Chinese people are bracing for a downturn by saving more this year

China’s citizens, who already have a reputation of being savvy savers, are saving even more amid uncertain economic prospects.

China’s citizens, who already have a reputation of being savvy savers, are saving even more amid uncertain economic prospects.

Chinese household savings grew by 7.86 trillion yuan ($1.2 trillion) between January and May, an increase of more than 50% from the same period last year, according to China’s central bank. In May alone, renminbi savings accounts in China added 3.04 trillion yuan, which was 475 billion yuan more than the same month last year, said the bank.

The explosion of savings in the first five months of this year was also affected by other factors: people depositing their year-end bonuses, and lockdowns in several cities hindering their ability to spend. But the fast growth of savings also reflects a smaller appetite for risk. In a telling sign, during the first five months of 2020, when the pandemic was ravaging the country, China’s household savings grew by 6 trillion yuan, lower than the amount seen this year. People are growing increasingly risk-averse, as China’s prolonged lockdowns combined with the Russian invasion of Ukraine and corresponding high oil prices feed worries about imminent recessions.

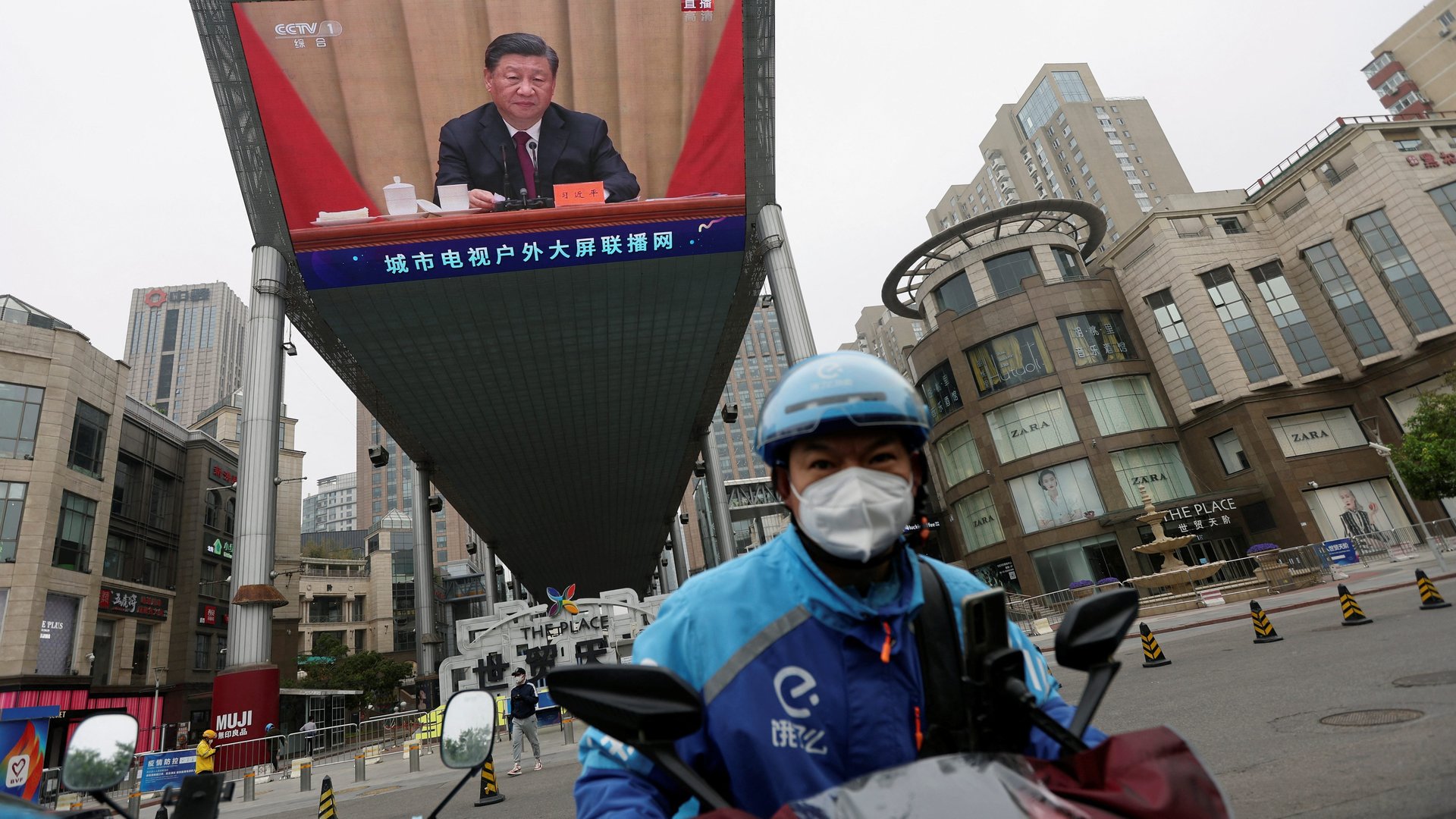

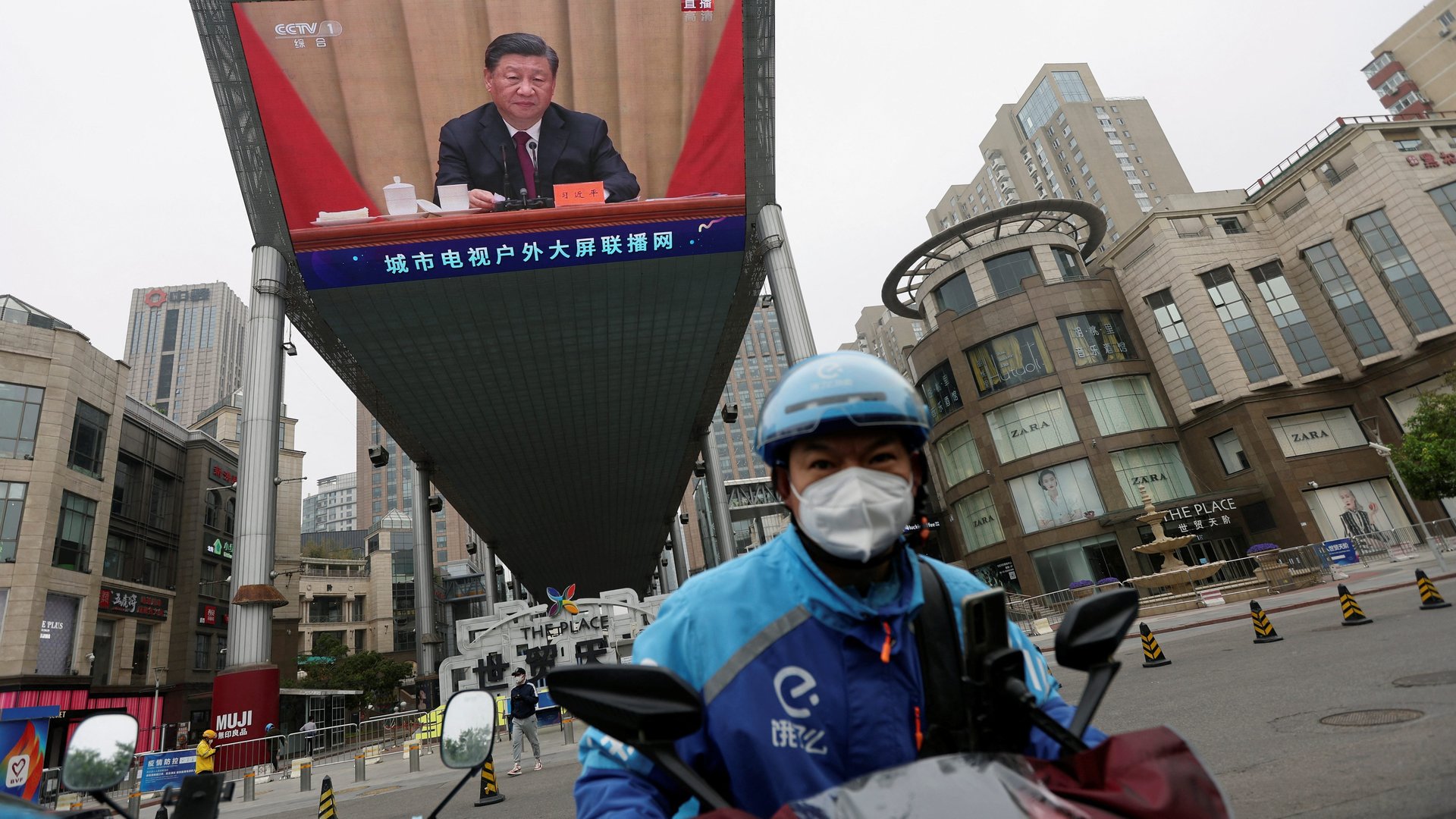

Chinese consumers are anxious about the future of their economy

“The pandemic situation in both 2020 and 2022 has led to big increases in household savings rate,” Shanwen Gao, the chief economist of Essence Securities, wrote in a note (link in Chinese) in May. “Part of this comes from an increase in unwilling savings, as the pandemic hinders consumption; the other part meanwhile comes from a rise in precautionary savings, which reflects residents’ concerns about uncertainty.” Gao thinks that the surge in savings this year, amid the new waves of covid-19, has been channeled into deposits, fixed income, and debt reduction, where citizens use savings to repay their liabilities and pre-pay mortgages. In contrast, in early 2020, people directed their savings into stock and property markets “This reflects the shaken confidence of residents in job security and future income,” Gao wrote.

Despite recovering from the pandemic relatively quickly in the past two years, China’s insistence on a zero-covid policy has damaged its economy deeply. On-and-off lockdowns in major cities including Shanghai have hindered business operations and shattered consumer confidence, while rising unemployment rates and mass layoffs in the once red-hot tech sector are also leading to more pessimism among citizens. Meanwhile, two-thirds of China’s 70 major cities saw their new home prices drop in April, compared with 38 cities in March, pointing to further danger of shrinking wealth of Chinese families, which count property as a major asset.

Naturally, without any clear deadline for zero-covid measures from the Chinese government, people are holding tight to their wallets. A rising propensity to save could mean that China’s already sluggish consumption, which saw retail sales plunge by 11% in April, will slow further for the rest of the year. Despite many cities’ recent embrace of using consumption vouchers and digital yuan subsidies to spur spending, these measures are seen by experts as far from being enough, as the hand outs only account for around 0.01% of some city’s GDP.