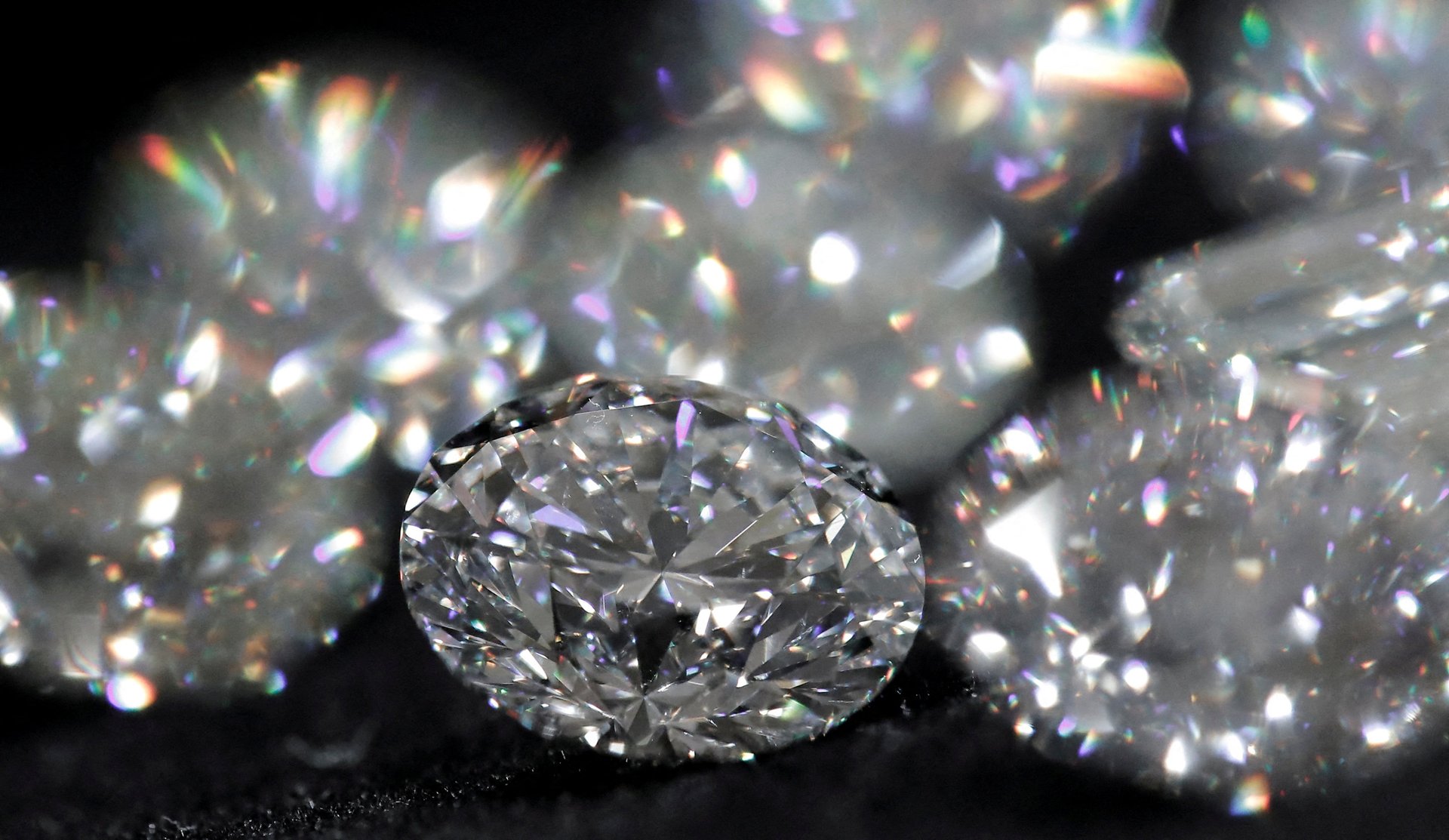

Russian sanctions could boost lab-grown diamonds

The US’s ban on Russian diamonds is burnishing the appeal of lab-grown stones.

The US’s ban on Russian diamonds is burnishing the appeal of lab-grown stones.

Russia contributes nearly a third of the global natural diamond supply, according to the US Treasury, with around 90% of Russian production coming from state-backed Alrosa, the world’s largest diamond mining company.

Industry experts are expecting a two-digit jump in diamond prices in coming months—and a boost in sales of lab-grown stones.

Even before the US announced the ban, part of wide-ranging measures to punish Russia for its Ukraine invasion, consulting firm Kenneth Research was expecting the lab-grown diamond market to grow by an average 9% until 2028. Even traditional natural diamond giants like De Beers have begun selling them.

Demand for diamonds has surged

The ban comes at a time when supply is already tight. Retail sales of diamond jewelry jumped 29% last year versus 2020, and are up 11% over pre-pandemic levels, a report from consulting firm Bain & Co. report said.

“For the jewelry industry, it has been a historical bonanza,” said Monil Kothari, founder of the fine jewelry brand Haus of Brilliance. “Everyone you talk to has made money because supply had been reduced. You had liquidity in the market and people just bored at home that had discretionary cash.”

Higher labor costs in India, where the majority of jewelry manufacturing is done, has also fueled the rise in diamond prices.

Coinciding with this is pent-up demand in the wedding market as covid restrictions subside. There will be an estimated 2.5 million weddings in 2022, according to The Wedding Report, the most in the US since 1984. This means wedding attendees—both brides and guests—will be looking for jewelry for the occasion.

The promise of lab-grown diamonds

The full impact of the ban is unclear. Rough diamonds are usually sent to India or China for cutting and other processing, obscuring the country of origin. But if Burmese rubies, which were also banned by the US, are any indication, the Biden administration will move to seal out opportunities for diamonds to arrive via intermediaries.

Amish Shah, founder of ALTR Created Diamonds, which sells lab-grown stones, believes consumers will turn to synthetic options in greater numbers, whether for ethical or budget reasons. He estimates that if US officials are strict about scrutinizing Russian diamonds, prices could jump 15 to 25%, although the impact would not trickle down for several months.

Typically, shoppers can get a nearly 50% larger stone for the same price as a naturally mined diamond, without compromising on quality. At the same time, these lab-grown diamonds have a lower carbon footprint and are guaranteed to be conflict-free, something Shah expects will resonate strongly with global consumers who object to the war in Ukraine.

However, while lab-grown diamonds could fulfill some of the consumer demand, they would not be able to fully replace Russian supplies. The total production of lab grown diamonds is around 8 million carats, much smaller than the 32.4 million carats Alrosa alone supplied in 2021.