As promised, JPMorgan delivered an ugly set of trading results

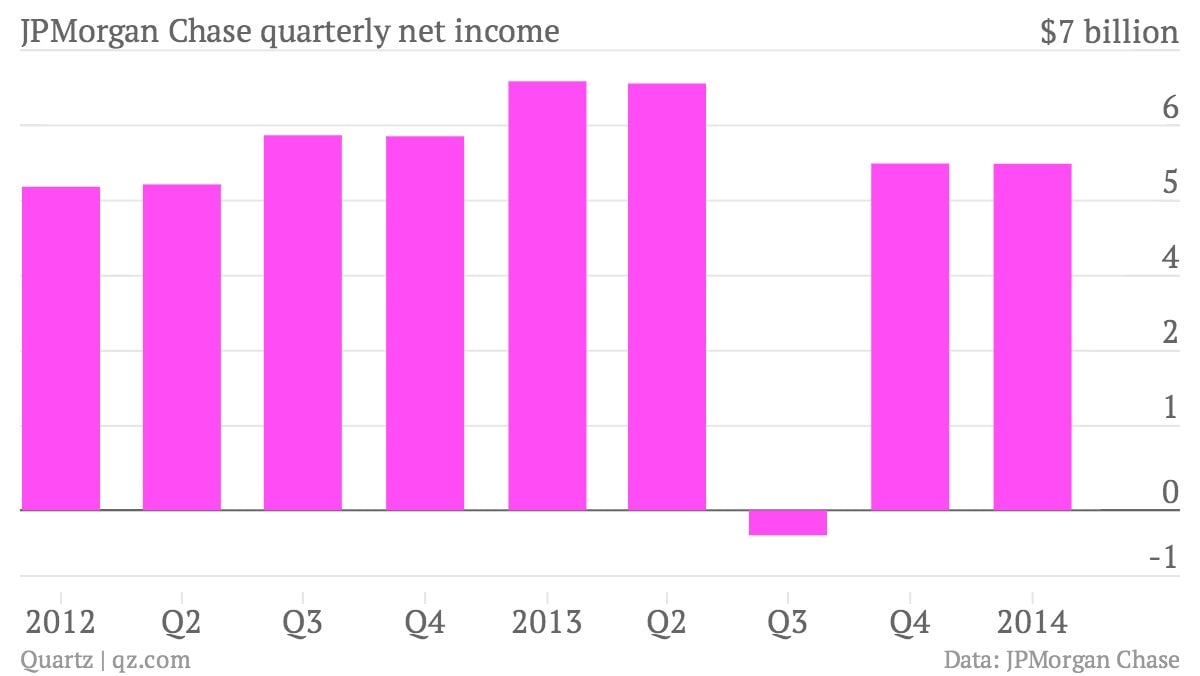

The numbers: Ouch! JPMorgan Chase rarely disappoints analysts, but its latest quarterly results managed to miss expectations that were already low to begin with. CEO Jamie Dimon had warned that the bank’s performance in key areas like fixed income wasn’t trending well. In the end, first quarter revenues fell by 8%, to $25.2 billion. Profits sank nearly 20%, to $5.3 billion.

The numbers: Ouch! JPMorgan Chase rarely disappoints analysts, but its latest quarterly results managed to miss expectations that were already low to begin with. CEO Jamie Dimon had warned that the bank’s performance in key areas like fixed income wasn’t trending well. In the end, first quarter revenues fell by 8%, to $25.2 billion. Profits sank nearly 20%, to $5.3 billion.

The takeaway: Traditionally considered a bellwether for the rest of the banking sector, JPMorgan’s woeful performance bodes ill for its rivals. The first quarter is usually the best for big banks, as high levels of activity following the holiday-shortened fourth quarter generate solid fee revenue. JPMorgan’s weak first quarter suggests that the rest of the year could be a slog.

What’s interesting: The bank warned that fixed-income trading was going to be bad, and that’s exactly what it reported. The firm generated fixed-income revenue of $3.8 billion in the first quarter, down 21% from the same quarter last year. Trading outside of the bond markets was hardly better, with equity trading revenues falling 3%, to $1.3 billion.