Eastern Europe’s analysts are furiously slashing their economic forecasts

The motto of today’s annual meeting of the European Bank for Reconstruction and Development was “Changing Economies, Changing Lives.” But many of the recent changes in Eastern Europe, where the EBRD operates, haven’t been for the better.

The motto of today’s annual meeting of the European Bank for Reconstruction and Development was “Changing Economies, Changing Lives.” But many of the recent changes in Eastern Europe, where the EBRD operates, haven’t been for the better.

At the gathering in Warsaw—which also celebrated 25 years since the fall of the Berlin Wall—the bank published a gloomy outlook for the countries where it operates. “Unusually high uncertainty” and “major risks on the downside” were frequent caveats to the bank’s latest batch of forecasts (pdf).

The economic fallout from the crisis in Ukraine has led the EBRD to slash its forecast for regional GDP growth this year in half, to a mere 1.4%. The bank last revised its forecasts as recently as January, so the severity of today’s downgrade is striking.

It’s no surprise that Ukraine and Russia are the ones dragging the average down. Ukraine’s shell-shocked economy will shrink by 7% this year, the EBRD expects; it had predicted that the country would eke out 1.5% growth a few months ago:

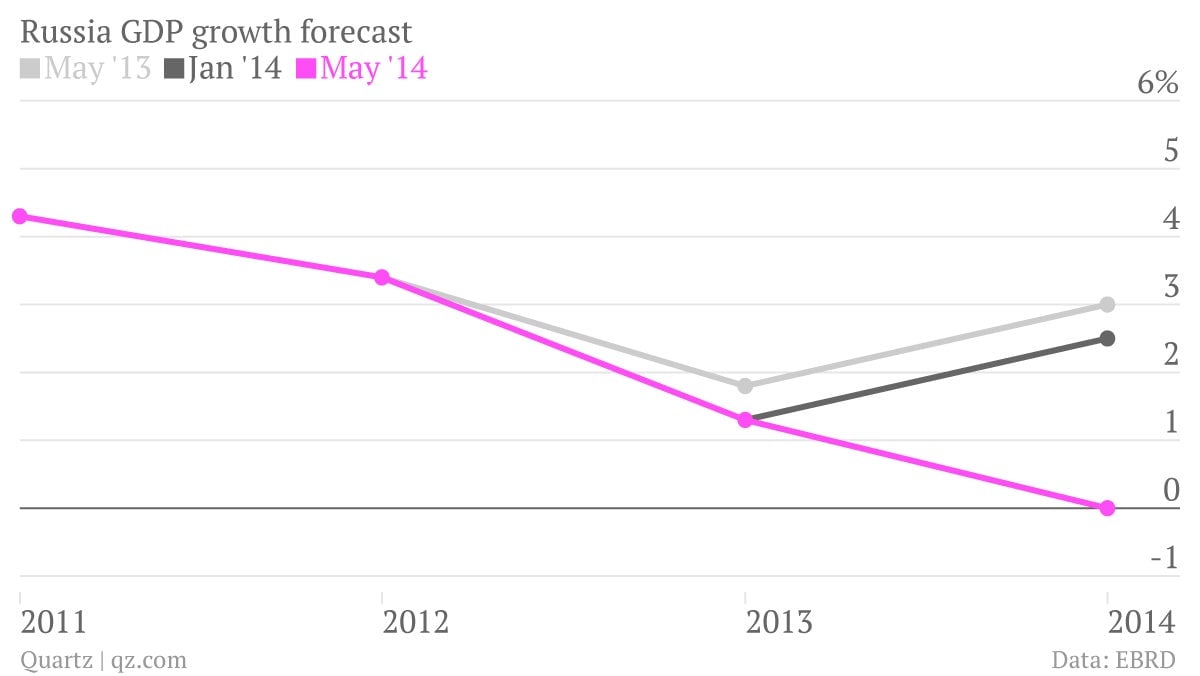

Russia, meanwhile, is expected to stagnate in 2014, subject to the “major risks on the downside” flagged throughout the bank’s analysis:

For now, the worst economic pain is “largely contained to the neighborhood of Russia and Ukraine,” the bank says. But tougher sanctions against Moscow could tip the Russian economy into recession, which would have a ripple effect. Growth across the region would ”grind to a halt” as a result.

The EBRD would probably have preferred a happier outlook as a backdrop to the anniversary celebration of progress made in post-communist Europe.