Secretive Swiss commodities giants are buying big chunks of US energy

Some of the world’s biggest commodities traders are buying up key pieces of the infrastructure that’s driving the US energy production boom.

Some of the world’s biggest commodities traders are buying up key pieces of the infrastructure that’s driving the US energy production boom.

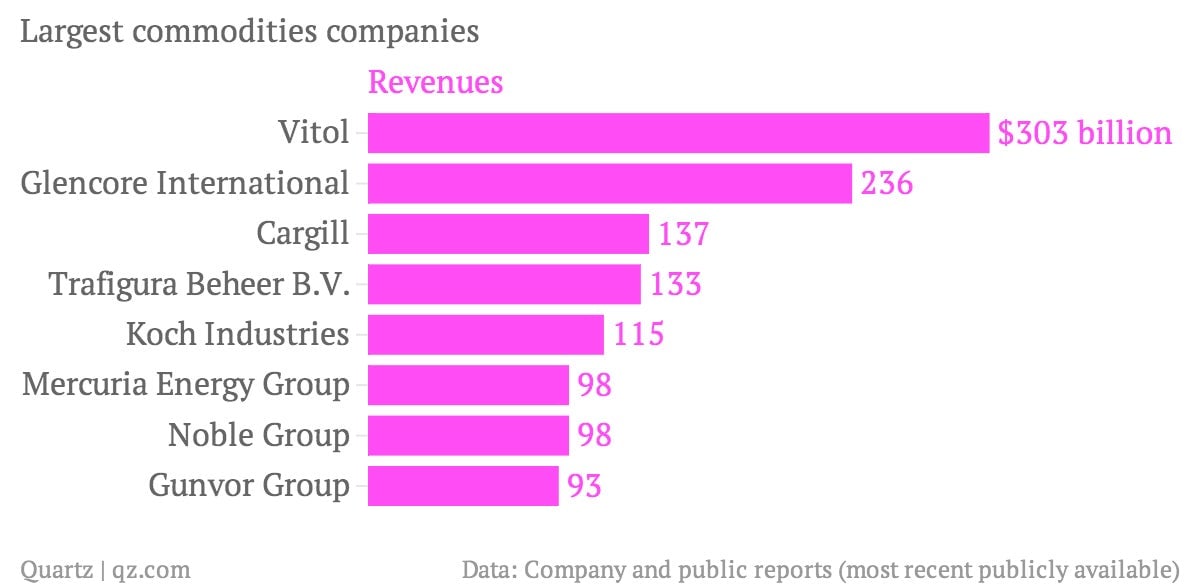

Secretive commodities investors like Vitol Group, Trafigura Beheer B.V. and Mercuria Energy Group are among the firms amassing physical assets like shale oil wells, oil and gas pipelines and offshore drilling projects in the US, Bloomberg reports.

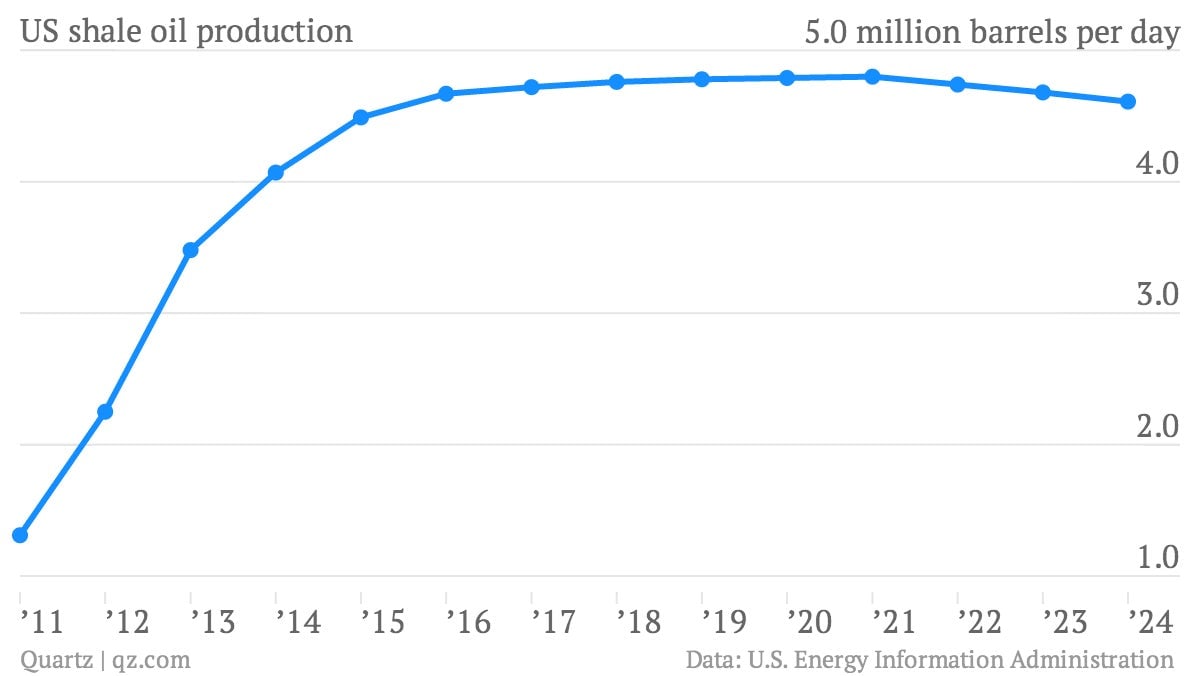

Why? The controversial fracking boom, which has driven US energy production sharply higher in recent years. Commodities firms want to get a piece of that production. They also see opportunities for arbitrage—that is profiting from price discrepancies—in the sometimes inefficient US oil and gas transport system.

Shale oil production in the US has increased by a 165%, from 1.31 million barrels a day in 2011 to 3.48 million barrels last year, according to the US Energy Information Administration. Those volumes aren’t expected to peak until 2021, when shale production hits 4.8 million barrels, according to estimates by EIA.

Another factor in commodities firms scooping up US assets is the exodus of large US banks from the business. For example, JPMorgan Chase sold a broad swathe of its commodities business, including North American power and gas (paywall) properties, to Mercuria in mid March. Other big banks like Morgan Stanley (paywall) and Barclays are exiting the commodities business too, in part due to heightened scrutiny by regulators like the Federal Reserve.

That’s presented a buying opportunity for for firms in the clubby world of private commodities trading–a group that is set to get more attention with the upcoming book The Secret Club That Runs The World by CNBC reporter Kate Kelly.