Swedish bank brags that it’s more creditworthy than Belgium

The European crisis has been characterized by the flow of money from risky peripheral Europe into the continent’s safe havens: primarily, Germany, France, and—most dramatically—Switzerland and Scandinavia. In particular, money has flooded into Scandinavian housing and currency, leading some analysts to worry about a possible asset bubble.

The European crisis has been characterized by the flow of money from risky peripheral Europe into the continent’s safe havens: primarily, Germany, France, and—most dramatically—Switzerland and Scandinavia. In particular, money has flooded into Scandinavian housing and currency, leading some analysts to worry about a possible asset bubble.

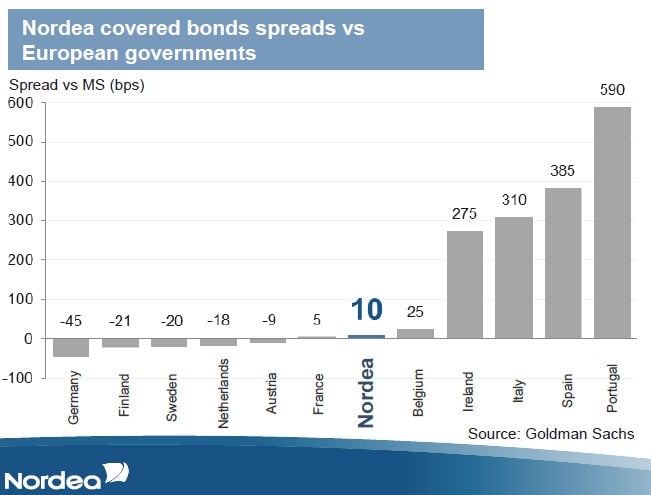

But in the meantime, Scandinavian bank Nordea is having a field day boasting about the quality of its assets. While the company actually missed analyst projections on earnings during the third quarter, investors are still far more willing to lend to Nordea than they are to banks in the euro zone’s periphery countries… or, it turns out, to some of those countries themselves. In its latest earnings report, the bank compared its cost of borrowing on its most secure form of debt—known as the “covered bonds spread”—with the cost at which countries can borrow by issuing sovereign bonds.

Bottom line: Nordea noticed that it can actually borrow more cheaply than Belgium can (and only slightly more expensively than France), meaning investors have more faith in its credit than they do in many of Europe’s largest economies. CEO Christian Clausen joked in yesterday’s earnings call that this makes Nordea “one of the safest jurisdictions in Europe.”