Putin’s Ukraine gambit has vaporized $25 billion in hedge fund investments in Russia

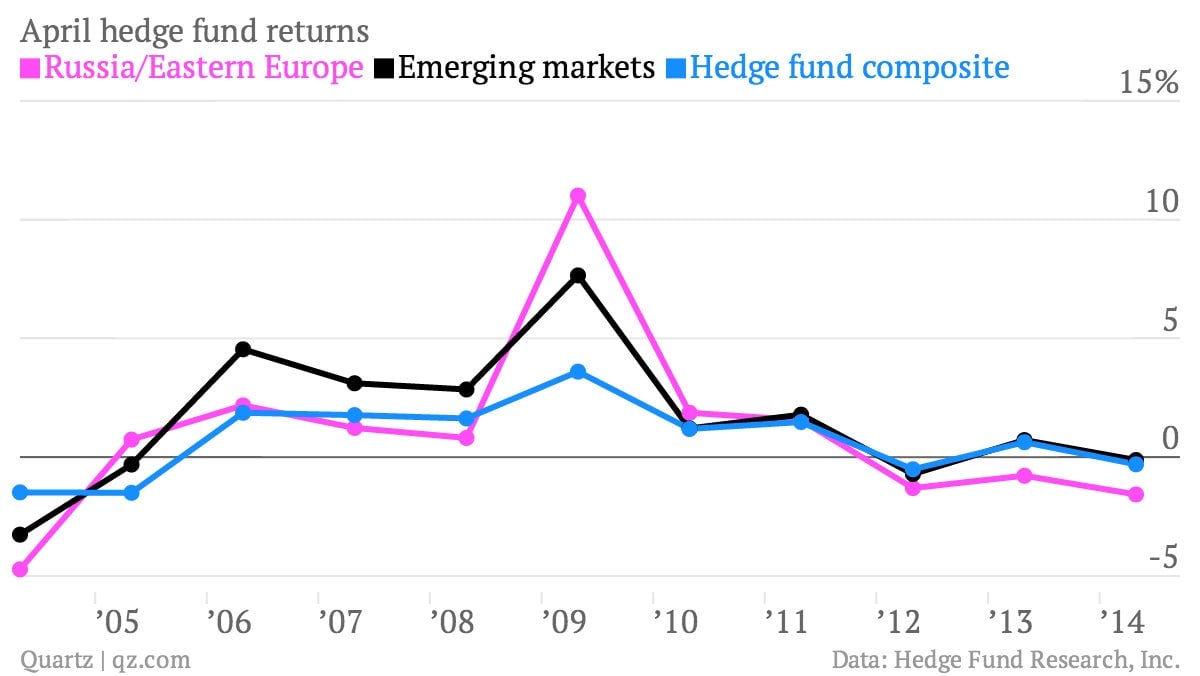

Hedge funds focused on Russia and Eastern Europe are encountering their worst monthly returns since 2004, according to Hedge Fund Research, Inc., a firm that tracks the industry.

Hedge funds focused on Russia and Eastern Europe are encountering their worst monthly returns since 2004, according to Hedge Fund Research, Inc., a firm that tracks the industry.

The crisis in Ukraine, which has resulted in sanctions against Russian officials and fostered general political unrest in the region, pushed returns into negative territory in April, with a 1.57% decline. That’s the worst April for funds targeting Russia and Eastern Europe since 2004, when HFR indexes recorded a 4.72% loss for the month. (That was the year of the so-called Orange Revolution in Ukraine, another turbulent period.)

To compare, emerging market returns for April are down fractionally, by .12%, and the aggregate returns for all hedge funds were down .3%, according to HFR.

So far this year, HFR’s Russia and Eastern Europe-oriented index is down 9.7%–its worse decline since suffering a 10.5% decline for the year in 2012. At the end of the first quarter, capital invested in Russian hedge funds has shrunk by $25.1 billion, while a relatively meager $300 million in new investments flowed into Russian regional markets, according to HFR.