The downside of being Goldman Sachs

Being an elite brand with household name recognition has clear advantages for attracting talent. Goldman Sachs, for example, recently said it accepted only 4% of the people that applied for its analyst program. A new paper (paywall) confirms that the most prestigious investment banks get the best talent out of business schools school without having to pay a premium.

Being an elite brand with household name recognition has clear advantages for attracting talent. Goldman Sachs, for example, recently said it accepted only 4% of the people that applied for its analyst program. A new paper (paywall) confirms that the most prestigious investment banks get the best talent out of business schools school without having to pay a premium.

But the prestige of firms like Goldman Sachs—which helps in hiring—has major drawbacks when it comes to managing retention and compensation over time, according to the study from Wharton professor Matthew Bidwell and co-authors, which looked at MBAs in investment banking. Early hires are high quality and surprisingly cheap. But as they move up the organizational ladder, that prestigious experience makes them extremely expensive to keep.

Prestige is attractive because the name and status of the firm will help employees for the rest of their careers. The authors of the new study calculated employer status by looking at survey data from career data company Vault, and ranking firms from 1 (least prestigious) to 50 (most prestigious). A one unit increase in an MBA’s perception of a firm’s reputation nearly doubled the likelihood they would accept an offer, according to the paper.

Firms get a few years of surplus benefit from those early career employees because they can’t leave right away, as other companies are often suspicious of those who want to jump ship too soon. Salary advantages don’t fully kick in until an employee has five years of experience. But, over time, the salary premium at top companies gets so high that employees capture a lot of the value of a firm’s status.

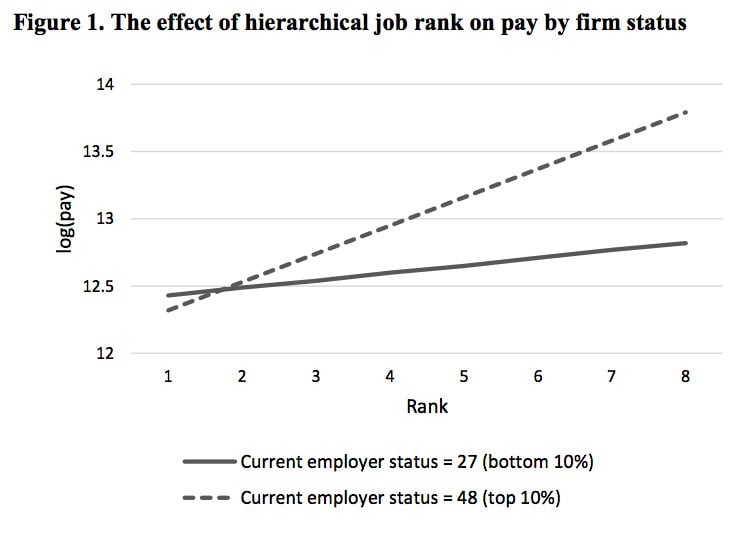

You can see this in the chart below. Job rank refers to an employee’s position in the organizational hierarchy. One would be an entry-level associate, and nine a senior executive. Pay rapidly increases at higher levels of prestigious firms:

According to the paper, a high-status employer pays 15% more for someone at the vice president level than a lower-tier firm. Since these firms are already seen as being better, those that get promoted only see their value increase more in the eyes of others.

Once someone hits the executive level at a top firm, everyone knows they’re good, so the value of staying isn’t that high. That’s when they start demanding more money.

The title of the paper (paywall) begins ”I used to work at Goldman Sachs!” which sums things up pretty well. As the research shows, once someone can say that, her perceived value increases.

The study doesn’t address the separate, obvious question, of whether the high-prestige firms are best equipped to pay higher salaries because of the premiums they can in turn charge clients. Higher fees and higher compensation are arguably their business models.

Firms looking to boost their prestige should look at why it matters to employees in the first place. People can flock to these firms because of their brands and reputation, networks, training offered, high-achieving staffs, and better career options for their alumni.

The first thing a firm looking to get better talent may want to concentrate on is providing more training and support to ensure that its alumni move on to great things. Those that already have high status can take advantage by hiring lots of entry level workers.