Sotheby’s has evaluated Dan Loeb’s performance, and found it wanting

Third Point hedge fund manager and Dan Loeb’s latest target is Sotheby’s, whose management, he claimed in a letter to shareholders, lacks “innovation and creativity,” which is stifling the auction house’s profits. Loeb is agitating for three seats on the company’s board and has filed a lawsuit challenging a recent poison pill that the company adopted to fend off takeovers.

Third Point hedge fund manager and Dan Loeb’s latest target is Sotheby’s, whose management, he claimed in a letter to shareholders, lacks “innovation and creativity,” which is stifling the auction house’s profits. Loeb is agitating for three seats on the company’s board and has filed a lawsuit challenging a recent poison pill that the company adopted to fend off takeovers.

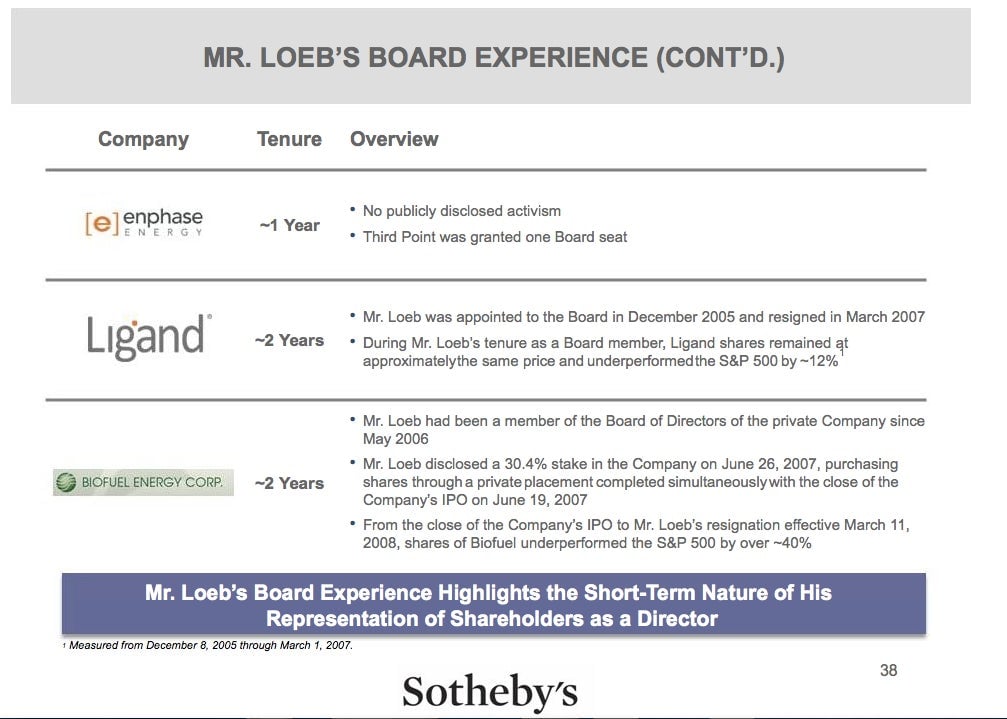

How well Sotheby’s managers are running the company is certainly up for debate, but their response to Loeb certainly showed some creativity. They filed a 53-slide Powerpoint presentation to the Securities and Exchange Commission this week that not only defends their performance, but takes a harsh look at how companies have done when Loeb has a seat on their boards:

After Loeb or his associates joined the board of Massey Energy, Biofuel Energy and Ligand, the companies underperformed the S&P 500 index, Sotheby’s said, sometimes substantially. The company also questioned the timing of Third Point’s controversial Yahoo stake sale and Loeb’s swift departure from the internet company’s board after agitating so strongly to join.

A Powerpoint presentation is unlikely to deter Loeb, whose letters to shareholders are so popular they have their own blog, and he’s sure to fire back at Sotheby’s with another barbed missive before long as he continues his campaign to force his way onto Sotheby’s board. The company’s shareholders will vote on May 6 to decide whether he’ll get his way.