A jpeg just sold for $69.3 million amid the NFT craze

For most artists, finding success in the volatile art market can entail years of perseverance and a lot of hustle.

For most artists, finding success in the volatile art market can entail years of perseverance and a lot of hustle.

But thanks to the current craze for blockchain-backed auctions, Mike Winkelmann—a relatively unknown 40-year old graphic designer from South Carolina who signs his works by the name Beeple—is now among the top three most valuable living artists, joining the ranks of contemporary art superstars Jeff Koons and David Hockney.

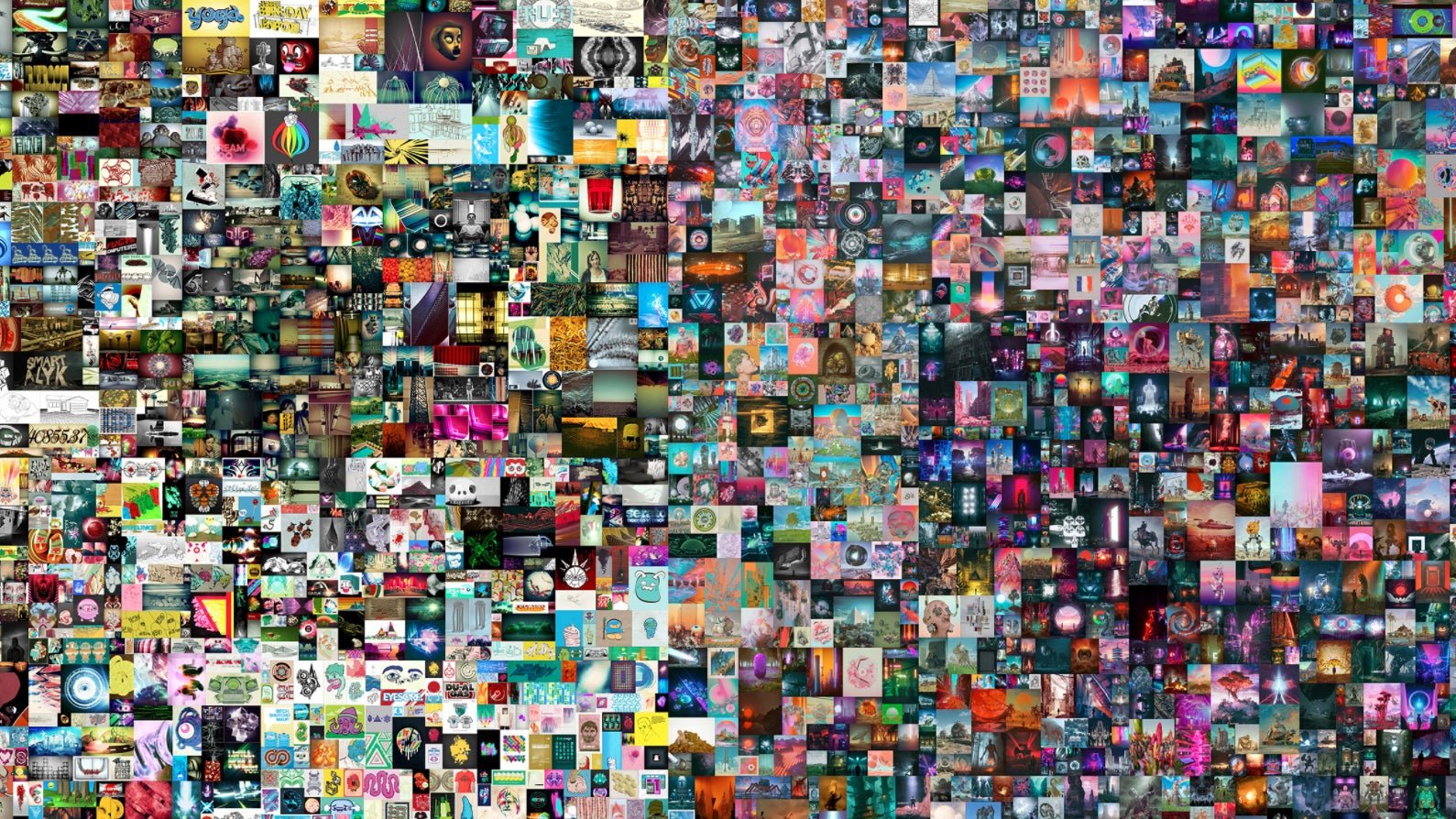

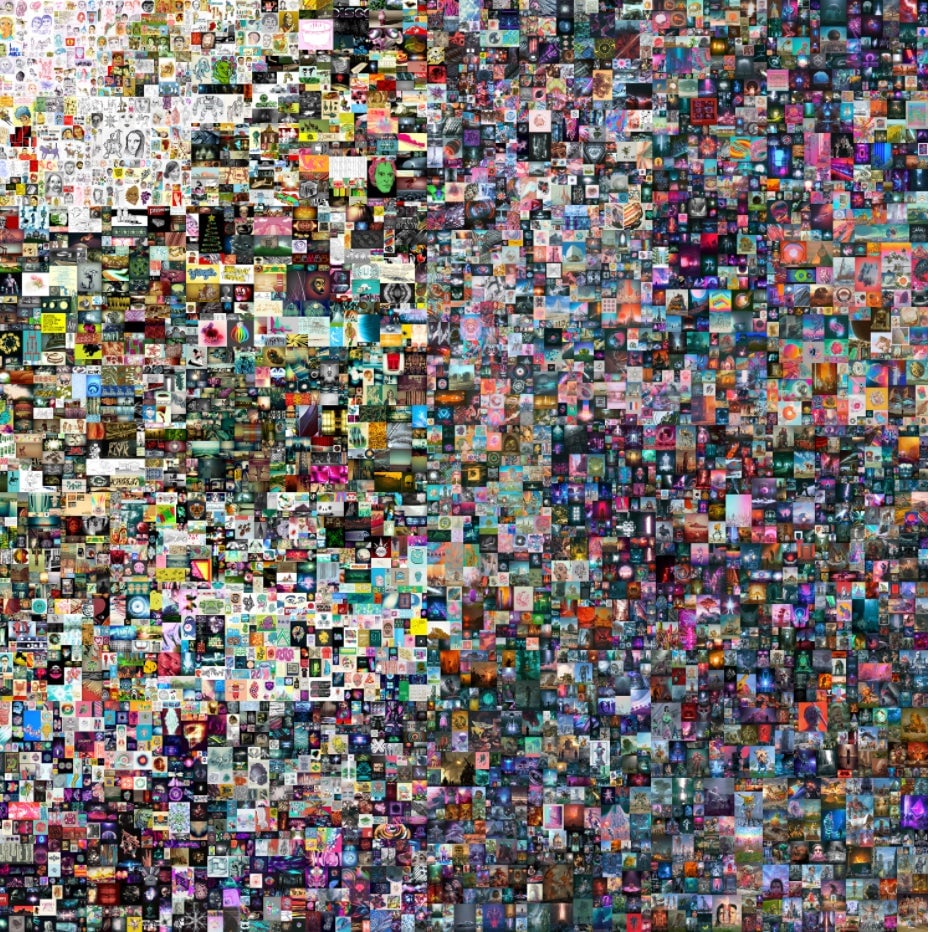

His digital collage titled Everydays—The First 5,000 Days, sold for $69,346,250 at Christie’s first foray in cryptoart. The winner of the historic auction, receives a 319 megabyte jpeg file and a non-fungible token (NFT), which is essentially a string of code that serves as a deed of authenticity. The Christie’s single lot auction, which ended today (March 11), sets a new record for an artwork sold in the NFT market. The 254-year old British auction house is the first among the big art houses to offer a purely digital work authenticated via the Ethereum blockchain, and the first to accept cryptocurrency as a form of payment.

Even Beeple, who sold a $6.6 million piece on Nifty Gateway last month and secured new collaborations with Louis Vuitton and Nike, was astonished.

Christie’s did not reveal the identity of the winning bidder.

The landmark auction is just the newest development in the burgeoning NFT market, where anything from tweets to trading cards sell for millions of dollars in a matter of minutes. Miami-based collector Pablo Rodriguez-Fraile, for example, recently pocketed over $6 million for reselling a 10-second video clip he acquired for $67,000 last October. Experts predict that cryptoart values will eventually decline because most bidders aren’t art patrons per se, but merely seeking a profit.