Why nobody lives in so many of New York’s most expensive apartments

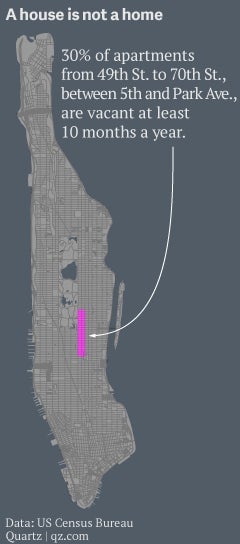

With millions to stash and stability on their minds, the world’s wealthy have been flocking to New York City to buy up luxury apartments—but not, necessarily, to live in them. Apartments in some of New York’s toniest precincts are vacant at least ten months out of the year.

With millions to stash and stability on their minds, the world’s wealthy have been flocking to New York City to buy up luxury apartments—but not, necessarily, to live in them. Apartments in some of New York’s toniest precincts are vacant at least ten months out of the year.

As with London’s wild property boom, the biggest buyers in New York are from abroad: They’ve got a millions of dollars, shell companies to protect their privacy and avoid taxes, and the desire for a beautiful nest egg that, for some, is also a source of rental income. New York Magazine has explored this burgeoning market, populated by people such as Dmitry Rybolovlev, a Russian oligarch who shelled out $88 million (the highest-ever price for a Manhattan condo), or Nassef Sawiris, an Egyptian businessman who dropped a cool $70 million on a co-op. Foreign investors put $50 billion into US real estate in 2012 alone.

These investments have driven up prices and reduced housing inventory, leading developers to follow in the footsteps of massive luxury towers near the city’s Central Park—One57, for example, sold a penthouse to the hedge fund investor Bill Ackman for more than $90 million. While Ackman is a home-grown plutocrat, these speculative developments depend on a global market for real estate to make them worth the builders’ while—if the multi-millionaires pouring out of emerging markets such as China, Russia and Brazil face economic or political troubles at home, these buildings might be in trouble, too.

To break even, New York Magazine reports, these super-towers need to sell at prices of $5,000 per square foot throughout the building—some 30% higher than the record price paid for a penthouse just a decade ago, in 2004. Is that even possible? There might be a hard road ahead: According to Case-Shiller’s index of the top-third of New York City homes, prices are just 10% higher than they were back then (after a sharp drop during the financial crisis and recession).

That’s why developers looking to sell to global buyers are betting on the future of emerging markets, in some cases with no questions asked. The strategy seems to be working—just so long as their units don’t get seized in corruption investigations in the US or abroad, as four luxury apartments in the financial district were last year.