If you look at the right baseline, the US economy is overperforming; the United Kingdom, not so much

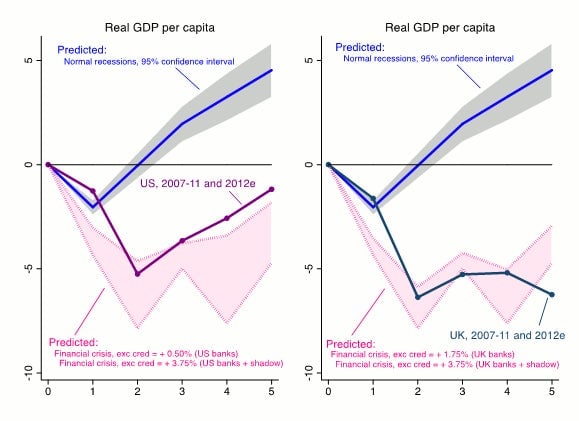

Complaints about economic growth in the US are non-stop and understandable: With the economy running below capacity, opportunities for work and investment are hard to find. Critics wonder why the recovery from the 2008 recession lacked the spring-back quality typical of an economy coming out of a slump. But recessions come in different flavors, and it’s important, say economists Alan Taylor and Moritz Schularick, to compare like with like. In the charts above, they compare the recent growth in per capita GDP in the US and UK to forecasts based on historic experiences with recessions stemming from boom-and-bust cycles (the gray areas) and from financial crises (the pink areas).

Complaints about economic growth in the US are non-stop and understandable: With the economy running below capacity, opportunities for work and investment are hard to find. Critics wonder why the recovery from the 2008 recession lacked the spring-back quality typical of an economy coming out of a slump. But recessions come in different flavors, and it’s important, say economists Alan Taylor and Moritz Schularick, to compare like with like. In the charts above, they compare the recent growth in per capita GDP in the US and UK to forecasts based on historic experiences with recessions stemming from boom-and-bust cycles (the gray areas) and from financial crises (the pink areas).

Recent research into the nature of financial crises shows that that how the economy falls apart determines the speed with which it is put back together. When debt drives a crisis, deleveraging takes time, in a way that recovering from a “normal” recession (the after-effects of economic overheating, or of a supply shock) does not. Compared against normal recessions, the American economy doesn’t look that good, but compared to its experience with bank crashes, the US is outperforming. The United Kingdom, however, isn’t meeting expectations.

The two countries have taken different approaches, with Prime Minister David Cameron implementing an austerity program of higher taxes and lower state spending; meanwhile, in America, President Barack Obama enacted a fiscal stimulus package and the Federal Reserve has provided easy money. The effects of these policies on growth are uncertain in both countries, but Taylor and Schularick are critical of UK lawmakers, since “the output path has now diverged below what a wide range of plausible historical projections might excuse.”