Did higher taxes on the rich accelerate the US stock sell-off?

Higher taxes on wealthy Americans could be one reason for the stock market’s recent downward correction.

Higher taxes on wealthy Americans could be one reason for the stock market’s recent downward correction.

In 2013, the tax paid on long-term capital gains increased from 15% to 23.8%. This led to a bit of a sell-off at the end of 2012, as investors sought to capture their gains under the old, lower tax rate. But it also mean that when that cash returned to the market, the new capital positions were considered “short-term.” Any gains resulting from their sale would be taxed as personal income, which for most investors would mean paying more than even the newly hiked long-term rate. Investors thus had an additional incentive not to sell during 2013’s massive bull market, when the S&P 500 increased more than 30%.

Now, many of those short-term positions are more than a year old and qualify for the lower, long-term capital gains tax rate—which means they are more willing to sell if things aren’t looking as rosy, and this year, things aren’t looking so rosy. At the same time, the success of the financial markets in 2013 combined with the new, higher tax rates on dividends and income likely left some people with bigger tax burdens than they expected, giving them another incentive to sell their stock so they have cash to pay the IRS today. Given this, we should expect a more volatile market in 2014, and we’ve certainly seen one.

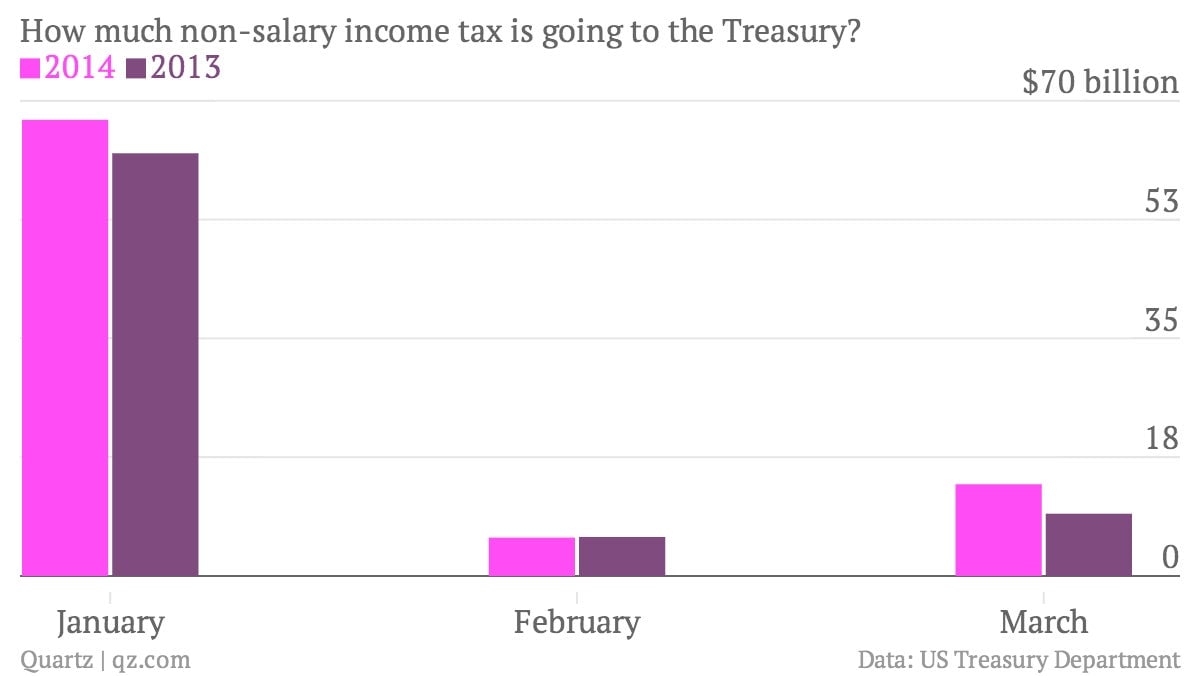

But how can we measure this effect until tax data is released in years ahead? Red Jahncke, a management consultant, suggested a useful proxy in February: Examine the monthly Treasury statements, and see how much individual tax was collected by the government outside of paycheck withholding—by setting aside salary withholding, we see mostly non-wage income like capital gains. This includes quarterly payments by individuals who estimate their taxes in advance—exactly the kind of people who might react to incentives like these. Looking at the data, we can see that so far this year, the Treasury has collected $9 billion more in this category than it did in 2013, a year that had unusually large capital gains payments, and $20 billion more than it did in 2012. If that entire $9 billion difference represents newly taxed capital gains—and it probably doesn’t, but we’re guesstimating here—that’s approximately $45 billion in taxed profits, which implies sales that would move the needle in the markets. And data for these three months just a leading indicator: Capital gains booked by sellers during these three months might be paid as quarterly taxes this April, or even next year.

Of course, the higher receipts might just reflect a healthier economy, and there are plenty of good arguments for this spring’s volatility that aren’t based on temporary tax effects. We’ll have a better idea when April’s monthly Treasury budget comes out, and we can see if a big spike in non-withheld individual income taxes suggests that many people sold stock and paid tax on the their gains.