Why investors are angry at Chipotle’s CEOs, even though the company is doing great

Chipotle is doing well. Really well.

Chipotle is doing well. Really well.

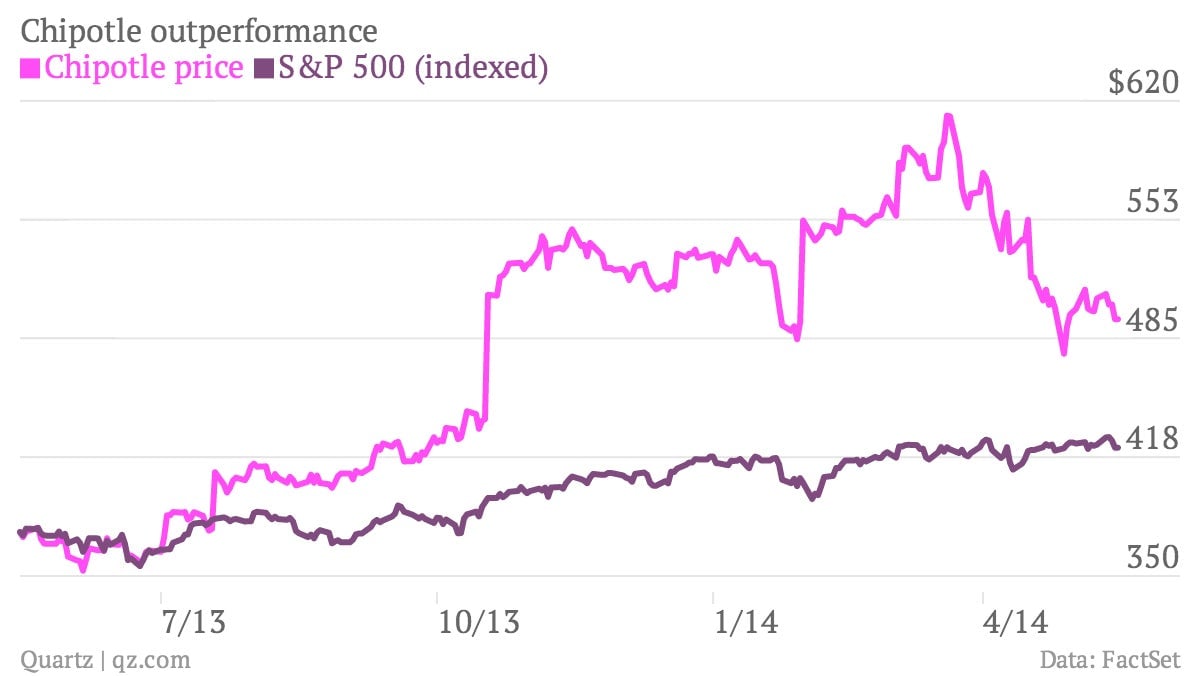

Sales are up, and the Mexican food chain is opening tons of new restaurants. It’s still making healthy profits, despite skyrocketing food prices. Revenue has doubled since 2009. The stock has tripled in value since 2011, and it substantially outperforms the S&P 500:

So why are investors upset with the company and its leaders? More than three-quarters—77%—of the company’s shareholders voted against ratifying the company’s pay package Wednesday, the biggest no vote of any “say on pay vote” at a sizable company this year. Though the vote is non-binding, it’s unusual for shareholders to object so vociferously when a company is outperforming the market.

Part of the reason is the sheer size of the pay package for the company’s co-CEOs, Steve Ells and Monty Moran. They made $25.1 and 24.4 million respectively last year, which is very much on the high end of CEO salaries.

But what really seems to have ticked investors off is an unusual and somewhat outmoded compensation plan that has paid them over $100 million each in stock options, making them some of the highest paid executives in America (paywall).

Rather than the more common stock options, they get stock appreciation rights. The plan automatically grants them stock when the company’s share price rises, and doesn’t require that they hold it for very long. “It’s a reckless pay structure that does nothing to appropriately incentivize management to create long-term value. Their pay is out of whack, however you measure it,” Michael Pryce-Jones told The New York Times (paywall). He’s an analyst at CTW, a union-backed pension fund that is leading the investor campaign against the pay package.

There’s a reason stock appreciation rights are uncommon. Option-based compensation is designed to align shareholders and CEOs by tying pay to the company’s long-term performance. By allowing Ells and Moran to reap quick rewards with their stock, this plan doesn’t add much of a long-term incentive. And as we’re seeing with Chipotle, it produces the sort of eye-popping pay numbers that make investors do a double-take even when they’re otherwise happy.

A Chipotle spokesman told Bloomberg that the company will engage with investors as it reviews pay structure.