Amazon says it will stop accepting Visa credit cards in the UK

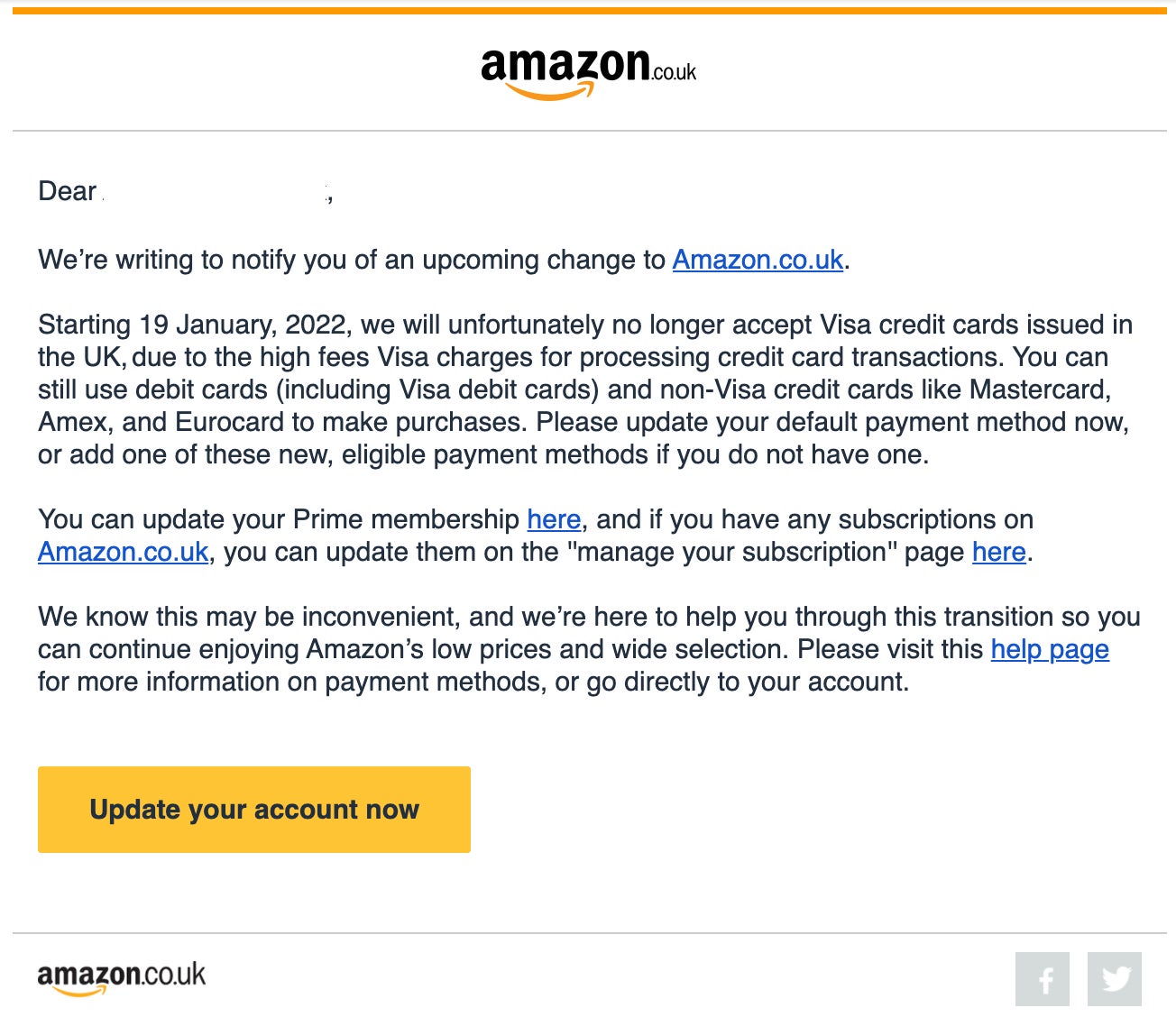

Millions of online shoppers in the UK are receiving emails notifying them that Amazon will stop accepting UK-issued Visa credit cards after Jan. 19, 2022. Amazon says Visa’s fees are too high.

Millions of online shoppers in the UK are receiving emails notifying them that Amazon will stop accepting UK-issued Visa credit cards after Jan. 19, 2022. Amazon says Visa’s fees are too high.

“The cost of accepting card payments continues to be an obstacle for businesses striving to provide the best prices for customers,” an Amazon spokesperson said about the decision.

Customers will still be able to use Visa debit cards, MasterCard credit cards, American Express credit cards, as well as Visa credit cards issued outside of the UK. They can also set up direct debit. The company is offering some UK customers a £20 ($27) incentive for setting a debit or non-Visa credit card as the payment default.

Visa’s response to Amazon’s credit card ban

While Visa takes solace in the fact that at least the holiday season will go smoothly, a company spokesperson said, “We are very disappointed that Amazon is threatening to restrict consumer choice in the future. When consumer choice is limited, nobody wins.”

The company, whose stock slumped more than 3% on the news, added that it’s working towards a resolution to reverse Amazon’s decision. There’s time for the two companies to solve this.

The Brexit effect on card fees

The main point of contention is the “interchange fee”—a charge levied on merchants that goes to issuing banks whenever a customer pays with plastic.

In 2015, a European Union (EU) law had capped credit card interchange fees at 0.3%. However, after Brexit, the UK no longer enjoys that ceiling. Visa has increased these charges to 1.5% for Brits. MasterCard made an identical fee hike but it hasn’t been blocked by Amazon. No particular reason has been given for singling out Visa.

Meanwhile, the Brexit issue only scratches the surface of this problem. Amazon has been taking on Visa all over the world.

Amazon’s global crackdown on Visa credit cards

In September this year, Amazon imposed a surcharge for Visa credit cards in Singapore. The company claimed it wasn’t a ploy to make more money. In fact, it was meant to be a deterrent.

“To avoid this surcharge, we encourage you to use a debit or non-Visa credit card as the default payment method in your account,” Amazon wrote in an email to customers. A similar surcharge was levied by Amazon in Australia, too.

Moreover, like in the UK, Amazon also offered monetary rewards to shoppers who switched payment methods in Singapore and Australia.

The recurring battle over Visa fees

Amazon’s issue isn’t unique or new. Card fees have long been been a point of contention. And Visa has been in the eye of the storm more than once.

Back in 2014, Walmart sued Visa’s US unit for more than $5 billion, for charging card-paying customers “unreasonably high” fees. In June 2016, the retail giant’s 370 Canada stores banned Visa cards over “unacceptably high” fees for six months.

In 2018, supermarket chain Kroger stopped accepting Visa’s credit cards at its Foods Co subsidiary. The next year, so did its Smith’s Food and Drug Stores division. “Visa’s excessive fees and unfairness cannot continue to go unchecked,” chief financial officer Mike Schlotman said in March 2019. Kroger reversed the ban after six months.

Amazon’s announcement could be a negotiation tactic. But if the past is any guide, it wouldn’t be unwise for shoppers to line up alternative payments methods—even if it’s only for a short period of time.