What the markets make of the upheaval in Iraq

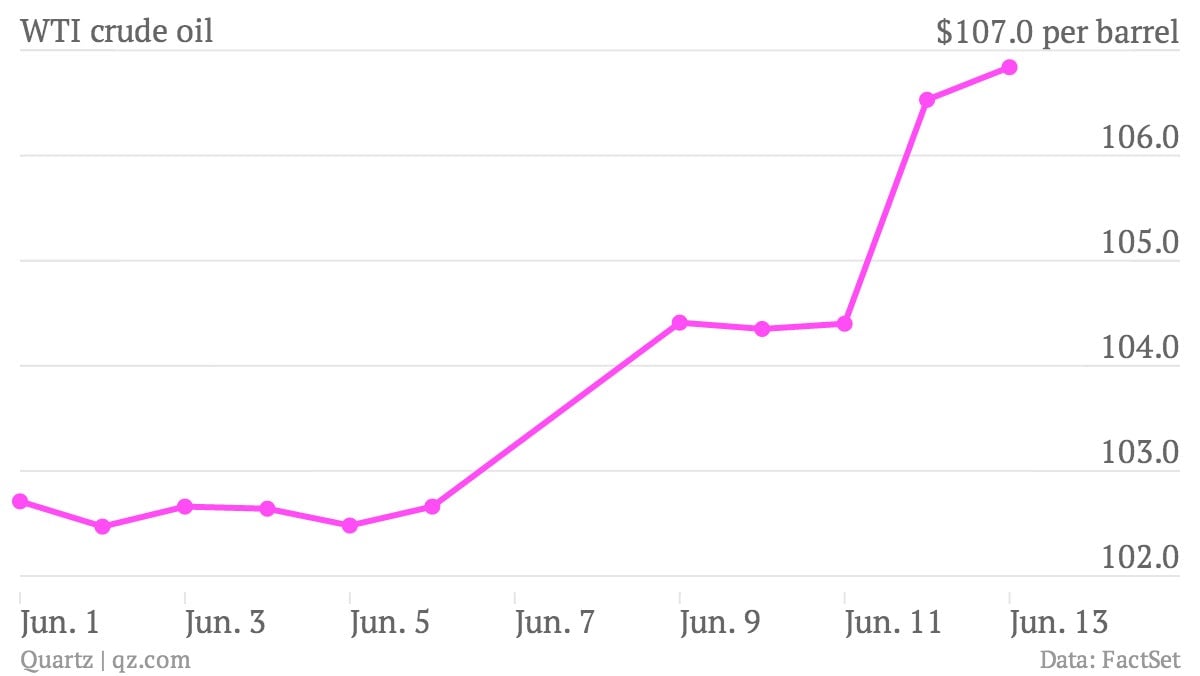

As Islamist militias march on Baghdad, markets are scrambling to assess the implications. Most obviously, the al Qaeda-inspired upheaval in Iraq means that oil prices aren’t coming down any time soon:

As Islamist militias march on Baghdad, markets are scrambling to assess the implications. Most obviously, the al Qaeda-inspired upheaval in Iraq means that oil prices aren’t coming down any time soon:

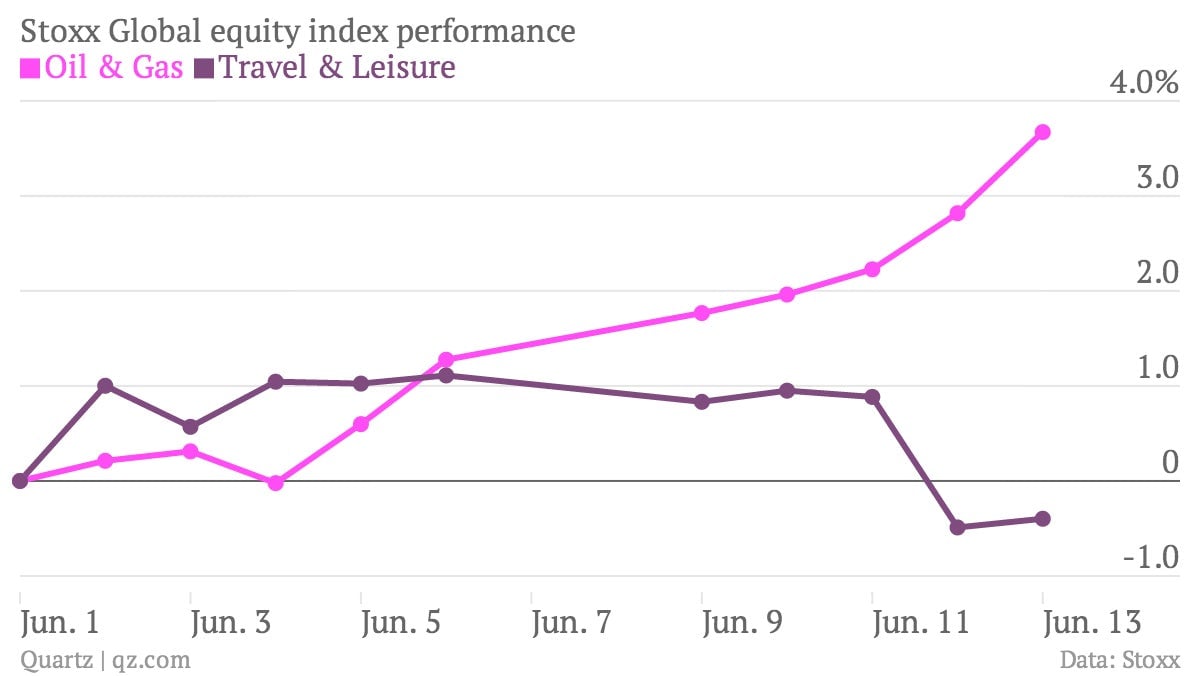

The speed and scope of the militants’ gains across the key oil-producing country forced traders to spring into action, boosting the shares of oil producers and punishing the stocks of big oil consumers, like airlines:

The effect of higher oil prices on airline profits is less pronounced than it once was, thanks to better hedging practices, tighter cost control, and higher ticket prices. Still, this hasn’t stopped air carriers’ shares getting battered this week. Airline investors were already spooked by warnings of weak demand from Lufthansa, so the prospect of higher costs from pricier fuel sent them heading for the exits.

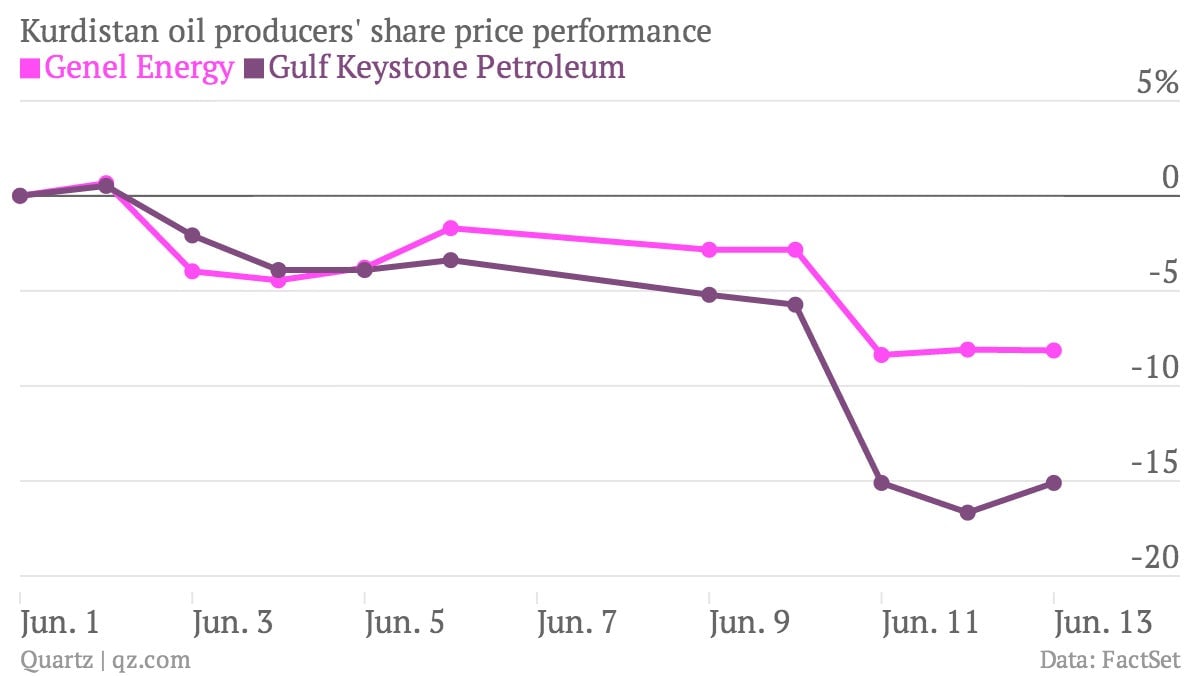

Meanwhile, elevated oil prices are always a good thing for energy companies. That is, if they can extract and sell the stuff. Oil companies that operate almost exclusively in the autonomous region of Kurdistan—Genel Energy and Gulf Keystone Petroleum—have been under pressure, despite the rise in most other energy companies’ shares:

Although the long-term implications of the upheaval in Iraq could cement Kurdistan’s semi-statehood, most notably its ability to finally sell crude without interference from the central government in Baghdad, the fighting in and around the territory has put investors on edge. Gulf Keystone tried to reassure markets today that its projects remain on track despite the violence.

When oil prices spike, it seems obvious that oil producers will do well and oil consumers will suffer. But nothing is ever that simple—some see the dive in airline shares as a great buying opportunity, while protracted disruptions to oil supply lines mean than energy producers in Iraq may suffer whatever the price per barrel.