A beginner’s guide to the world of SPACs

What do a health insurance company, a space tourism company, and an electric vehicle company all have in common? They’re all SPACs. And that’s not space with the letter “e” missing.

What do a health insurance company, a space tourism company, and an electric vehicle company all have in common? They’re all SPACs. And that’s not space with the letter “e” missing.

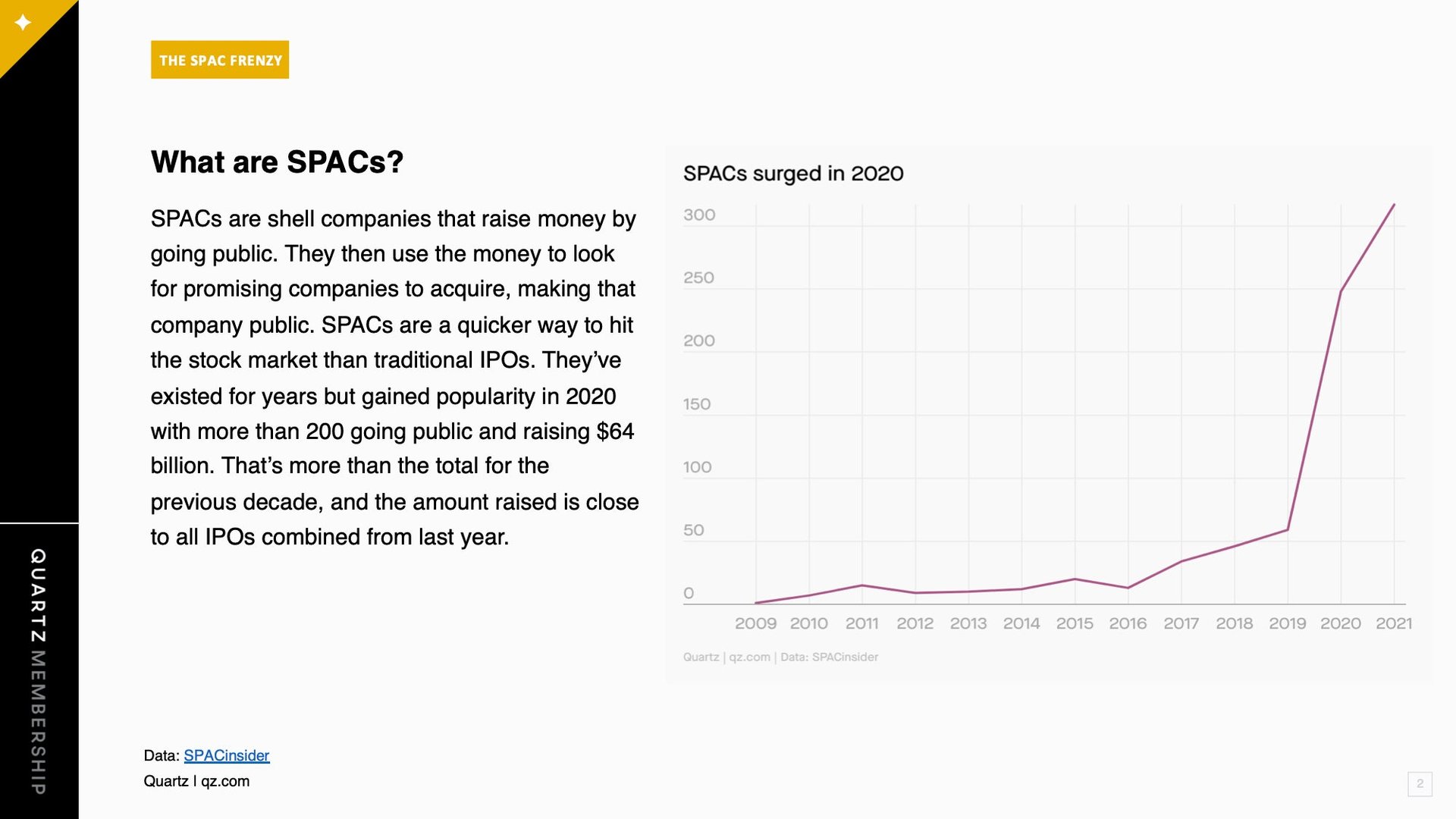

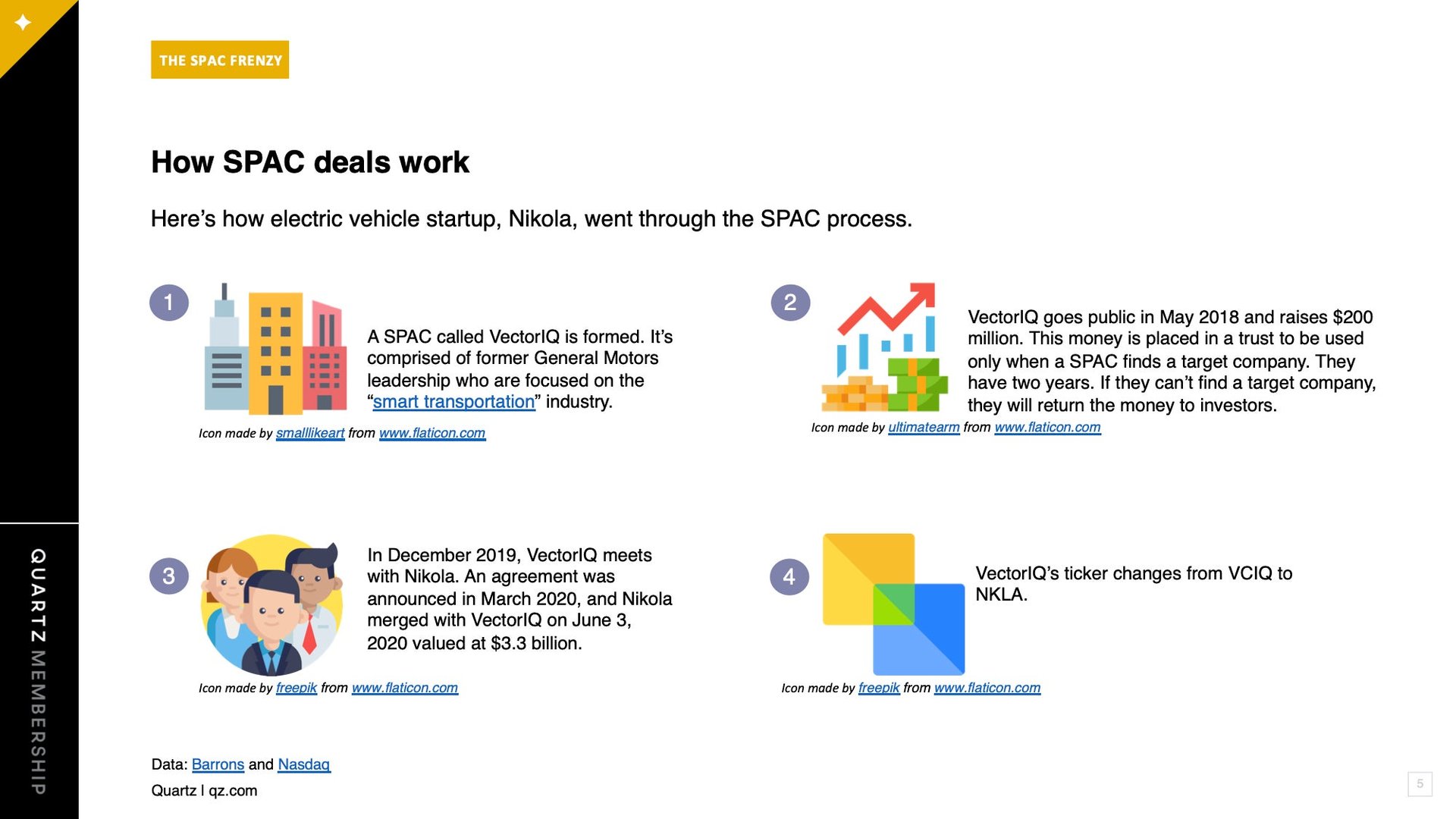

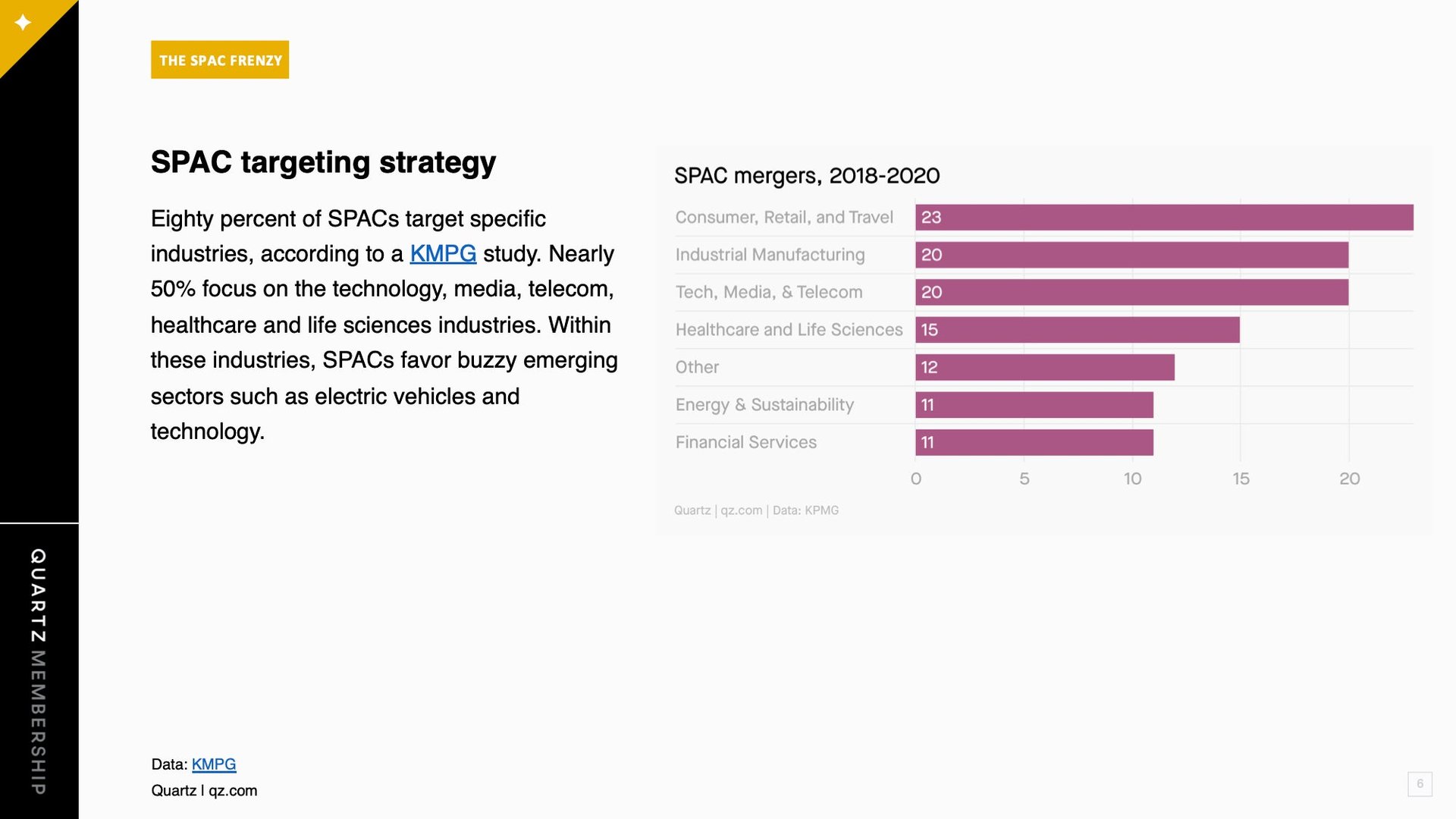

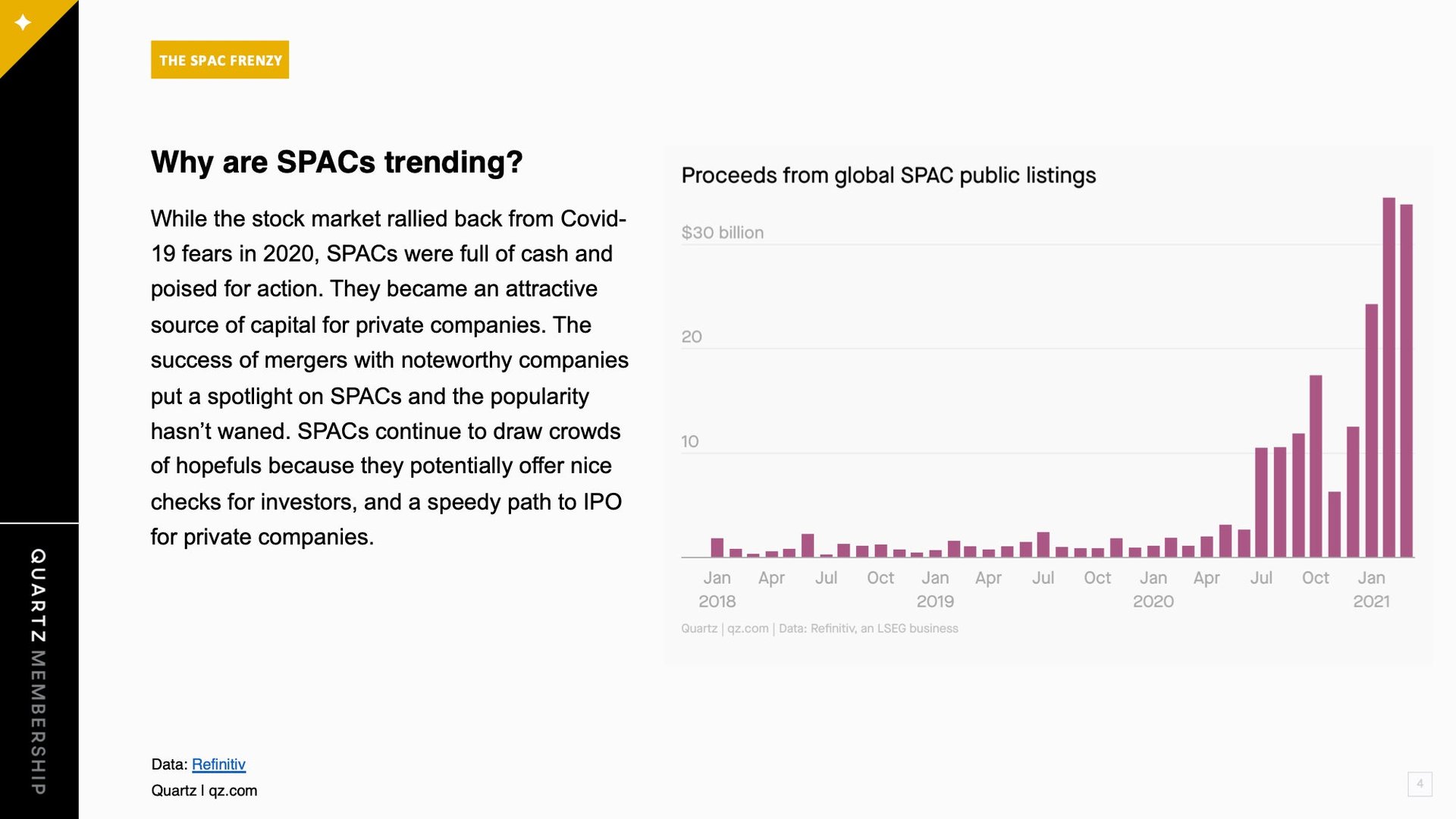

SPACs, short for “special purpose acquisition companies,” exist to acquire promising private companies and take them public on the stock market. They aren’t new but surged in popularity among investors in 2020. SPAC deals swarmed the stock market; over 200 went public, a giant 300% leap from 2019 and nearly matching traditional IPOs in aggregate deal sizes.

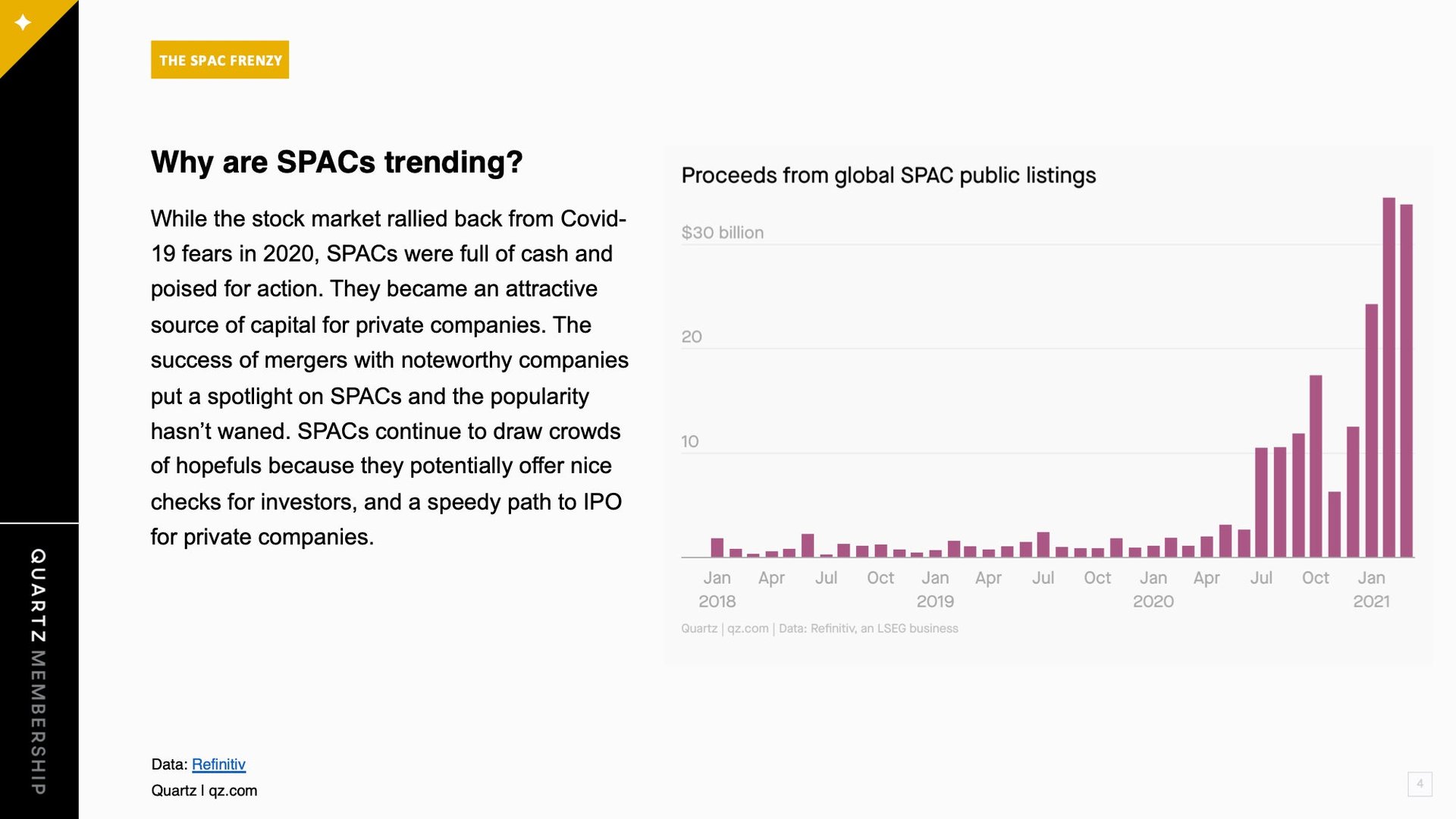

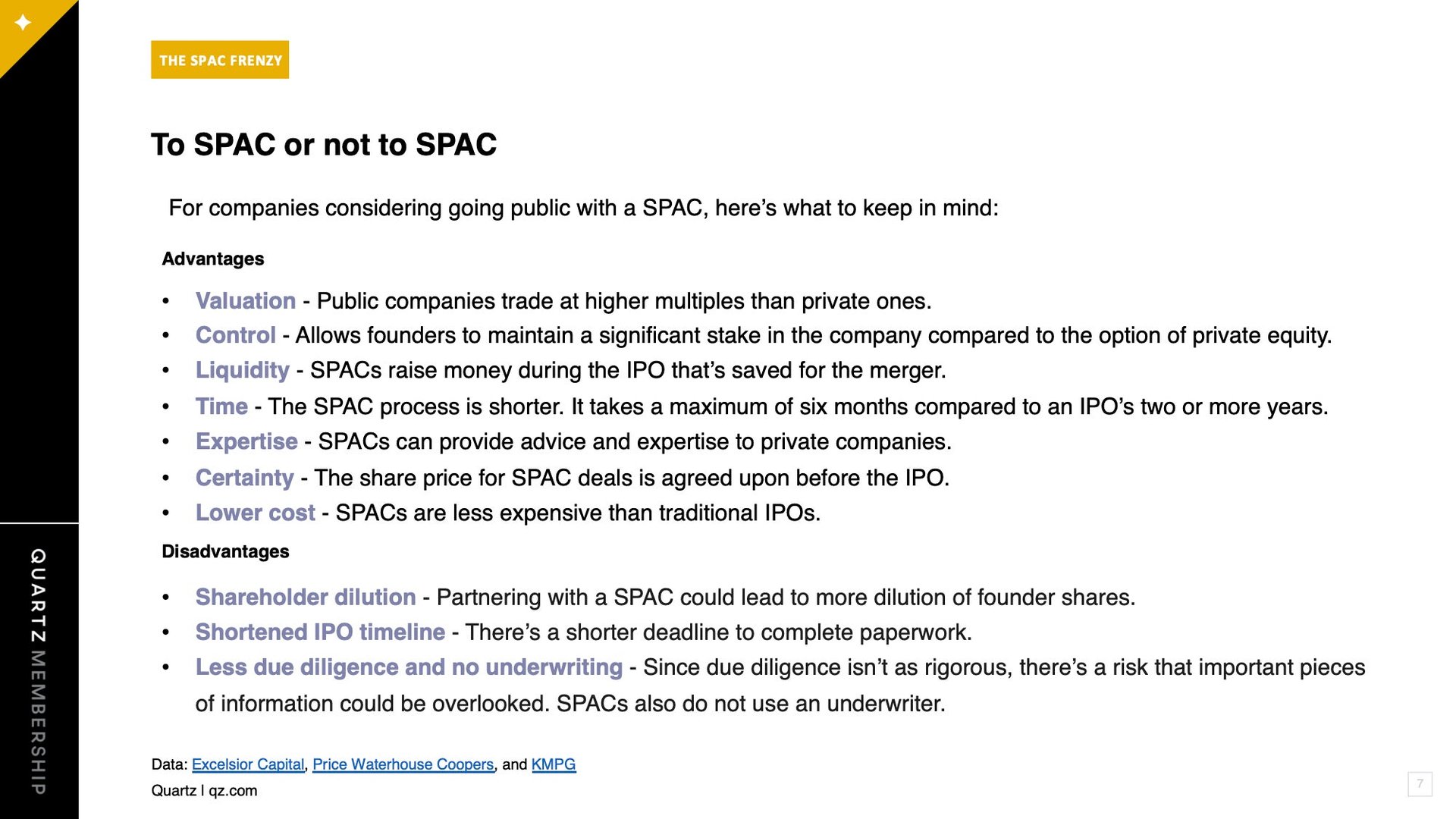

So what makes SPACs so special? Timing. While Covid-19 torpedoed the global economy in 2020 and stalled traditional IPOs, SPACs offered companies the cash they needed. After a couple of successful deals, founders realized that SPACs presented a desirable alternative: a faster route to go public and fewer upfront costs. It’s a relatively stress-free way for a company to launch on the stock market—just the ticket for founders already stretched thin.

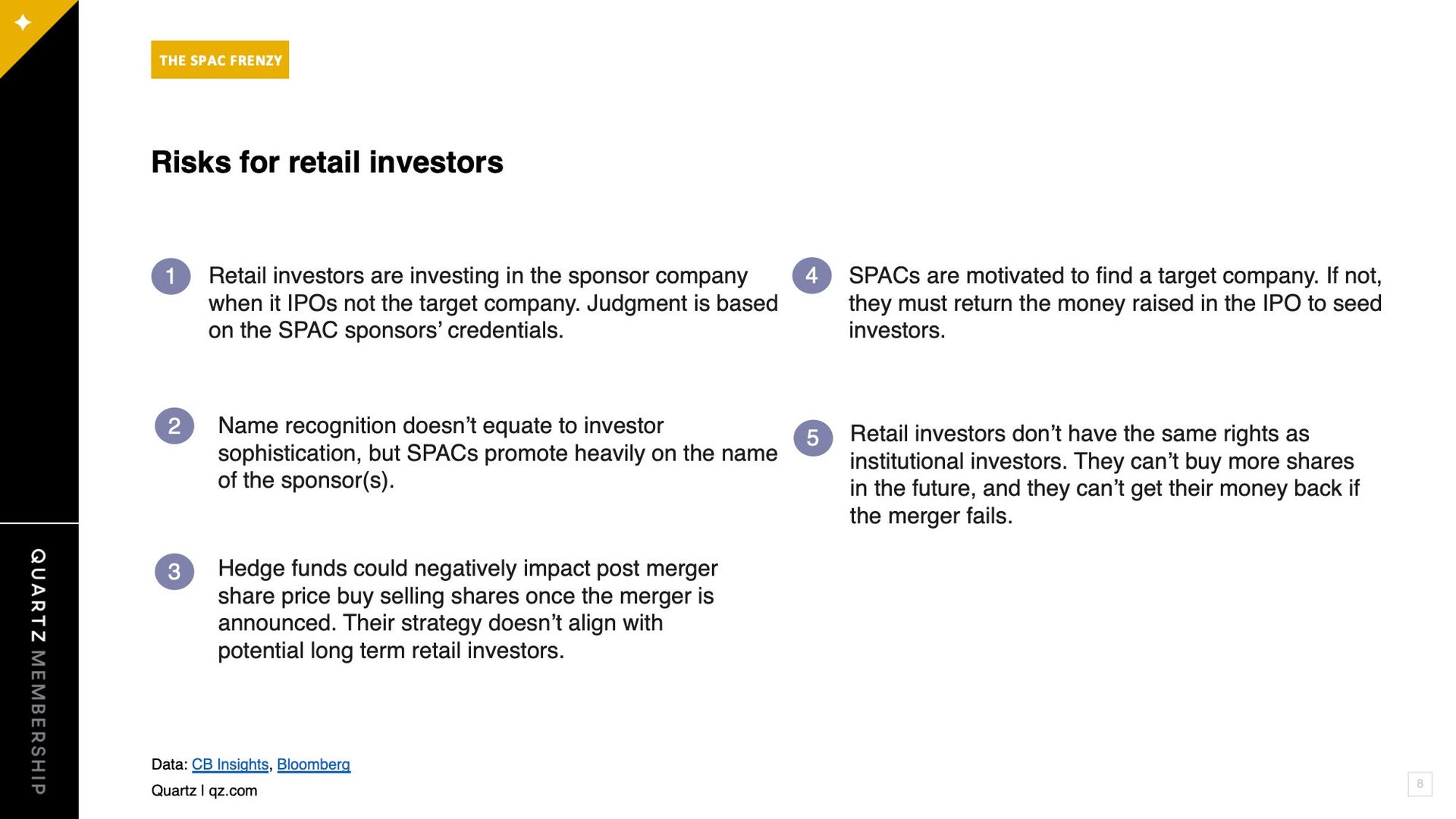

But SPACs aren’t just appealing for founders—they also present an opportunity for regular people to participate in the wealth-building process that a public offering can provide. Retail traders can’t invest in a SPAC pre-IPO, but they can make gains by buying shares once it’s public and before it acquires a private company.

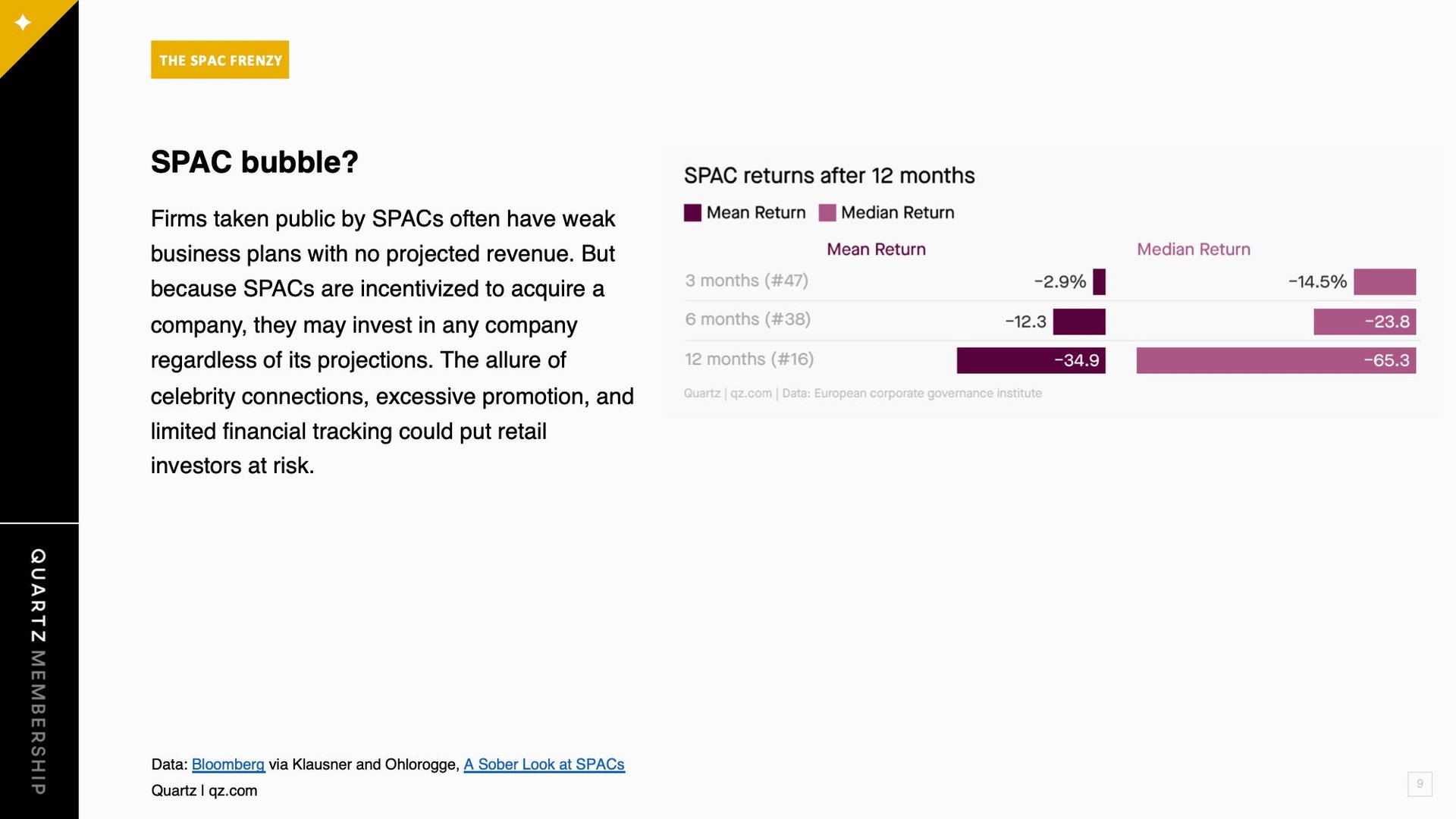

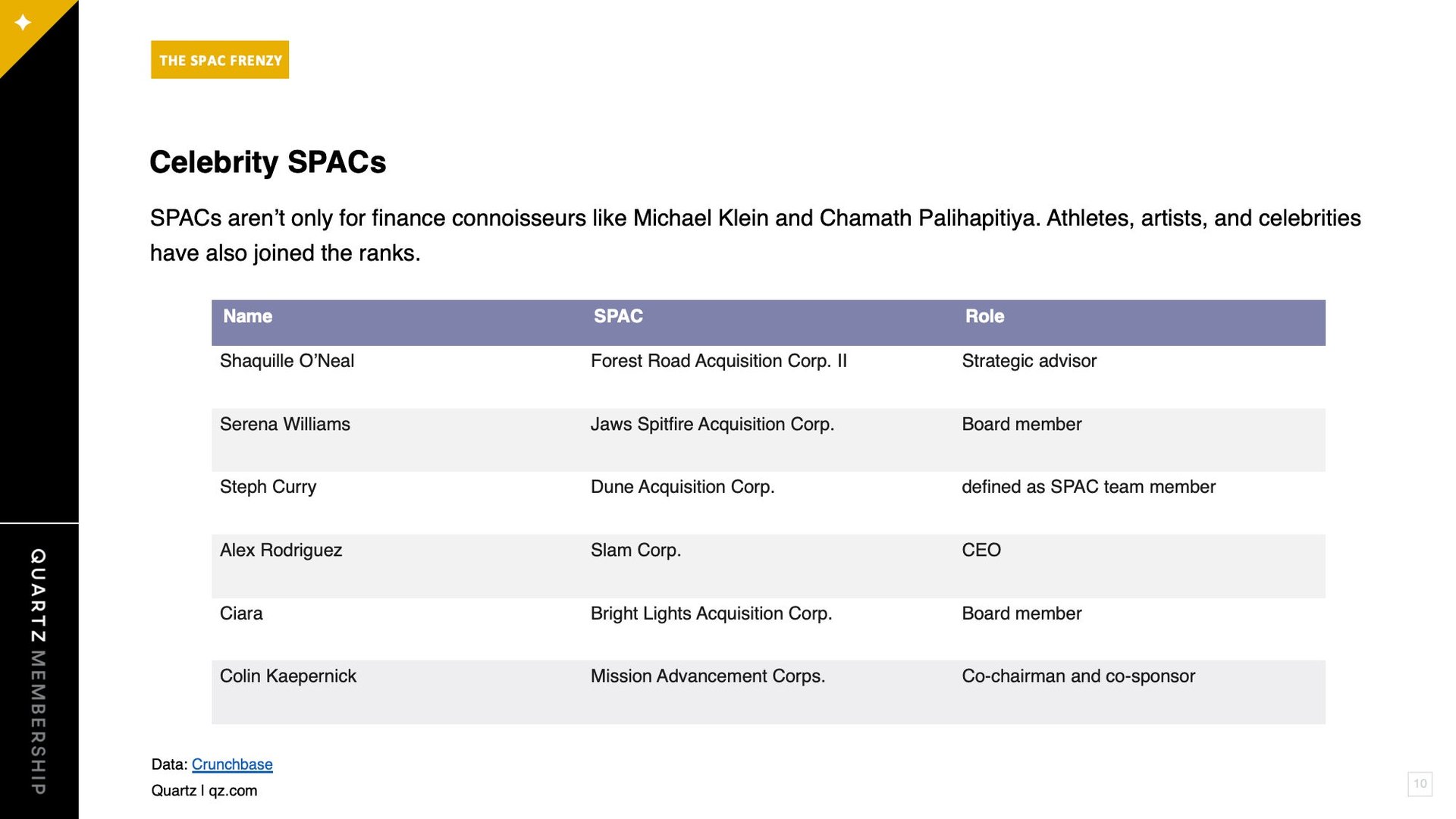

The potential gains from SPACs have everyone wanting to create one. Celebrities like Shaquille O’Neal and Serena Williams are involved and continue to bring attention to their companies. However, the glitzy sister to the traditional IPO isn’t without detractors. SPAC promotion can paper over facts about companies that might raise red flags to potential investors. Experts worry that retail investors in particular are at risk. Because of the lack of transparency, retail investors must make decisions based on the track record of whoever runs the SPAC. Others are concerned that so much frenzy about SPACs is creating another bubble.

To learn more about why SPACs are trending, read our latest presentation.

Keep scrolling to see all of the slides in our SPACs presentation. Or, if you’d prefer, you can view the PDF version or download the PowerPoint file, which includes our sources. Download the Excel file for access to the raw data for our charts. You can also download the Powerpoint, PDF, and Excel files, together here.

This is one of an ongoing series of member-exclusive presentations, which you can read, reformat, and use as you wish

Please share any feedback about what would make these presentations more useful—or topics you’d like to see us cover—by emailing us at [email protected]. These presentations are an exclusive benefit for Quartz members. We’d love it if you’d encourage any friends or colleagues who express interest to become a member so they can access them too.