India’s largest coal company is going shopping—again

Coal India, one of the world’s largest coal producers with a majority stake owned by the Indian government, is on the hunt again.

Coal India, one of the world’s largest coal producers with a majority stake owned by the Indian government, is on the hunt again.

After years of hits and misses, the mining company recently floated a tender seeking consultants to help it evaluate overseas coal assets.

Specifically, Coal India wants to either develop a new mine, or buy equity in an operational venture, to bring coking coal—used to make steel—and thermal coal for power plants back to the country.

The firm has cash reserves of about 620 billion rupees (about $10.5 billion).

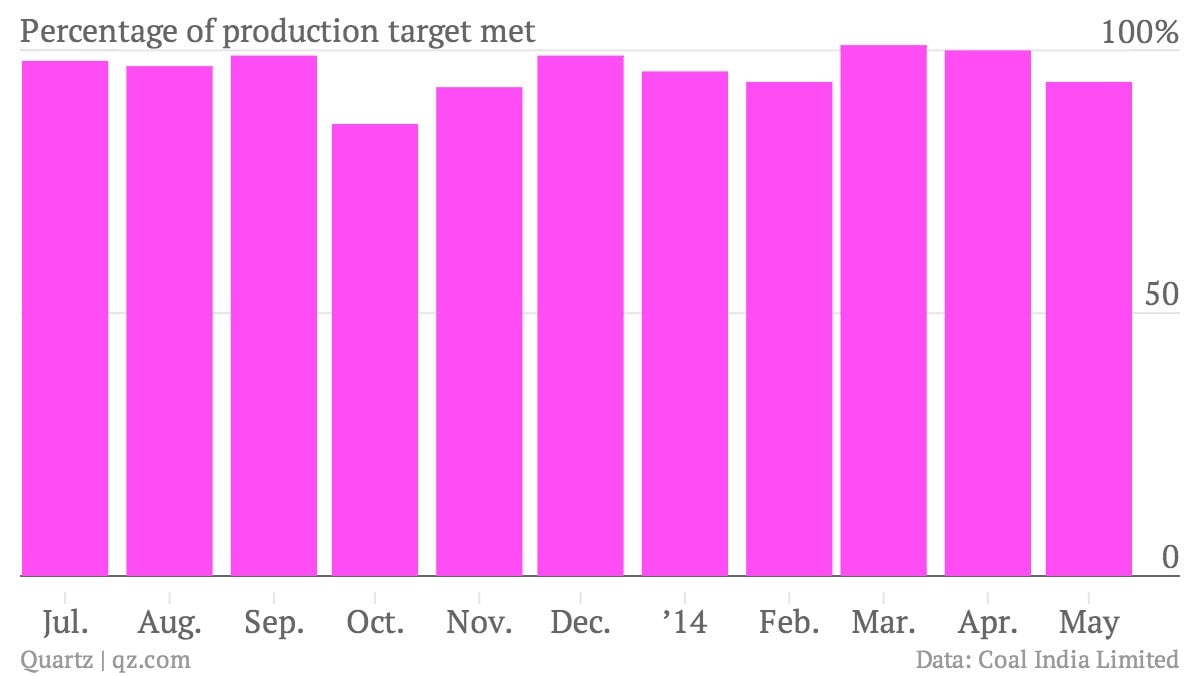

But regulatory issues, including delays in environmental clearances for new projects, have hamstrung the company’s production. Since July 2013, Coal India has consistently missed its own production targets.

It’s not for lack of trying. For at least five years, the mining firm has been scouting for acquisitions, as part of the Indian government’s plans to shore up energy resources globally. In 2009, the company bought coal blocks in Mozambique, which it is yet to commission.

Subsequent attempts in Indonesia, Australia, and the United States fell through, including via a partnership with Peabody Energy, the world’s largest private-sector coal company.

The renewed acquisition attempt will likely focus on major coal-producing regions proximate to India, a Coal India official told Quartz, on the condition of anonymity. The cost of importing coal from elsewhere may make the venture too expensive, he added.

Australia and Indonesia, once again, are on the company’s radar, the official said, though there has been some regulatory uncertainty surrounding the latter in recent months.

Any major acquisition by the company, however, will require clearance from the Indian government, its biggest shareholder.

Meanwhile, the recently elected Narendra Modi government is reportedly mulling breaking up Coal India, which currently contributes about 80% of India’s coal output, and opening up the sector up to foreign players.