Boutique M&A advisory firm Lazard scores boost from AT&T-DirectTV deal

Among the winners in AT&T’s $48.5 billion bid to purchase satellite television provider DirecTV are some the banks handling the deal, which are in line to collect hundreds of millions in fees (paywall) and earn bragging rights among their rivals. (If, of course, the deal gets done.)

Among the winners in AT&T’s $48.5 billion bid to purchase satellite television provider DirecTV are some the banks handling the deal, which are in line to collect hundreds of millions in fees (paywall) and earn bragging rights among their rivals. (If, of course, the deal gets done.)

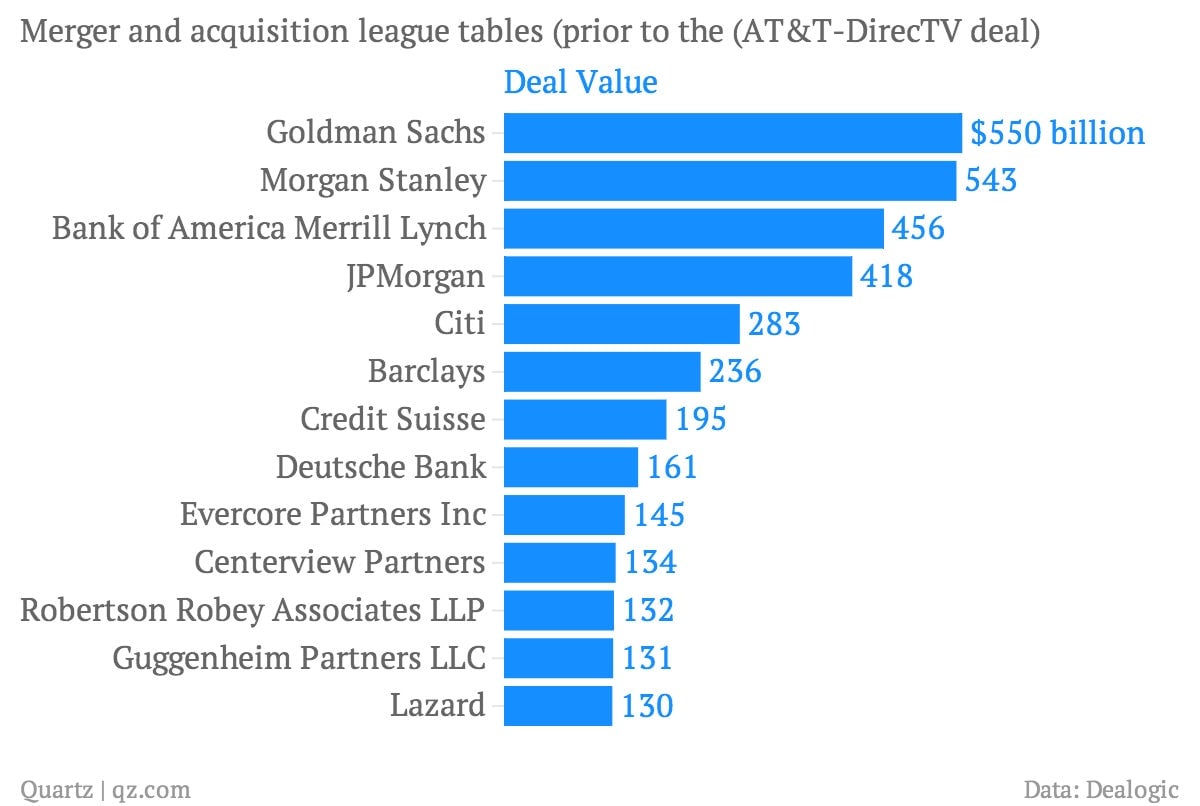

In the bragging rights department, boutique investment banking firm Lazard seems to be a winner. It enjoyed a healthy jump in the mergers and acquisitions rankings due to its role in advising telecommunications giant AT&T on the announced deal. Lazard leapfrogged into 7th place in the league tables from 13th, according to data from Dealogic. That puts the the New York-based advisory firm just below sprawling financial giants like Barclays, Citigroup, JPMorgan Chase as wells as investment banking M&A heavyweights Morgan Stanley and Goldman Sachs.

Yes, league tables are a bit of self-congratulatory banking industry hokum. (The origins of so-called league tables or deal rankings are believed to harken back to soccer league tables, where the league standings of European clubs are ranked). However, they play a big part in the world of finance because bankers point to them in order to generate new business by touting their past success.

The AT&T deal vaults Lazard it to its best position in the rankings since 2009, when it was sixth. Here are the league table standings for deals announced in 2014 prior to the AT&T deal, according to Dealogic:

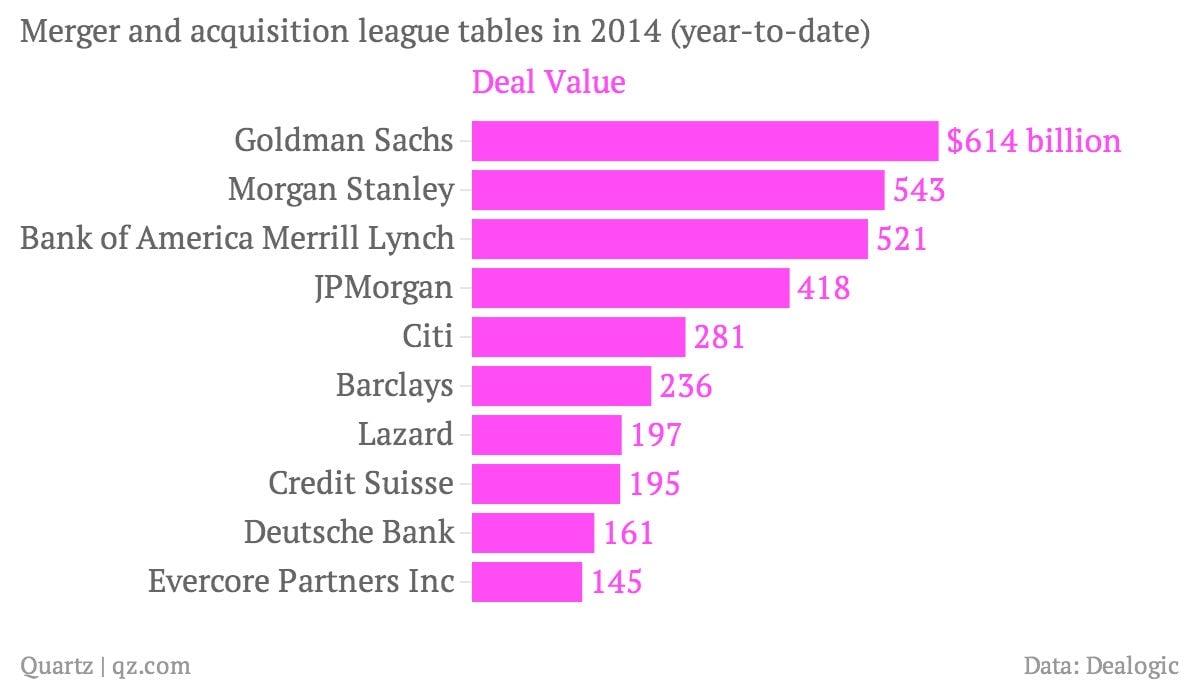

And here are the rankings after the deal between the telecommunications giant and DirecTV.