To score a point against China, the US is willing to kneecap its solar industry

An investigation by the US Commerce Department into possible import tariff evasion by China-based solar panel manufacturers is dealing a harsh blow to broader US climate change and clean energy goals.

An investigation by the US Commerce Department into possible import tariff evasion by China-based solar panel manufacturers is dealing a harsh blow to broader US climate change and clean energy goals.

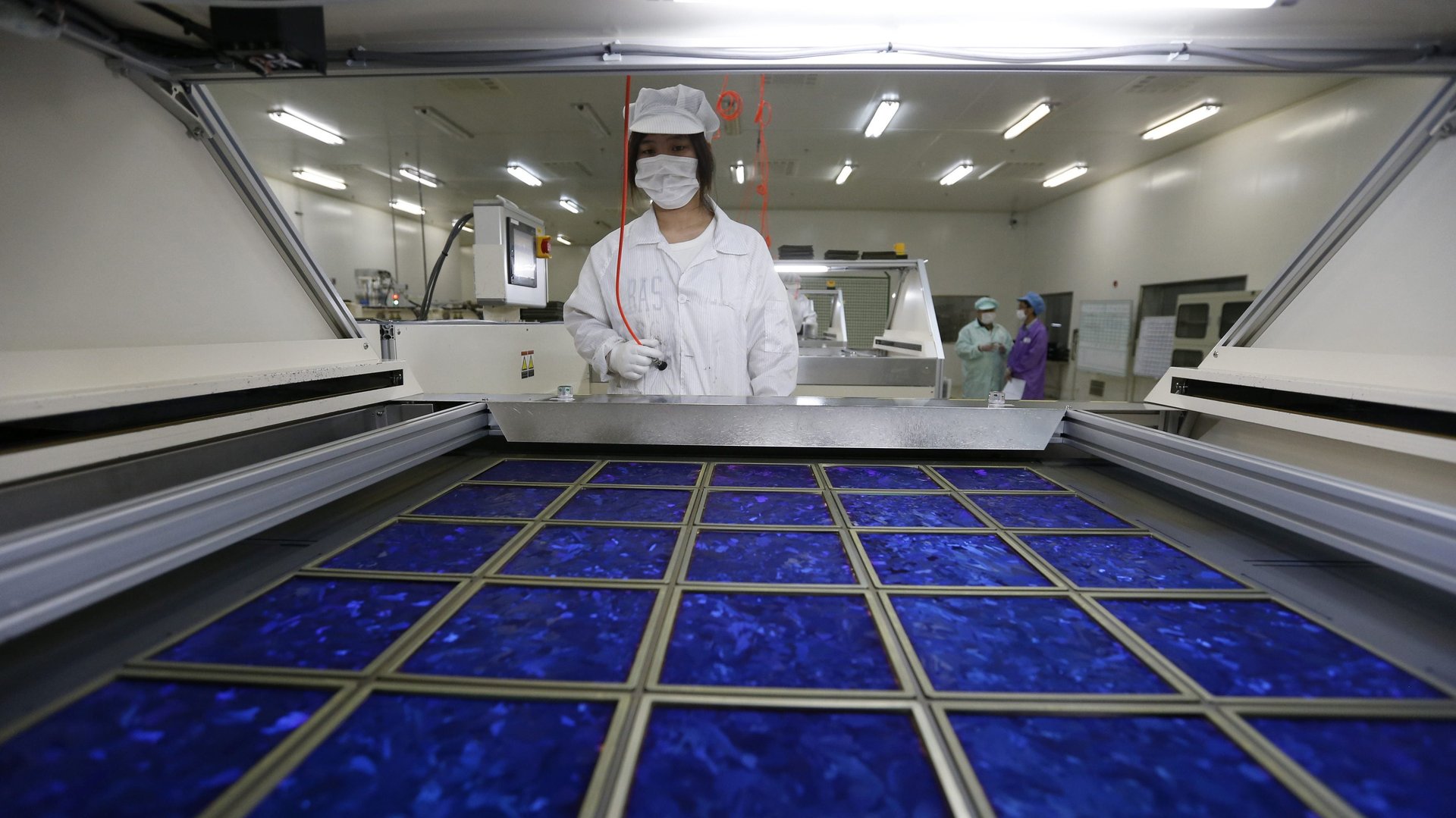

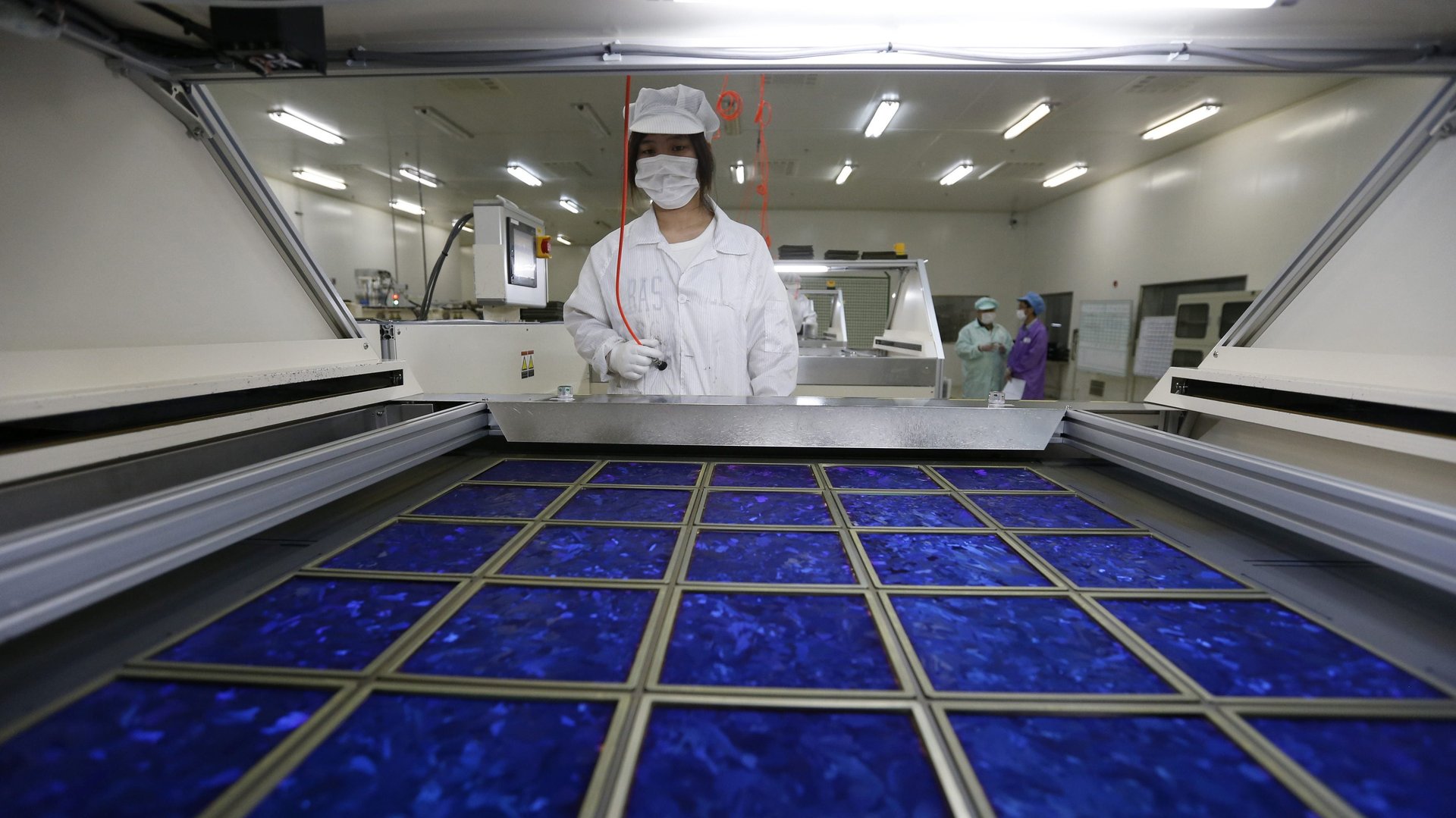

Before 2012, the vast majority of solar panels in the US were imported from China. That year, an investigation by the Obama administration concluded that many Chinese manufacturers were illegally dumping low-cost panels on the US market, undermining any hope for US manufacturers. So the administration slapped on stiff tariffs of up to 250% that remain in place today. In the years since, US solar panel production has increased slightly, but most panels are still imported—now from Cambodia, Malaysia, Thailand, and Vietnam. Those four countries were the source of 85% of imports in 2021, according to intelligence firm Rystad Energy.

Chinese solar panel producers might be avoiding US import tariffs

In March, a US manufacturer called Auxin Solar filed a petition alleging that Chinese companies are actually the ones operating solar factories in southeast Asia, effectively offshoring their operations in order to circumvent US tariffs. The Commerce Dept. decided to follow up. If true, and if the administration decides to extend tariffs to those countries, manufacturers could be on the hook for up to $3.6 billion in retroactive tariffs, according to Rystad. A decision is expected in August.

But in the meantime, to forestall any further potential liability, many southeast Asian solar producers have halted exports to the US. The upshot is that up to 64% of solar installations planned this year could be canceled, a big setback for the administration’s goal that the US will get all its electricity from low-carbon sources by 2035.

“This could be the most disruptive event ever to face the US solar industry,” Marcelo Ortega, a renewables analyst at Rystad, said.

In a best-case scenario, it would take at least until 2024 for US solar manufacturers to scale up enough to offset the lost imports, according to Rystad. In the meantime, a bipartisan group of US Senators argued in a March 9 letter that the investigation “threatens thousands of American solar jobs.”