Uber could overtake Airbnb, with a $17 billion valuation

Uber could be set to claim some serious bragging rights in the world of startups. Bloomberg reports that mutual fund giant Fidelity is competing to lead a round of financing for startup car service Uber Technologies.

Uber could be set to claim some serious bragging rights in the world of startups. Bloomberg reports that mutual fund giant Fidelity is competing to lead a round of financing for startup car service Uber Technologies.

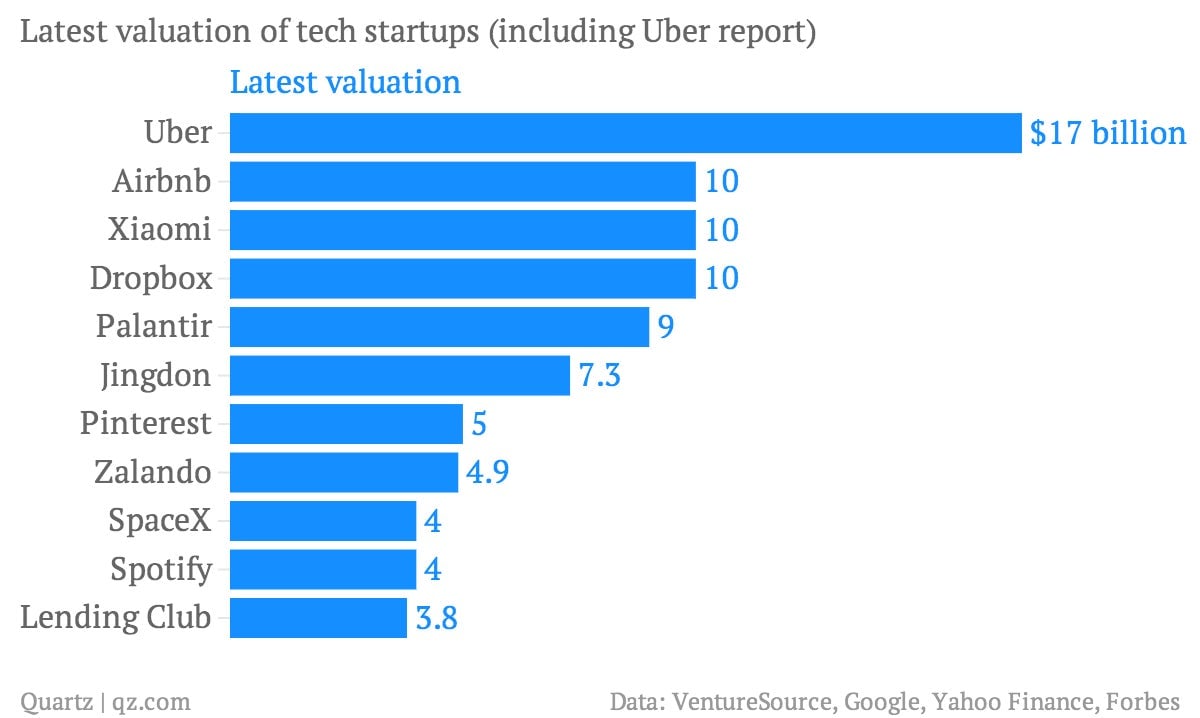

The valuation, if completed, would make Uber arguably the most highly valued startup of the moment, with an estimated $17 billion valuation, according to the report. That would put it above other startups with high-flying valuations, including Airbnb and Dropbox, most recently valued at $10 billion a piece.

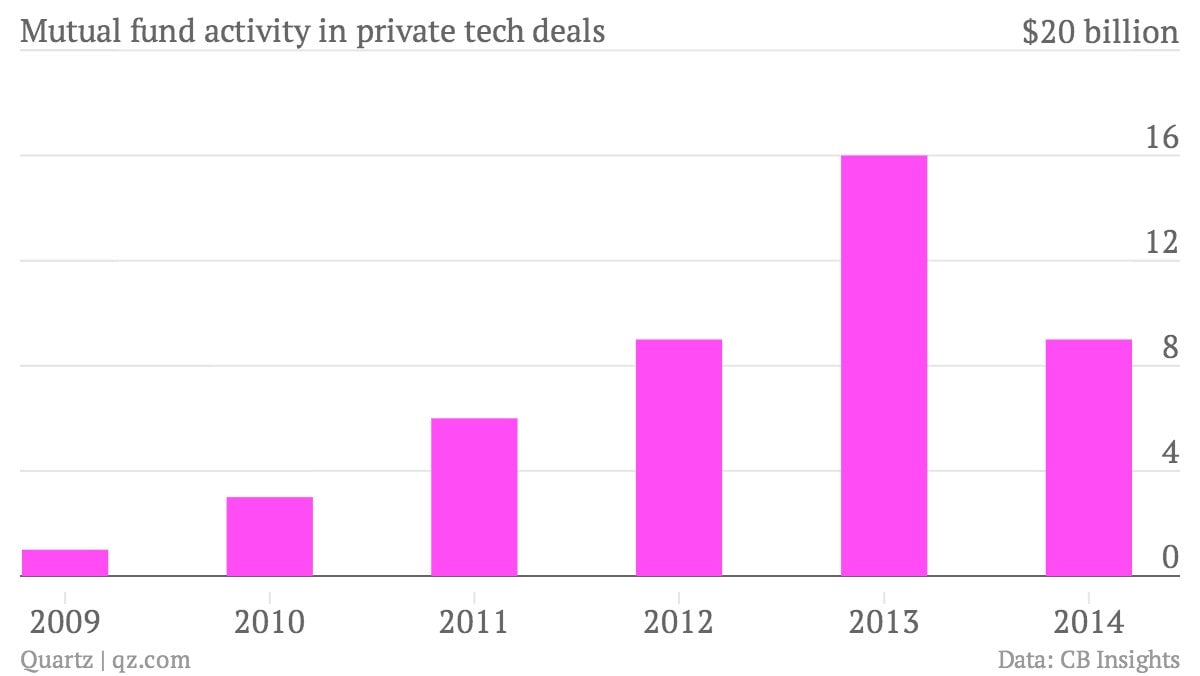

Fidelity’s involvement also highlights the rise of giant asset management companies such as Fidelity, T. Rowe Price and BlackRock as a growing force in the venture capital universe–an area previously dominated by firms including the likes of Benchmark Capital, Sequoia Capital and Andreessen Horowitz. Just to illustrate, here’s a chart of mutual fund company investments in tech deals over the past few years. (The data for 2014 is through the middle of April.)

What’s driving mutual funds into the tech startup world? For one thing, companies seem to be waiting longer before offering shares in the public markets. That means they tend to have bigger pre-IPO operations, and need more cash to keep their businesses running. Deep-pocketed mutual fund companies—who might shy away from riskier earlier stage venture investments—are helping to fill that funding gap.