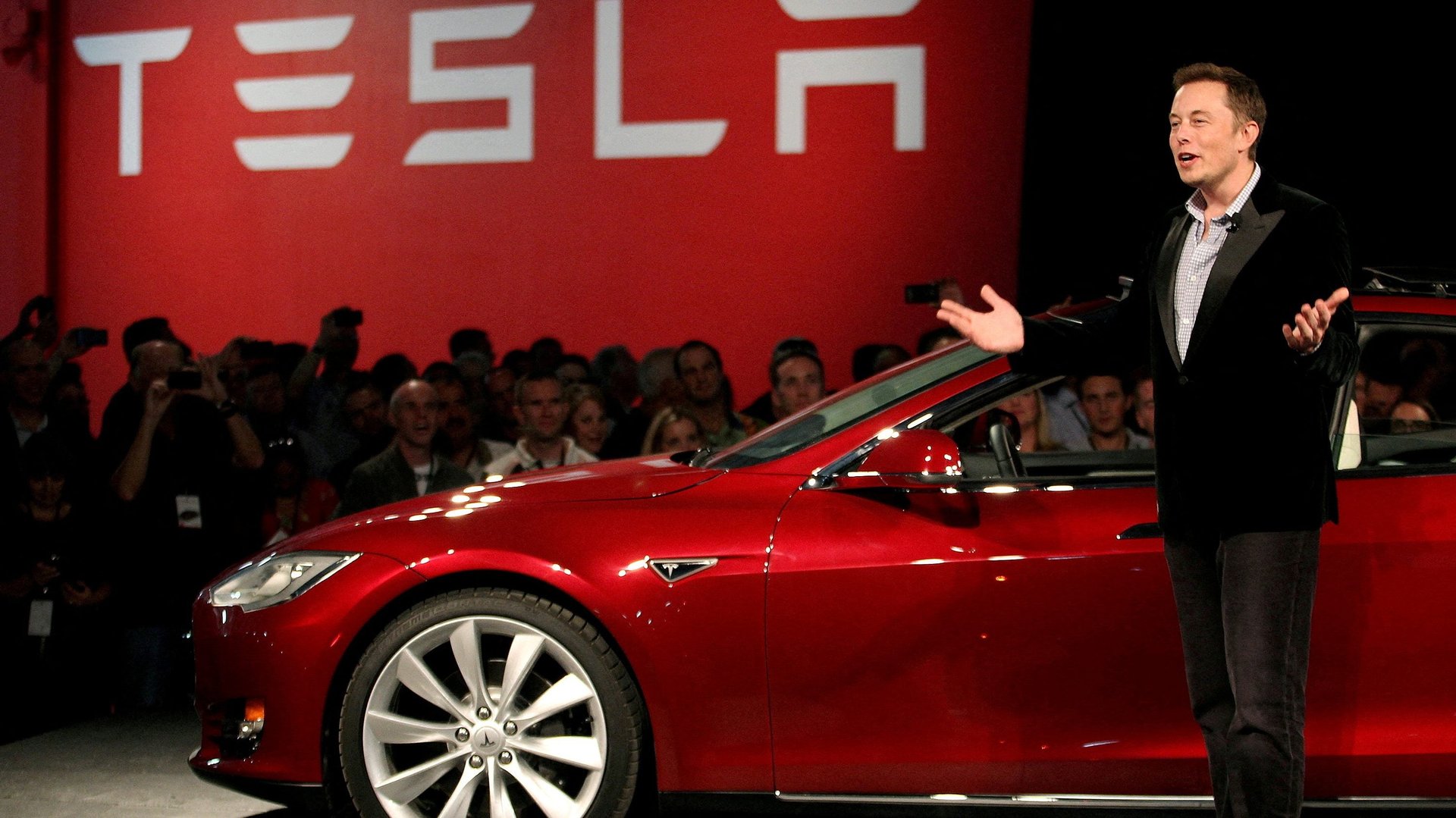

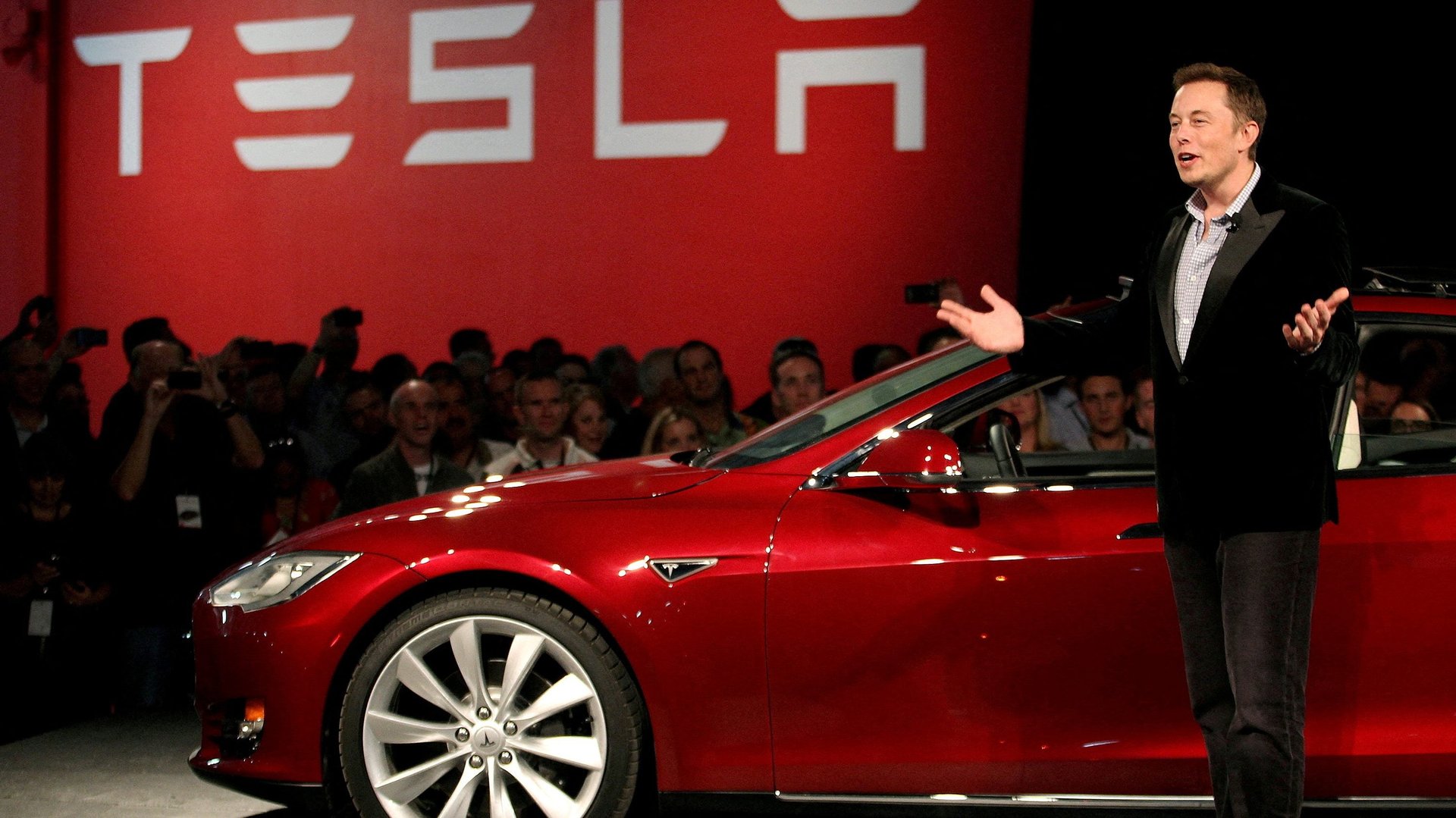

Elon Musk hints Teslas could become more expensive

While Tesla aficionados can celebrate not having to pay for pricey gas, they won’t entirely dodge massive bills.

While Tesla aficionados can celebrate not having to pay for pricey gas, they won’t entirely dodge massive bills.

On March 14, Elon Musk tweeted about his electric vehicle (EV) company Tesla and space exploration firm SpaceX “seeing significant recent inflation pressure in raw materials & logistics.” Already, last week, Tesla raised prices of some models in the US and China by more than $1,000 and $1,500 respectively.

Musk added that Tesla was “not alone” in its struggles to contain price pressures, referring to an article saying Russia’s invasion of Ukraine sent commodity prices to their highest levels since 2008.

Tesla competitor Rivian also raised prices earlier this month, but had to back down after customers and investors complained. While Rivian didn’t explicitly blame the Russia-Ukraine war, it did say supply chain constraints due to rising raw material costs could cut its production in half.

Tesla EVs affected by Russia’s metal supply

Automakers’ supply chains were already devastated by the pandemic. The war is only making things worse.

Consider Tesla’s lithium-ion batteries, which are 80% nickel. Russia accounts for nearly 10% of the world’s nickel supply. Since the conflict began, the price of the metal has skyrocketed.

On Mar. 8, three-month LME nickel contracts briefly surpassed the $100,000-a-metric ton mark for the first time, and the London Metal Exchange (LME) has suspended trading ever since.

The body and chassis of a Tesla is almost entirely made from aluminum, and so is part of the wheel. The commodity’s price has come down from its peak of more than $3,700 a metric ton earlier this month, but remains high. Russia is the world’s second largest aluminum supplier, after China.

Prices of other key raw materials like steel and palladium have also been rising.

China to the rescue?

If things don’t cool off soon, car makers may turn to China.

“EV and battery companies in China may well step in and buy the commodity at lower prices,” according to GlobalData thematic research team battery analyst Daniel Clarke. “China already has a strong position in the battery metal supply chain, and buying Russian nickel on the cheap as a result of sanctions would further strengthen its globally competitive position.”

Meanwhile, Tesla recently announced plans to more than double its China production capacity to 2 million cars annually with a second Shanghai plant.