2 gigawatts for the first time, according to energy research firm Wood Mackenzie. New community solar installations are set to hit 1 GW per year by 2021. Although just 5% of the solar market (which is still dominated by utilities controlling about 75% of solar capacity), community solar is likely to be the most competitive force in the market by offering a choice no one else can.

“Every state we’re following is looking at community solar,” says Ravi Manghani, head of solar research for Wood Mackenzie. “Community solar is basically leading growth in the non-residential space. I think it’s going to be a major driver.” Almost half of non-residential solar (that is, excluding utilities and homes) should come from community projects by next year, up from 29% in 2019.

Twenty states and the District of Columbia have already passed community solar legislation, says Matt Hargarten, the public affairs director for the Coalition for Community Solar Access, and more are considering it. New Jersey, New York, Massachusetts, Colorado, and Minnesota have led the charge thanks to strong local demand and political backing. Electricity prices vary by state, but EnergySage says the average discount off utility rates on its community solar marketplace is about 10%, with the largest in Minnesota (12%), Maine (as high as 12%), and New York (as high as 20%) thanks in part to more mature, competitive markets.

The future of community solar is now up for grabs. States are pursuing divergent policies. California, which recently mandated solar panels on most new homes, remains tepid on the community option, fearing it will dilute the incentive for renewable energy expansion. In Florida, the main utility FP&L has elbowed into the community solar market by controlling all new offerings in the state so far. Texas’ famously decentralized energy market has seen pockets of community solar flourish even as the state itself lacks a strong renewables standard.

The success of the model, argues, Hargarten, relies on competition. “There are no technical barriers to community solar,” he says, although utilities have fought hard to exclude rivals. “In order to ensure a robust community solar market it requires passing enabling legislation at the state level.”