Why the Bay Area might be the best market for bankers in the country

Silicon Valley, and the San Francisco Bay Area in general, has been a magnet for technology innovation going back seven decades—to long before Apple was even a wannabe disruptor. And despite aspirations of cities such as Boston and New York, the recent boom in startups and a spate of techy IPOs has only reinforced the Bay Area’s status as the Westeros of the tech universe (in the parlance of Game of Thrones enthusiasts).

Silicon Valley, and the San Francisco Bay Area in general, has been a magnet for technology innovation going back seven decades—to long before Apple was even a wannabe disruptor. And despite aspirations of cities such as Boston and New York, the recent boom in startups and a spate of techy IPOs has only reinforced the Bay Area’s status as the Westeros of the tech universe (in the parlance of Game of Thrones enthusiasts).

Investors that have been plowing money into tech startups include the venture capital companies Andreessen Horowitz, Khosla Ventures, Benchmark Capital and Sequoia Capital, to name a few. And although the growth of the tech market in recent years has driven up real estate prices and fostered some tension over the area’s gentrification, a recent note by JPMorgan makes it clear why the banking community has been paying very close attention to the Bay Area.

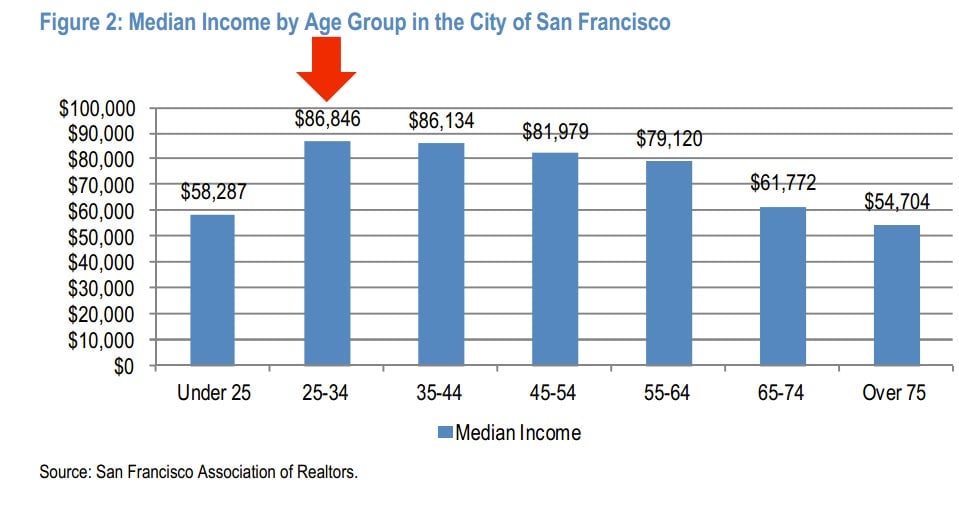

Lucrative tech jobs and a relatively young, smart population are at the heart of the area’s appeal, JPMorgan’s report indicates. Silicon Valley boasts a median annual household income of about $87,000, compared to the US average of $52,000, according to SNL Financial. Although other cities have emerged over the years as tech outposts, the Bay Area remains the world’s preeminent tech hub, JPMorgan’s analysts conclude:

VC funding, companies and entrepreneurs need a presence in the Valley. This became almost palpable to us and, we believe, in large part is why some of the largest companies keep all of their employees in one place even within the Valley. New York and Boston came up as secondary hubs for innovation, but the network effect of being in close proximity to the Valley was evident, with implications for sustained business formation as well as appreciation for real estate values given supply/demand imbalance across commercial, multifamily and residential real estate categories.

Regional banks such as First Republic and SVB Financial are poised to benefit from the tech boom, wrote JPMorgan analysts, who cover stocks of mid-sized banks. And, they said, the boom has another two years to run before real estate and company valuations peak. That’s good news for venture firms, which JPMorgan estimates still have $60 billion to invest in the next would-be tech disruptors.