Some traders are making a killing because they’re being paid in weird bonds

Cash bonuses make up a huge part of overall pay and prestige on Wall Street. An ex-Goldman banker recently sued because his $8.25 million bonus was less than he expected. Credit Suisse and UBS have veered away from tradition in the past year by paying some of their traders’ bonuses partly in a weird kind of bond called contingent capital, or CoCos. And now, Bloomberg reports, those bonds are doing rather well.

Cash bonuses make up a huge part of overall pay and prestige on Wall Street. An ex-Goldman banker recently sued because his $8.25 million bonus was less than he expected. Credit Suisse and UBS have veered away from tradition in the past year by paying some of their traders’ bonuses partly in a weird kind of bond called contingent capital, or CoCos. And now, Bloomberg reports, those bonds are doing rather well.

CoCos are a way for a bank to hedge risk. They’re debt, but if certain conditions are met—in this case, if the banks’ capital falls below a certain level—they can be wiped out or converted into equity, propping up the balance sheet. (If you think the idea of debt that magically vanishes or becomes equity is really strange, you’re in good company.)

That means CoCos can be risky for the people getting paid in them, because their pay could essentially disappear. But they can also be great if the bank is doing well. And the banks are doing well. CoCos issued by Credit Suisse have returned 6.7%, and UBS’s 6.6%. The bonds have been helped along by continued stimulus from the Federal Reserve, and more ambitious measures from the European Central Bank. Cash is nice, but it doesn’t appreciate by nearly 7% on its own.

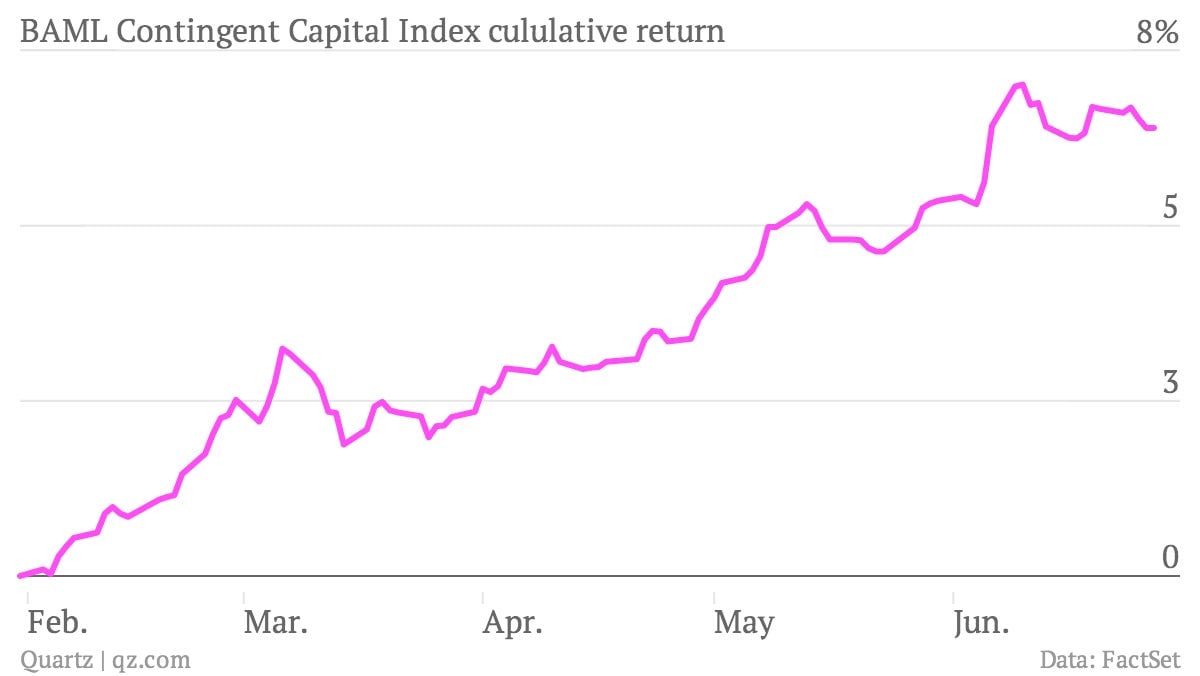

Here’s the return on Bank of America Merrill Lynch’s index of the asset class for the year to date:

The idea behind paying the bankers this way wasn’t to boost their earnings. It was meant as an incentive for them to take less risk—i.e., not do anything that would threaten to make their CoCos vanish. It was also a way for both banks to raise a portion of the capital they need to meet regulatory requirements by 2019.

But as Matt Levine points out at Bloomberg View, as good as the asset’s performance might be for the bankers holding these bonds, it’s not exactly good news in general. The Bank of England mentioned in a report that the bonds might be substantially riskier than investors seem to think based on pricing.

Credit Suisse previously made a foray into unorthodox banker pay by passing along some $5 billion of its riskiest assets to employees. The bankers who got what then looked like a raw deal ended up making a pretty nice return.