India’s central bank is overstating its forex reserves by 10%

The Reserve Bank of India (RBI) has been shoring up its foreign exchange reserves by buying dollars. The latest figures show them to be at $312 billion, hovering just below the all-time high of $320 billion from September 2011.

The Reserve Bank of India (RBI) has been shoring up its foreign exchange reserves by buying dollars. The latest figures show them to be at $312 billion, hovering just below the all-time high of $320 billion from September 2011.

This time around, though, the number is misleading.

Here’s why: The RBI actually has “borrowed” $31 billion, which it has to return by 2016, to Indians living overseas, so-called NRIs, who placed deposits with Indian banks with their money, spurred by a special RBI program. In September 2013, when the rupee fell to Rs68 to a dollar (from about Rs55) foreign investors were running out the door with their money. When they demanded dollars in the market, the demand was much greater than the supply, and the difference was made up by the RBI selling from its hoard.

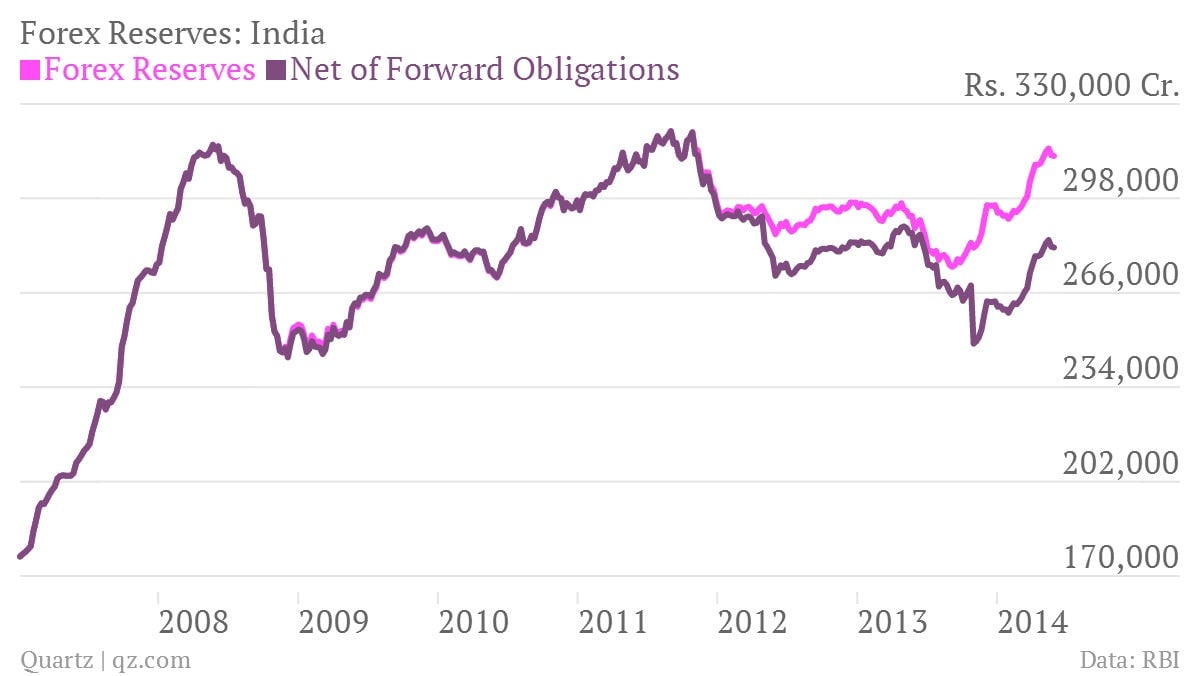

To meet demand, the RBI had to dip substantially into its reserves, which fell from $293 billion in March 2013, to $275 billion in September. To build these reserves back, the RBI did some financial innovation.

That included a new “swap” for Indian banks announced by Raghuram Rajan, who took over as RBI governor in September as well. Non-resident dollar deposits, which guaranteed a dollar return (in percentage) for incoming dollars, were being offered at an unattractive 2% to 3% a year. While rupee interest rates of banks (offered to those depositing rupee) were 9%, the banks needed 6% to hedge the currency risk.

Rajan stepped in and underwrote the currency risk of the banks and limited it at 3.5% per year. Now banks knew the price at which they could buy back the dollars from the RBI at the end of the three-year term, irrespective of the exchange rate at that time.

This allowed banks to offer rates up to 5.5% to expat Indians in dollar terms, which was attractive because it gave depositors much higher returns than banks in their host countries, and yet, was insulated from rupee volatility.

However this was a one-time swap, offered only for two months. By November 2013, Rajan’s move had convinced expat Indians to pump in more than $30 billion into India.

While this money shows up as reserves today, it will have be returned in 2016, when the swap comes to an end, and the deposits mature. How much has to be returned? According to data release by the central bank, the current figure is $31 billion, which is a forward obligation we must subtract from the top figure to arrive at the real forex reserve number. Effectively, our reserves are overstated by 10%. RBI declined to comment.

In our calculations, the real number is a lower $281 billion, net of the forward obligation. This is nowhere near an all-time high.